The season of reckonings approaches, when companies lay bare their fortunes, and the markets, ever restless, judge their worth. Among these titans stands Microsoft, a name synonymous with the relentless march of technological progress, and yet, lately, a shadow has fallen upon its once-unblemished ascent. Since the closing of the last accounting period – a time when the fruits of labor were tallied – its share price has suffered a decline, nearly a fourteenth part of its former value. A considerable sum, enough to give pause even to the most ardent of investors.

It is a curious thing, this vulnerability of even the most formidable enterprises. One might observe a certain hubris in the market’s prior valuations, a tendency to extrapolate present success into an infinite future. Microsoft, like all organizations, is subject to the immutable laws of consequence, where every action, every innovation, carries with it a corresponding reaction. The question, therefore, is not simply whether the stock will recover, but whether the underlying foundations remain sound. The company is due to report its second-quarter earnings on January 28th, and it is to this moment that our attention must turn.

The Multifaceted Nature of Microsoft’s Dominion

Microsoft’s reach extends into many corners of modern life. From the ubiquitous Office suite, a constant companion to countless workers, to the immersive worlds of Xbox and Activision-Blizzard, and the professional networks of LinkedIn, the company has woven itself into the fabric of our daily routines. But it is in the realm of artificial intelligence, a field promising both unprecedented opportunity and unsettling disruption, that the true measure of its future lies. Investors, naturally, are consumed by this prospect.

MSFT”>

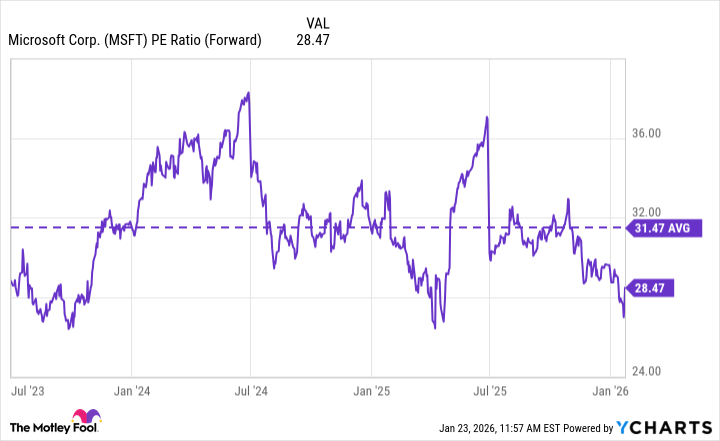

Should Azure maintain its vigor, and the rest of the company continue to perform as expected, a further increase in the share price is certainly plausible. But the markets are fickle creatures, easily swayed by rumor and sentiment. A disappointing earnings report could easily trigger a further decline. The valuation, it must be said, had become somewhat inflated, exceeding thirty-two times forward earnings. While such multiples are not uncommon in the technology sector, they leave little room for error.

A Return to Reason?

The recent correction, therefore, is not necessarily a cause for alarm. Indeed, it may represent a welcome return to reason, a recalibration of expectations. At 28.5 times forward earnings, the stock appears to offer a more attractive entry point, particularly when compared to its five-year average of 31.5 times. It is a level that acknowledges the company’s strengths without succumbing to excessive optimism. The true test, of course, lies in the upcoming earnings report.

If Microsoft delivers solid results, a modest increase in the share price is likely. But the markets are rarely predictable. One must consider the broader economic landscape, the geopolitical uncertainties, and the ever-present risk of unforeseen disruptions. It is a complex equation, and one that requires careful consideration. For the long-term investor, however, Microsoft remains a compelling proposition, a company with a proven track record of innovation and a dominant position in a rapidly evolving industry. It is a wager, to be sure, but one that, at the current valuation, appears to be weighted in their favor.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Ephemeral Engines: A Triptych of Tech

- Dividends: A Most Elegant Pursuit

- Venezuela’s Oil: A Cartography of Risk

- AI Stocks: A Slightly Less Terrifying Investment

2026-01-25 20:55