China has fixed the yuan at its strongest level since 2023, betting on continued U.S. policy that keeps the dollar weak. According to Xinhua, the currency has stayed below the 7 yuan‑per‑dollar mark, strengthening to 6.9843 yuan per dollar on Monday.

People’s Bank of China Sets Yuan Stronger as Dollar Weakens

China has signaled it is ready to strengthen its currency. A move as bold as a cat wearing a top hat, if you ask me.

The People’s Bank of China (PBOC), the institution that sets what’s called the daily fixing price of the yuan, has allowed the currency to reach its strongest level since May 2023. A feat so impressive, it’s like watching a slow cooker boil water.

In its latest fixing operation, the PBOC fixed the exchange rate at 6.9843 yuan per dollar, taking it under the 7 yuan per dollar mark, a figure considered a benchmark for China’s monetary policy. A benchmark so high, it’s practically a mountain.

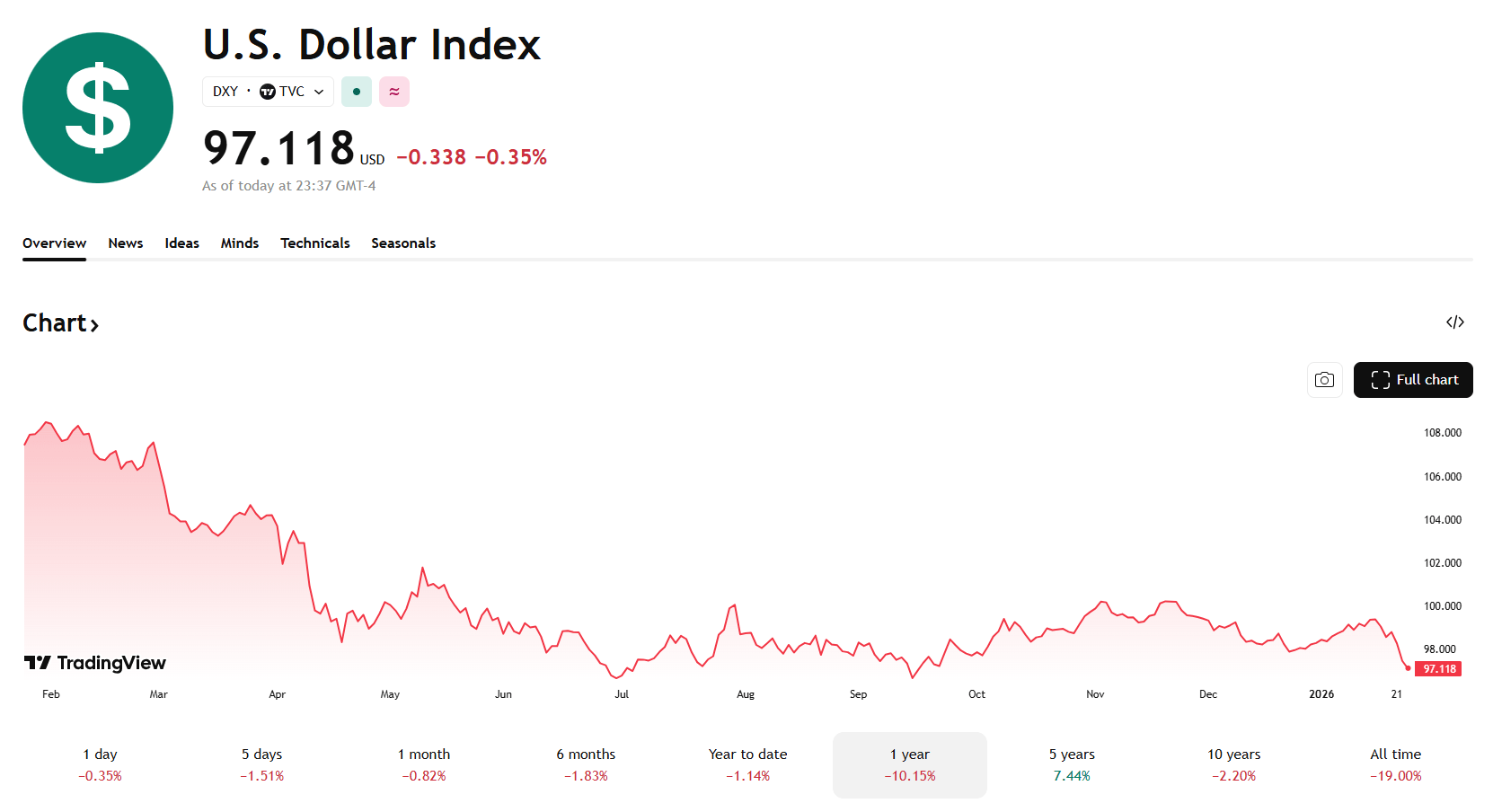

The strengthening of the yuan can be seen as a move to level the playing field, as the dollar index (DXY) has also fallen 10% during the last year. A fair fight, if the dollar weren’t already on its knees.

He Wei, an economist at Beijing-based research firm Gavekal Dragonomics, agreed with this take. He stated:

“The PBOC seems happy to permit more appreciation against the dollar, as long as the dollar’s weakness against other currencies means that the renminbi’s competitiveness is little affected.”

Rumors of a possible intervention to aid the yen, with help from the U.S. Treasury, selling dollars to strengthen the Japanese currency, have also affected forex markets worldwide, as it is seen as a development to avoid a possible treasury selloff by the Japanese government. A game of chess where every move is a gamble.

Takayuki Kobayashi, a senior official of Takaichi’s Liberal Democratic Party (LDP), declared that this could be troublesome for international markets. “Using reserves set aside for currency intervention would require selling U.S. Treasuries. That could affect markets,” he assessed. A warning as dramatic as a thunderstorm in a teacup.

Nonetheless, Wei states that the PBOC will be cautious about further strengthening the yuan. “Given China’s economic growth is still highly dependent on exports, the PBOC may not yet be willing to risk a more significant appreciation of the currency,” he concluded. A cautious approach, if you can call it that, in a world where everyone’s playing for keeps.

FAQ

-

What recent action has China taken regarding its currency? The People’s Bank of China (PBOC) has allowed the yuan to reach its strongest level since May 2023, fixing the exchange rate at 6.9843 yuan per dollar. A move so bold, it’s like a magician pulling a rabbit out of a hat-only this time, the rabbit is a currency.

-

Why is this strengthening of the yuan significant? This movement takes the yuan under the 7 yuan per dollar benchmark, indicating a strategic shift in China’s monetary policy to enhance competitiveness. A strategic shift so subtle, it’s like a whisper in a hurricane.

-

What factors are influencing the PBOC’s decision to strengthen the yuan? Analysts suggest that the PBOC is willing to permit more yuan appreciation as long as the dollar’s weakness against other currencies does not significantly affect the renminbi’s competitiveness. A balancing act so delicate, it’s like walking a tightrope while juggling flaming torches.

-

What caution does the PBOC have regarding further yuan appreciation? The PBOC remains cautious about aggressive strengthening due to China’s reliance on exports, wanting to avoid jeopardizing economic growth. A caution so thorough, it’s like a squirrel storing acorns for a winter it might not survive.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Ephemeral Engines: A Triptych of Tech

- AI Stocks: A Slightly Less Terrifying Investment

- 20 Games With Satisfying Destruction Mechanics

2026-01-26 12:57