The year 1871 feels distant now, a time when the wounds of a fractured nation were still tender. Reconstruction was underway, and the air held a cautious hope. But for those who watch the flow of money, 1871 marks the beginning of a long count, the first tick on a clock measuring the pulse of the market. Robert Shiller, a man who sought to understand the rhythm of things, began his tally then, building a record that would come to be known as the CAPE ratio.

The CAPE, or Cyclically Adjusted Price-to-Earnings ratio, is a simple thing, really. It takes the price of the market – the S&P 500, a broad measure of American industry – and sets it against the earnings of those industries over a decade. It smooths out the bumps, the lucky years and the lean ones, to give a truer picture of value. It’s a way of asking whether the price being paid for a share reflects a reasonable claim on the future earnings of the company behind it.

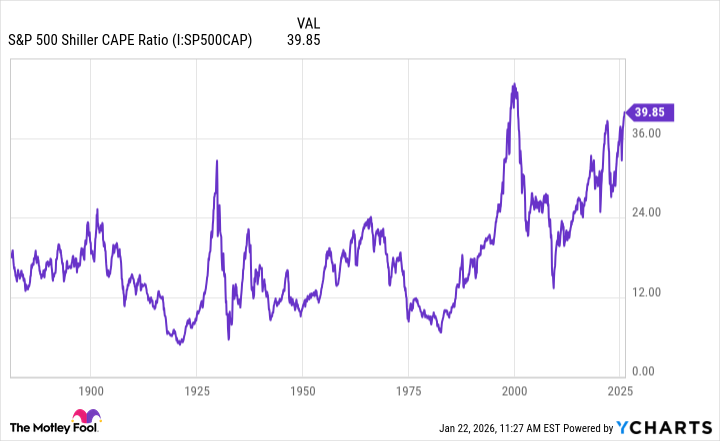

Shiller himself, a quiet man with a keen eye, used this measure to foresee the bursting of the dot-com bubble. He saw the fevered speculation, the prices climbing on air, and he warned of a reckoning. Now, in the early days of 2026, that same ratio is flashing a warning once more. It has climbed to levels not seen since those heady, and ultimately disastrous, days.

What the Numbers Are Saying

Historically, the CAPE has tended to stay within a reasonable range, a gentle swell between twelve and twenty-four. But twice it has surged above forty. The first time was at the peak of the dot-com frenzy, a moment of collective delusion. The market, believing itself unbound by earthly rules, reached for the sky and then, inevitably, fell.

The second time is now. After three years of steady gains – the S&P 500 rose over 78% – the CAPE has settled into a range of 39 to 40. It’s a quiet alarm, perhaps, but one that shouldn’t be ignored. The market, it seems, is once again testing the limits of reason.

Looking back, such rapid surges in the CAPE have only occurred twice before: once in the roaring twenties, and again in the nineties. In both cases, the market reached a peak, a moment of unsustainable optimism, before crashing down to earth. It’s a pattern, a rhythm, and it’s one that makes a careful observer uneasy.

Now, a high CAPE doesn’t guarantee a correction. The future, as always, is uncertain. But it does suggest that caution is warranted. It suggests that this isn’t a time for reckless speculation, for chasing the latest fads. It’s a time to remember the old virtues: prudence, patience, and a healthy respect for value.

The market will likely reward those who focus on strong, stable businesses, companies with solid balance sheets and a proven track record. It will punish those who chase after empty promises, companies built on nothing more than hope and hype. This is a time to be skeptical, to ask hard questions, and to demand evidence of real value.

Those who stick to quality, who remain patient, and who remember that the market is a means to an end, not an end in itself, should be well-positioned, regardless of what the future holds. The dustbowl years taught us that much, and the lessons, though often forgotten, remain true.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Ephemeral Engines: A Triptych of Tech

- AI Stocks: A Slightly Less Terrifying Investment

- 20 Games With Satisfying Destruction Mechanics

2026-01-26 18:52