The Nasdaq, they say, has gone up. A hundred and eleven percent in three years. So it goes. The other index, the S&P 500, only managed seventy-four. A difference, yes, but mostly a difference in bragging rights. It’s all about the tech, naturally. Everyone’s chasing the artificial intelligence ghost. Billions are being thrown at it. Two and a half trillion this year, if you believe Gartner. And who doesn’t need to believe something?

They expect another jump next year. Thirty-two percent. More money, more machines, more things to distract us from the inevitable heat death of the universe. It’s a good time, they say, to look at a couple of stocks. I suspect it’s always a good time to look at stocks. Or a bad time. It rarely makes much difference in the long run.

Applied Materials: Making the Machines That Make the Machines

Applied Materials, a company that makes the things that make the chips. Shares are up seventy-two percent in six months. Not surprising. Demand for chips is up. Everything needs a chip now, even your toaster, probably. Omdia says the semiconductor industry could bring in over a billion dollars this year. A billion. It’s a big number, isn’t it?

There’s a shortage, of course. Always a shortage. Taiwan Semiconductor and Micron aren’t making enough. So, they need more equipment. SEMI says equipment sales could hit $145 billion in 2026. Maybe. TSMC is planning to spend $13 billion more on capital expenditures. Micron another $6 billion. More money, more machines. It feels a bit like building a bigger and bigger sandcastle as the tide comes in. But someone will profit, I suppose.

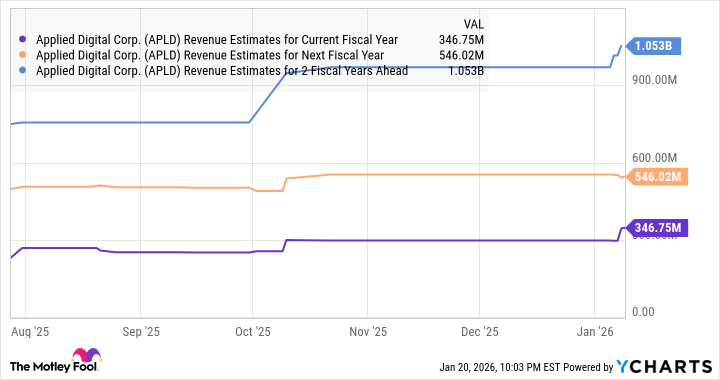

Applied Materials made $28.4 billion last year. A record. They aren’t expecting a big jump this year, but they are hoping for one next year. They might get it. Or they might not. The market is a fickle beast. Trading at nine times sales, it’s about average for the tech sector. A premium is possible, if they outperform. A gamble, certainly. But aren’t we all just gamblers, in the end?

SentinelOne: Fighting Ghosts with Ghosts

SentinelOne had a bad year. Shares fell thirty-two percent. They couldn’t meet Wall Street’s expectations. It happens. The stock also fell the year before. A pattern, perhaps. So it goes. But it’s also trading at 4.6 times sales and 38.6 times forward earnings. A discount, if you believe the hype. They’re focused on AI, naturally. Everyone is. They acquired Observo AI for $225 million to boost their threat detection. More AI fighting AI. A perfectly absurd situation, really.

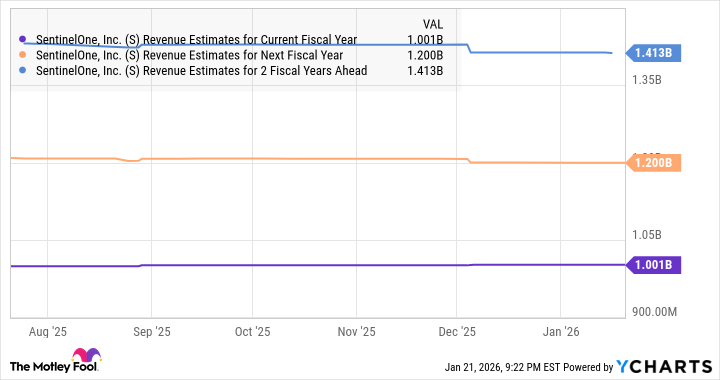

Singularity, their AI platform, is winning contracts. They’re building a pipeline. Revenue increased by 23% last year. Remaining performance obligations increased by 35%. More business than they can currently fulfill. A good problem to have, I suppose. Their non-GAAP net income margin went from breakeven to 9.6%. Progress, of a sort.

Analysts expect the stock to jump 48%. A median price target of $20.50. Possible, yes. The cybersecurity market is expected to double this year to $51 billion. More money chasing more threats. Gartner says so. It’s all a bit exhausting, isn’t it? But then, what isn’t?

These are just stocks, of course. Pieces of paper, or, more accurately, entries in a computer database. They go up, they go down. Sometimes they disappear altogether. Don’t bet the farm. And don’t expect miracles. Just a few lucky gambles, perhaps. So it goes.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Ephemeral Engines: A Triptych of Tech

- Dividends: A Most Elegant Pursuit

- Venezuela’s Oil: A Cartography of Risk

- AI Stocks: A Slightly Less Terrifying Investment

2026-01-25 18:32