Ah, the weekend-when the world holds its breath and the market takes a leisurely stroll through the meadows of indecision. But lo! As if summoned by some unseen hand, Bitcoin once again decides to waltz downwards, plummeting to a new multi-day low that elicits gasps from the faint-hearted, sinking below the illustrious $88,000 mark.

And what of the altcoins, those gallant knights striving valiantly in the treacherous fields? ETH has found itself gasping for air beneath $2,900, while SOL takes a swift tumble of over 2.5% in an hour, as if caught in a sudden rainstorm without an umbrella.

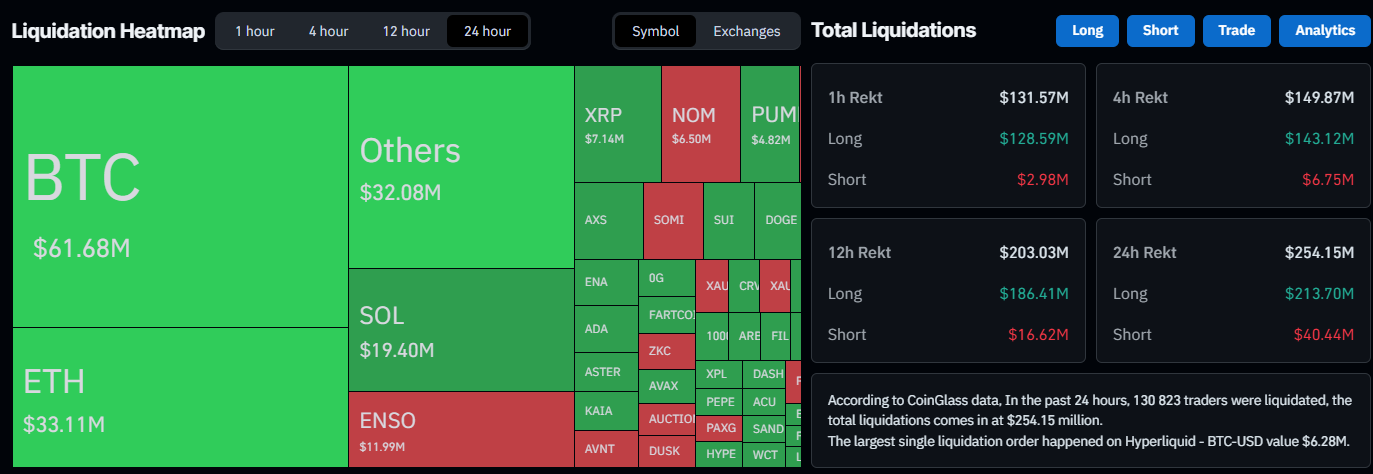

BREAKING: Bitcoin’s grand descent below $88,000 is accompanied by a cacophony of liquidated longs worth a staggering $60 million in just half an hour. Who needs fireworks when you have this spectacle?

In the political arena, a government shutdown looms ominously on the horizon, with President Trump wielding his tariff sword, threatening a full-blown 100% tax on our friendly neighbors up north.

Meanwhile, the US stock market futures prepare to awaken from their slumber in less than 7 hours. What a time to be alive!

– The Kobeissi Letter (@KobeissiLetter) January 25, 2026

The analysts at the Kobeissi Letter have donned their thinking caps and suggest that the ongoing market corrections may stem from the anticipated US government shutdown following the Minneapolis shooting-oh joy, round two during Trump’s presidency! And let’s not forget the ominous tariffs dancing on the edge of the political stage, ready to leap into action should Canada decide to cozy up to China.

Much like a drama unfolding on a grand stage, BTC initially held its ground but began to lose its composure as the opening of the futures markets approached. It is now perched precariously at a five-day low of $87,500, having faced rejection at the lofty heights of $89,000 earlier today. The past hour has been akin to a rollercoaster ride for altcoins; some, such as SUI, SOL, ARB, PEPE, ENA, and ADA, have plummeted over 2%, leaving traders clutching their pearls.

Ethereum, not one to be left out of the turmoil, has shed 1.5% of its value in the last hour alone, struggling valiantly below $2,900. The total wreckage from yesterday’s skirmishes sits at a staggering $250 million, with more than half of that sum ($131 million, according to CoinGlass data) crumbling into dust within the last hour.

In a dramatic twist, over 130,000 traders have faced the grim fate of liquidation daily, with a single position on Hyperliquid valued at a jaw-dropping $6.3 million being the proverbial cherry on top of this chaotic cake.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Ephemeral Engines: A Triptych of Tech

- Dividends: A Most Elegant Pursuit

- Venezuela’s Oil: A Cartography of Risk

- AI Stocks: A Slightly Less Terrifying Investment

2026-01-25 20:14