So, the market went up for a while. Three years, to be precise. Fueled, they said, by artificial intelligence. A lot of optimism. Optimism is a funny thing, isn’t it? It usually precedes disappointment. The S&P 500 obliged, of course. It always does. There were tariffs, interest rates… minor inconveniences, really. The overall trend was upward. A little blip of good fortune. So it goes.

Everyone wanted a piece of the AI pie. A new technology. They always promise a revolution. Revenue growth. Explosions of wealth. It’s the same story, repeated endlessly. The valuations climbed. Vertiginous, they called it. High. And then the worry started. A bubble. Naturally.

Is it going to burst? That’s what they’re asking. It’s a perfectly reasonable question, if you’re the type to ask questions. Here’s a thought, though: it doesn’t much matter. Either way, someone will profit. That’s just how the gears turn.

Strong Earnings, For Now

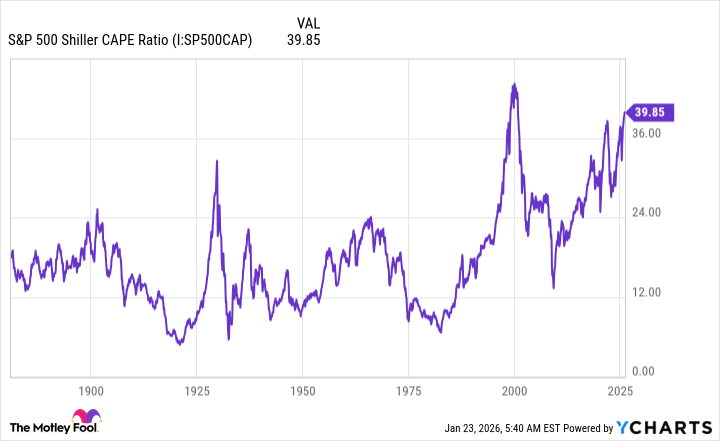

The earnings reports are… okay. Not terrible. Nvidia did well last quarter. Taiwan Semiconductor Manufacturing too. Demand is up. For the moment. But the S&P 500 Shiller CAPE ratio? That’s a different story. It’s been there once before. A lonely peak in a long, flat landscape. A warning, perhaps. Or just a coincidence. It’s hard to say.

So, what does one do? Prepare. That’s the sensible thing. Prepare to win, or at least, to not lose too much. It’s a simple plan, really. A little bit of hope, a little bit of resignation. So it goes.

Diversify, they say. Spread your money around. Buy shares in Nvidia, sure. But also buy shares in healthcare. Or a solid financial player like American Express. Just in case the AI thing doesn’t work out. A little insurance against the inevitable. A prudent move, wouldn’t you say?

Inexpensive Players

Look for companies involved in AI, but not dependent on it. Amazon and Apple, for example. They have other things going for them. Social media, mostly. And Meta Platforms (META +1.77%) is trading at a reasonable price, as these things go. Twenty-one times forward earnings. Not exorbitant. Not yet, anyway. It’s mostly advertising revenue, which is a bit like selling dreams. But it pays the bills. So it goes.

Consider your risk tolerance. If you’re an aggressive investor, load up on high-growth AI stocks. If you’re cautious, stay away. It’s a simple equation, really. Risk equals potential reward. But also, potential regret. It’s a balancing act. A delicate dance with fate.

With all of this in mind, you might just set yourself up to profit. Or at least, to survive. Whether the AI bubble bursts or not. It’s a small victory, perhaps. But in the grand scheme of things, what isn’t?

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- TON PREDICTION. TON cryptocurrency

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Ephemeral Engines: A Triptych of Tech

- AI Stocks: A Slightly Less Terrifying Investment

- Amazon: A Spot of Resilience

- The Weight of First Steps

2026-01-25 21:23