The chronicle of Peloton Interactive (PTON 0.17%) presents itself as a curious case for the student of cyclicality. One might posit it as a modern iteration of the ‘ship of Theseus’ paradox – at what point does a transformation so complete render the initial entity unrecognizable? The company, once hailed as a harbinger of a new fitness orthodoxy, descended into a period of what the vulgar might term ‘difficulty’ – a state, I suspect, more accurately described as a temporary divergence from the expected trajectory of valuation. The precipitous decline – a near total eclipse of its former glory – is, of course, the most readily apparent facet of this tale.

The accounts speak of prodigious cash burn – a hemorrhage of capital totaling $2.7 billion over four fiscal years. This, coupled with the inevitable procession of executive departures and the contraction of revenue, might suggest a terminal case. Yet, the very nature of markets is to confound simple prognostication. The Library of Babel contains all possible books, and within that infinite collection, even the improbable finds its page.

Recent reports indicate a stabilization – a tentative cessation of the downward spiral. Free cash flow, a metric often regarded as a phantom by those enamored with accounting illusions, has turned positive – a modest $324 million in fiscal 2025, followed by $67 million in the first quarter of fiscal 2026. A margin of 12% is not to be dismissed lightly. It suggests a temporary reprieve, perhaps, but not necessarily a restoration. The market, it seems, has momentarily forgotten the law of conservation of capital.

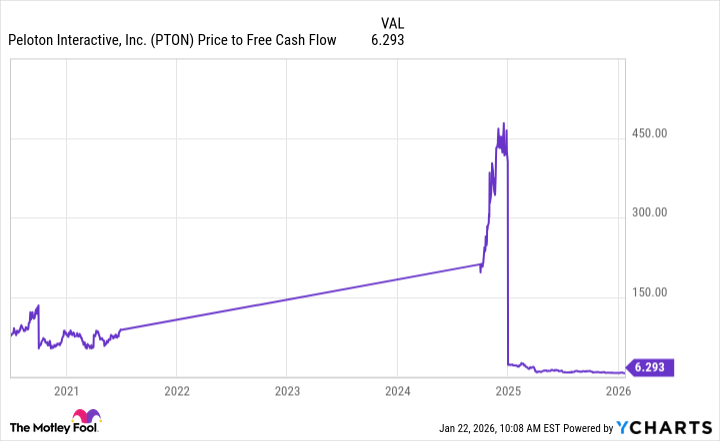

The current valuation – a mere six times trailing free cash flow – is, on the surface, almost absurdly low. One searches, in vain, for a comparable instance of such apparent mispricing. It is as if the market, in a fit of collective amnesia, has overlooked the fundamental principles of discounted cash flow analysis. Or perhaps, it possesses a prescience we lack.

The resumption of profitability is, naturally, a welcome development. However, it is merely a necessary, not a sufficient, condition for a successful investment. The true test lies in the company’s ability to rediscover a path to sustained growth. To merely survive is not to thrive.

The Labyrinth of Revenue

The historical record reveals a consistent decline in revenue over the past four years. The projected increase of less than 1% for the upcoming quarter is a faint glimmer of hope, but hardly a resounding endorsement. The reliance on price increases to offset subscriber losses is a precarious strategy – a temporary fix that postpones the inevitable reckoning. It is akin to rearranging the furniture in a sinking ship.

The expansion into smaller format stores – dedicated sections within larger retail spaces – is a more promising development. It represents a shift away from the hubristic ambition of standalone megastores – a recognition of the limitations of scale. It’s a move towards a more subtle, less intrusive presence, like a secret passage within a larger structure.

The introduction of commercial products carries both promise and peril. Growth is always alluring, but it must be grounded in reality. The accumulation of unsold inventory – hardware gathering dust in warehouses – is a specter that haunts every manufacturer. One must always remember the lesson of the infinite monkey theorem: even with infinite resources, the probability of achieving a desired outcome remains finite.

In my estimation, Peloton’s path to profitable growth is fraught with uncertainty. The stock may be cheap, but cheapness alone does not guarantee success. I remain content to observe, to analyze, to wait for a more compelling narrative to emerge. The market is a vast and intricate labyrinth, and one must proceed with caution, lest one become hopelessly lost within its winding corridors.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Dividends: A Most Elegant Pursuit

- Venezuela’s Oil: A Cartography of Risk

- AI Stocks: A Slightly Less Terrifying Investment

- Chipotle & Sweetgreen: A Market’s Quiet Bloom

2026-01-25 12:22