Hark, gentle investors, and lend an ear to a tale of commerce most curious! We find ourselves amidst a throng of enterprises vying for our affections, yet few possess the peculiar charm—or, shall we say, the calculated audacity—of Coupang. This Korean purveyor of goods, a veritable merchant prince of the digital age, presents a spectacle worthy of our scrutiny—and, perchance, a modest investment.

For too long, we have chased after the gilded idols of Silicon Valley, the Nvidias and Palantirs, whose valuations seem to defy the very laws of reason. Let us, instead, turn our gaze eastward, to a company that, while not entirely untouched by the follies of the market, offers a more grounded—and, dare I say, amusing—proposition.

Of Data Breaches and Public Outcries

A scandal, you say? A leak of customer data? Such trifles are the daily bread of the modern age! While the Korean public—ever sensitive to matters of propriety—has raised a considerable hue and cry, let us not mistake a temporary tempest for a lasting squall. A momentary lapse in security does not invalidate a fundamentally sound enterprise. Indeed, it provides a most advantageous opportunity for the discerning investor to acquire shares at a reduced price.

Observe, if you will, the habits of the Korean consumer. They are a people enamored of convenience, swiftness, and a prodigious selection of goods. Coupang, with its unwavering commitment to these virtues, has captured their hearts—and, more importantly, their wallets. From a mere fifteen million active customers a few years past, their ranks have swelled to nearly twenty-five million. A testament, I assure you, to the company’s undeniable appeal.

And what of spending? Ah, there’s the rub! Each customer now bestows upon Coupang an average of $329 per quarter—a rise of seven percent from the previous year. A most encouraging sign, indicating that Coupang is not merely attracting customers, but cultivating a lasting relationship with them. Let the scandal fade into memory; the convenience endures.

Expanding the Realm of Commerce

A wise merchant does not confine his operations to a single village. Coupang, recognizing this fundamental truth, has ventured forth to conquer new territories. Taiwan, a land ripe with opportunity, has become its latest domain. Though still in its infancy, the Taiwanese venture is already yielding impressive results, with revenue growth soaring to triple-digit figures. A most promising sign, indicating that Coupang’s formula for success is not limited to the Korean peninsula.

But Coupang is not content with merely delivering goods. It aspires to become a purveyor of entertainment, a provider of sustenance, a curator of luxury. Its investments in Coupang Play (a streaming service), Coupang Eats (a food delivery service), and R.Lux (a luxury goods platform) are a testament to its ambition. The Korean appetite for luxury, it seems, is insatiable—and Coupang is eager to satisfy it.

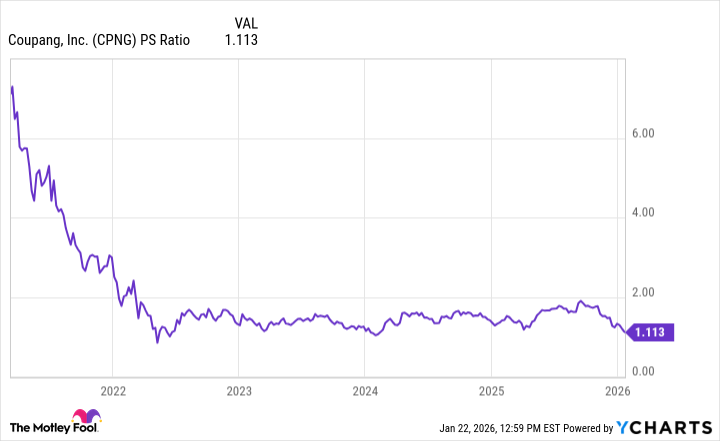

A Most Reasonable Valuation

Now, let us speak plainly. Coupang’s current price is, shall we say, a trifle excessive. However, a discerning investor should not be deterred by short-term fluctuations. The company’s revenue has more than doubled in the past five years, and its potential for future growth remains substantial. A market capitalization of $37 billion, while not insignificant, appears quite reasonable when viewed in light of its long-term prospects.

Consider this: Coupang’s trailing revenue stands at $34 billion, and its consolidated profit margin is poised to expand to ten percent or higher. This would translate to earnings of $3.4 billion, yielding a price-to-earnings ratio of a mere eleven. But what if Coupang continues to grow at a double-digit pace? If revenue reaches $55 billion in the next five years, earnings could soar to $5.5 billion, bringing the forward P/E ratio down to a paltry seven. A most agreeable prospect, wouldn’t you agree?

And let us not forget that Coupang is generating positive cash flow and actively repurchasing its own shares. A company that is both profitable and shareholder-friendly is a rare and precious commodity indeed. Therefore, I submit to you that Coupang is a premier growth stock trading at a dirt-cheap price. A most singular speculation, and one that I, for one, am eager to pursue.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Ephemeral Engines: A Triptych of Tech

- AI Stocks: A Slightly Less Terrifying Investment

- 20 Games With Satisfying Destruction Mechanics

2026-01-26 17:52