Gold. A weight in the hand, a glint in the darkness. For ages, man has clung to it, not for its utility, but for the illusion of permanence it offers in a world steeped in decay. It is the tangible representation of a fleeting hope, a bulwark against the inevitable tide of economic uncertainty. Even now, when reason might suggest a more… enlightened approach, the anxious investor still clutches at its cold, unyielding surface.

And then there is Bitcoin. A phantom, a digital echo born of algorithms and the fervent belief in a decentralized future. It promises liberation from the failings of established systems, yet remains tethered to the very anxieties it seeks to alleviate. A curious paradox, wouldn’t you agree? A ghost attempting to anchor itself in the material world.

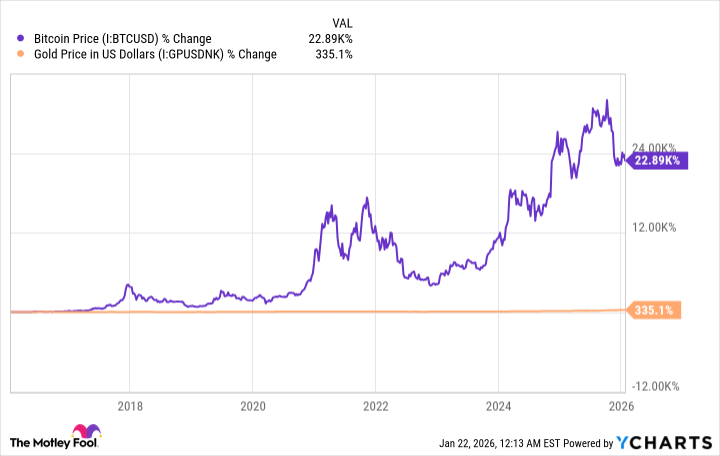

The prevailing narrative, that Bitcoin is merely digital gold, suffered a rather… unsettling collapse last year. The two assets, once presumed to move in tandem, diverged with a starkness that demands contemplation. It revealed a fundamental disconnect, a divergence in the very souls of these contenders. One, steeped in the weight of history; the other, a restless spirit yearning for validation.

The Spectre of Utility

Assets like stocks and estates, they produce. They offer the illusion of growth, a semblance of purpose. Gold and Bitcoin… they offer nothing of the sort. They are vessels, filled only by the winds of speculation and the slow erosion of faith in fiat currencies. A precarious foundation, wouldn’t you say?

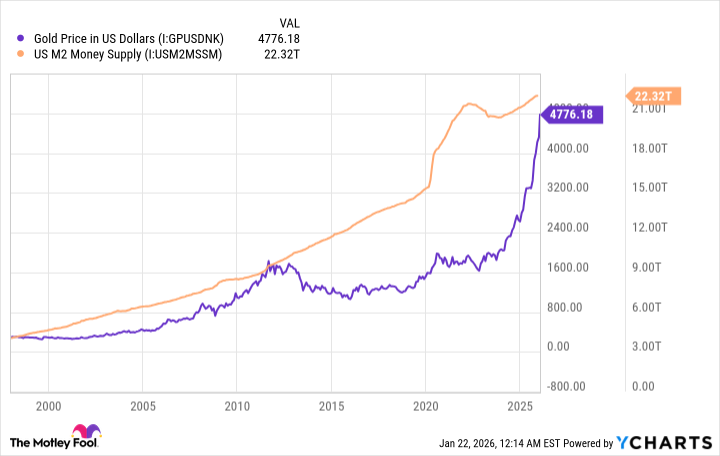

Until 1971, the United States clung to the gold standard, a desperate attempt to impose order on the chaos of monetary policy. But the dam inevitably broke. The unleashing of paper money, unmoored from tangible backing, has resulted in a gradual, agonizing devaluation of the dollar. Ninety percent, if one dares to calculate the extent of the loss. A chilling testament to the fragility of trust.

Thus, whenever the specter of unrestrained monetary expansion looms, the anxious investor flees to gold. The recent American budget deficit, a staggering $1.8 trillion, and a national debt reaching a record $38.5 trillion, only amplify these fears. Governments, in their infinite wisdom (or perhaps, their infinite desperation), often resort to currency devaluation to alleviate the burden of their debts. A cynical practice, to be sure, but one steeped in historical precedent. Gold, predictably, soared by a remarkable 64% last year.

Bitcoin, however, fell by 5%. A disconcerting sign, wouldn’t you agree? It casts a long shadow over the notion that it is a viable substitute for the ancient metal. The cryptocurrency, devoid of intrinsic utility, relies entirely on the fickle whims of the market. A precarious existence, to say the least.

The Illusion of Security

Bitcoin, with its decentralized nature, promises freedom from control. It is built on a blockchain, a secure and transparent ledger, designed to instill confidence. And its limited supply of 21 million coins has fueled a meteoric rise in value. But is this merely a fever dream, a collective delusion built on the shifting sands of speculation?

Over the past decade, Bitcoin has eclipsed gold in terms of performance. The returns are… astronomical. But past performance, my friends, is a treacherous guide. It offers no guarantee of future success. Last year served as a stark reminder of this truth.

The question, then, is not what has been, but what will be. The United States government, relentlessly pursuing its path of deficit spending, is poised to add another trillion dollars to the national debt. And the Federal Reserve, in its endless quest to manage the economy, has begun to cut interest rates and purchase government-backed securities. A dangerous game, wouldn’t you say? A reckless disregard for the long-term consequences?

Therefore, it is likely that this year will mirror the conditions of the last. Gold, with its enduring appeal and tangible presence, will likely prove to be the more prudent investment. Bitcoin, a phantom chasing its own tail, will remain a creature of speculation, forever haunted by the specter of uncertainty.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Dividends: A Most Elegant Pursuit

- Venezuela’s Oil: A Cartography of Risk

- AI Stocks: A Slightly Less Terrifying Investment

- Chipotle & Sweetgreen: A Market’s Quiet Bloom

2026-01-25 13:32