Palantir Technologies. The name itself sounds like a particularly gloomy chapter from a forgotten history of Central Europe.1 Once a purveyor of shadowy arts to governments – a sort of high-tech divining rod for intelligence agencies – it now finds itself, rather unexpectedly, at the forefront of this… Artificial Intelligence business. A bit like a blacksmith suddenly finding he’s good at making cuckoo clocks. It’s not what anyone expected, least of all Palantir, I suspect.

The stock, as these things do, has been on a journey. A rather enthusiastic parabolic arc, rising some 2,300% over the last three years. Which, let’s be honest, is the sort of number that usually precedes a stern talking-to from the Department of Common Sense. But here we are. And now, in the early days of 2026, a wobble. A dip. A chance, perhaps, to acquire a small piece of the future at a slightly less astronomical price.

But before we start throwing gold coins at the screen, let’s acknowledge the rather unsettled state of things. The market, you see, is currently operating under the principle that any good news is immediately followed by a counter-argument, and vice versa. It’s a bit like watching a particularly indecisive dragon try to choose between a princess and a pile of gold.

The Stock Market: A Fragile Ecosystem

Palantir hasn’t reported its latest earnings yet, so attributing this little tremor solely to the company would be… premature. Both the S&P 500 and the Nasdaq-100 are currently bobbing about like corks in a particularly choppy sea. Growth stocks, in particular, seem to be experiencing a mild case of the jitters. They’re sensitive souls, these things, easily spooked by shadows and whispers.

Here are a few of the specters haunting the market, as I see them:

- Geopolitics: The usual suspects are causing trouble. Eastern Europe is still…Eastern Europe. The Middle East is, well, the Middle East. And President Trump, bless his disruptive heart, is renegotiating tariffs with Europe and muttering about the Arctic. It’s enough to give a rational investor a strong cup of tea and a quiet room.

- Trump Boom or Bust: The economy is showing signs of life, consumer spending is surprisingly robust, but unemployment remains stubbornly elevated. It’s a confusing picture. Trying to read the economic tea leaves these days is like trying to decipher the instructions on a flat-pack golem.

- The Federal Reserve: Will they lower interest rates? Won’t they? It’s a coin toss. And the market, naturally, is treating it like a high-stakes game of dragon poker.

- The AI Bubble: Some investors are starting to suspect that the AI hype might be…a bit overblown. They’re taking profits, trimming positions, and generally behaving like sensible people. Which, in the world of high finance, is always a bit suspicious.

Should You Buy Palantir? A Question for the Ages

Palantir is, shall we say, a polarizing stock. Analysts are divided. Sixteen rate it a ‘hold’, which is analyst-speak for ‘we’re not entirely sure what’s going on’. Only five offer a ‘buy’ rating. It’s a bit like asking a committee of wizards to agree on the proper way to brew a potion.2

Nevertheless, the average price target is around $190, implying a 14% upside. Bank of America, Morgan Stanley, Citigroup, Piper Sandler, and Wedbush Securities all have targets of at least $200. They’re either very optimistic, or they’re playing a very long game. Or possibly both.

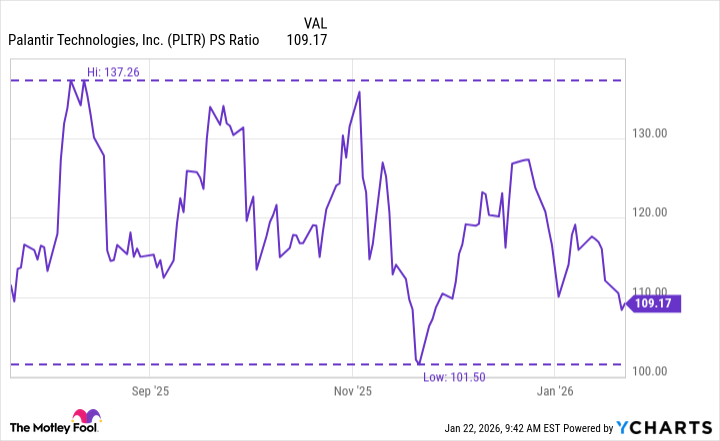

Palantir isn’t cheap, but its price-to-sales ratio is at a six-month low. Which, in the current climate, is something of a miracle.

My advice? A prudent strategy, as always, is dollar-cost averaging. Consider a small purchase now, and then add to your position over time, so long as your conviction remains high. Think of it as planting a small seed. It might not grow into a mighty oak overnight, but with a little patience, and a little luck, it might just bear fruit. And remember, even the most seasoned investor is, at the end of the day, just a gambler with a spreadsheet.3

1

Palantir, in folklore, was a sort of all-seeing crystal ball, used by kings and sorcerers to predict the future. It was also notoriously unreliable.

2

Analysts, you see, are often paid to be cautious. It’s a strange profession.

3

The spreadsheet, of course, is merely a sophisticated form of divination.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Ephemeral Engines: A Triptych of Tech

- AI Stocks: A Slightly Less Terrifying Investment

- 20 Games With Satisfying Destruction Mechanics

2026-01-26 08:02