Right then. The world is, as usual, attempting to unravel itself. Geopolitical kerfuffles, trade wars conducted with the subtlety of a goblin raid, and interest rates doing a jig that nobody predicted. Is this a time for investing? Well, is a dragon a good idea for a pet? Probably not, but some people insist. The point is, there’s always a reason for pessimism. The sensible thing, historically, is to keep adding a bit of coin to the pot. A slow drip, not a frantic plunge. It’s like feeding a gargoyle – regular offerings prevent it from taking an interest in you.

Which brings us to e.l.f. Beauty. A company that makes… well, things people put on their faces. I’m more of a ‘wash and hope for the best’ sort myself, but others seem to require more elaborate rituals. And, as a consequence, e.l.f. might just find its way into my portfolio. Possibly. Don’t mistake contemplation for commitment; I’ve seen perfectly good investments vanish like smoke in a wizard’s beard.

From a purely business-like perspective (and I use the term loosely, as business rarely is purely anything), e.l.f. has some attractive qualities. First, the revenue growth. Twenty-seven consecutive quarters of it, apparently. That’s… a lot of quarters. Enough to make a dwarf envious. They’re taking market share from the larger, more established players, which is always satisfying. It’s like watching a nimble imp outwit a lumbering troll. Management expects 18% to 20% top-line growth this year, which, if true, means they’re doing something right, or have a very persuasive sales goblin.

They’ve achieved this by being, shall we say, economical. The average price of their products is $7.50. Compared to $9.50 for the competition. A small difference, perhaps, but when multiplied across millions of faces… well, it adds up. They even had the audacity to increase prices by a dollar recently. A bold move. One expects pitchforks and torches, but so far, the customers seem… tolerant. It’s a testament to the power of a well-marketed illusion.1

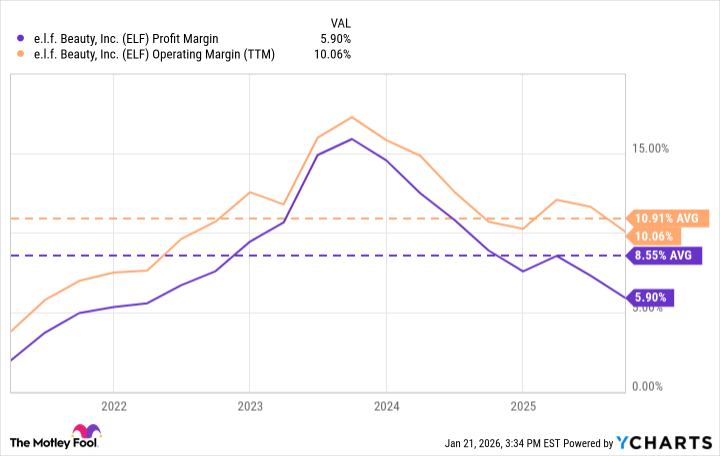

What’s truly remarkable is that they manage to do this without sacrificing profitability. Don’t expect the margins of a tech firm here; we’re not dealing with digital illusions, but actual powders and creams. But a five-year average operating margin of around 11%, and a profit margin of 9%? That’s… acceptable. It suggests they’re not simply throwing glitter at the problem and hoping for the best.

Of course, there’s the matter of tariffs. Most of their products are made in China, which means they’re at the mercy of trade winds and political whims. This is impacting margins, naturally. But the price increase should help offset some of the pressure. It’s a bit like trying to bail out a sinking ship with a thimble, but it’s a start.

With only $1.4 billion in revenue, they’re still a relatively small fish in a very large pond. Which means there’s plenty of room for growth. Assuming, of course, they don’t accidentally summon a sea monster. That would put a damper on things. It’s a long-term play, if you will. A slow, steady accumulation of value, like a dwarf collecting gemstones.

What else investors should know

I started by saying I might buy e.l.f. Beauty stock. And that’s precisely what I meant. My mind is, as always, a shifting landscape of possibilities. There are other companies vying for my attention, each with its own merits and flaws. I haven’t decided which one I like best yet. It’s a bit like choosing a favourite goblin – they all have their charms, but some are more likely to bite.

Even if I don’t buy e.l.f. Beauty stock this year, I still find the investment thesis compelling. Which is why it’s on my list in the first place. It’s a solid company, with a decent business model and a reasonable valuation. It’s not going to make me rich overnight, but it might provide a steady stream of income over the long term.

The stock is down over 50% from its 2024 high. Which, naturally, raises a red flag. But it also presents an opportunity. A chance to buy a good company at a discounted price. It doesn’t mean the bottom is in, of course. Stocks can always fall further. They’re notoriously unpredictable, like a flock of startled pigeons. And this is unlikely to be the last 50% drawdown it ever experiences.

This is a good reminder that stocks are volatile, even good ones. That’s why it’s important to hold through market turbulence. You don’t want to sell before the rebound. It’s like waiting for a dragon to wake up – you have to be patient.

Personally, I’ve found that investing in companies you… tolerate… helps you hold on during the hard times. While I’m not a user of their products myself, several people in my household are. And they would be delighted to see this… colourful… growth stock added to our investment portfolio. It’s a matter of domestic harmony, you see. A small price to pay for a peaceful household.

1 The illusion, of course, being that applying various creams and powders will somehow transform you into a different person. A remarkably persistent myth, considering the evidence to the contrary.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- TON PREDICTION. TON cryptocurrency

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Ephemeral Engines: A Triptych of Tech

- AI Stocks: A Slightly Less Terrifying Investment

- Amazon: A Spot of Resilience

- The Weight of First Steps

2026-01-26 02:32