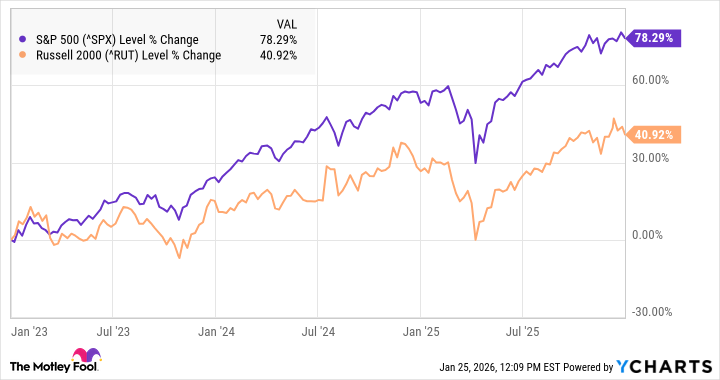

The year begins, and with it, a subtle tremor runs through the established order of things. For some time now – these past few years, in fact – the larger concerns, the venerable names of the S&P 500, have enjoyed a prosperity that felt, if not entirely unearned, then at least… disproportionate. A surge, they call it – a lifting of all boats, though some, naturally, were more seaworthy than others. From 2023 to 2025, the index ascended with a vigor that recalled, perhaps, the heady days of a different sort of boom – one built not on silicon and algorithms, but on railways and speculation. A gain of 78%, they say, as if quantifying such a phenomenon truly captured its essence.

Yet, even in the most assured of ascensions, a counter-current begins to form. The disparity between the grand estates of the S&P 500 and the more modest holdings of the Russell 2000 – the smaller concerns, the nimble ventures – has been, of late, quite striking. As one observes the charts – these pale imitations of life, these attempts to impose order on chaos – the gulf between the two becomes almost… melancholic. The larger firms have doubled the returns of their smaller counterparts, a circumstance that speaks not necessarily of inherent superiority, but perhaps of a certain… inertia. They are the established landowners, content to reap what is sown, while the smaller tenants strive to cultivate new fields.

This divergence, of course, is not entirely unexpected. The recent fervor has been largely driven by a handful of companies – the so-called “Magnificent Seven” – whose fortunes have become inextricably linked to the promises of artificial intelligence. They represent, at this moment, a considerable portion of the entire index – a concentration of power that feels, if not precarious, then certainly… unusual. It is as if the entire landscape is being reshaped by the whims of a few dominant peaks.

Historically, in such bull markets, one might expect the smaller concerns to flourish – to demonstrate a vitality that the larger firms, weighed down by their own successes, often lack. They are, after all, more exposed to the prevailing winds, more susceptible to both fortune and misfortune. Yet, for a time, this pattern seemed to be… suspended. The grand estates continued to accumulate wealth, while the smaller holdings struggled to keep pace.

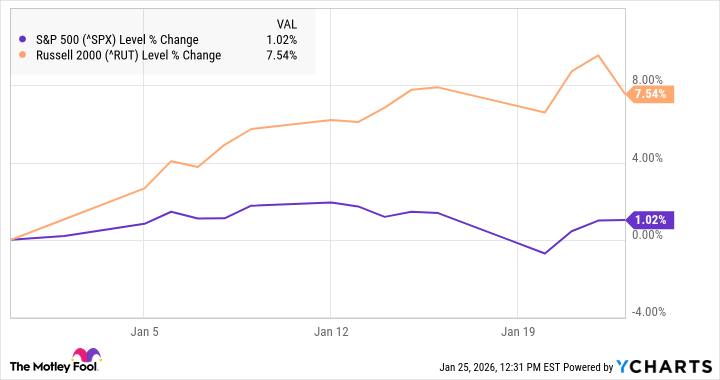

But now, a change is afoot. The tide, it seems, is beginning to turn. Through the early weeks of this year, the Russell 2000 has shown a surprising resilience – a willingness to challenge the established order. It has outpaced its larger counterpart for a period not seen since 1996 – a time when the world felt, perhaps, a little less… complicated. Fourteen consecutive sessions of outperformance, they say – a remarkable feat, though one should not, perhaps, read too much into such fleeting moments.

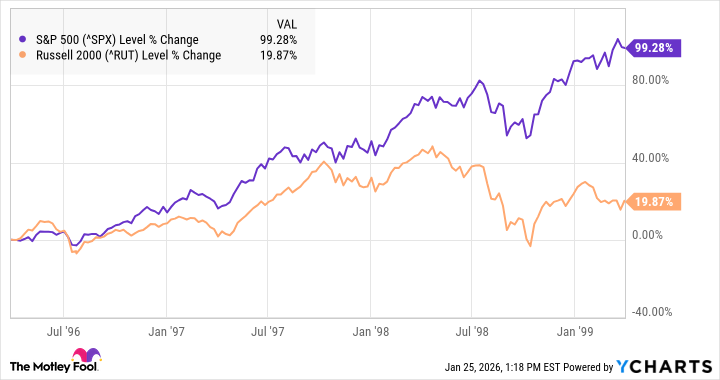

Reflections on May 1996

One recalls, dimly, the spring of 1996 – a time of burgeoning optimism, of unchecked enthusiasm for the possibilities of the new technologies. It was, as it turned out, the second year of a five-year boom – a period of speculative excess that ultimately culminated in the inevitable reckoning. The Russell 2000 enjoyed a brief period of ascendancy then, as it does now, but it proved to be a false dawn. The larger firms, bolstered by their established positions, ultimately regained their dominance.

In those days, the S&P 500 surged by 99% over three years, while the Russell 2000 languished with a mere 20% gain. A sobering reminder that past performance is, indeed, no guarantee of future results.

A Cautious Outlook

A streak of outperformance, however brief, does not necessarily portend a lasting shift in the balance of power. The market is a fickle creature, prone to sudden whims and unexpected reversals. But there are, perhaps, some underlying currents that suggest a more sustained period of strength for the smaller concerns.

They are, for one thing, considerably cheaper – their valuations far more reasonable than those of the larger firms. And investors, increasingly wary of the concentration of risk in the hands of a few dominant players, may be seeking to diversify their holdings. The SPDR S&P 500 ETF trades at a price-to-earnings ratio of 27.9, while the iShares Russell 2000 ETF hovers around 19.4 – a significant difference, and one that cannot be ignored.

Furthermore, the S&P 500 has outperformed the Russell 2000 for five consecutive years – a remarkable run, and one that seems, inevitably, destined to end. The pendulum, it appears, is beginning to swing in the opposite direction.

For the discerning investor, holding a diversified portfolio remains the wisest course. But if a majority of your holdings are concentrated in the larger firms, it may be prudent to consider allocating a portion of your capital to the smaller concerns – to a small-cap ETF like the IWM, or a growth alternative like the Vanguard Russell 2000 Growth Index Fund ETF. A shift in the prevailing winds may be at hand, and it would be unwise to be caught unprepared.

One streak, it is true, does not make a summer. But there are, perhaps, other reasons to believe that the smaller concerns may finally have their moment in the sun. The bull market, after all, is a long and arduous journey, and even the most venerable of travelers must occasionally yield to the nimbler, more agile adventurers.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Ephemeral Engines: A Triptych of Tech

- AI Stocks: A Slightly Less Terrifying Investment

- 30 Overrated Strategy Games Everyone Seems To Like

2026-01-26 07:02