![]()

TSMC, as it is known, is a foundry, a maker of the very building blocks of modern technology. From the smartphones that occupy our hands to the autonomous vehicles that promise to reshape our cities, and most importantly, the burgeoning realm of artificial intelligence, its creations are ubiquitous. It serves as a partner to those who dream of a future shaped by these intelligent machines—Nvidia, Amazon, Apple—and while others may strive to compete, TSMC holds a position of dominance, a reliance upon which these ambitious enterprises depend.

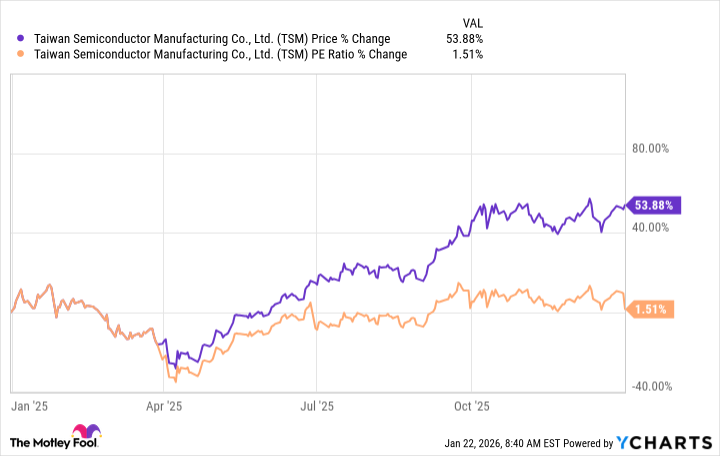

Taiwan Semiconductor Manufacturing, a name whispered with increasing reverence in the halls of commerce, has lately enjoyed a prosperity not unlike a favored season. The past year has seen its value swell by a considerable measure—fifty-four percent, to be precise—and the chorus of Wall Street analysts sings its praises, nearly unanimous in their assessment of a favorable outlook. Yet, it is a curious thing, this collective wisdom of the market, so often swayed by fleeting sentiments and the allure of immediate gain. They anticipate a rise of twenty-five percent in the coming months, a respectable sum, to be sure. But I, having observed the currents of fortune for a number of years, suspect they underestimate the true potential that lies before this company—a potential born not merely of technological prowess, but of a fundamental shift in the very nature of our age.

The Crucible of Artificial Intelligence

The great houses of commerce—Amazon, Meta, Alphabet—have declared their intention to expand their investments in artificial intelligence, a commitment amounting to hundreds of billions of dollars. TSMC, recognizing the winds of change, is increasing its own capital expenditures, anticipating the surge in demand. This is not mere speculation, but a logical consequence of the forces at play. The company itself foresees a thirty percent increase in sales for the coming year, a forecast that, while ambitious, seems well within reach.

The Inevitable Reflection of Value

The movements of the market are often capricious, governed by forces that defy simple explanation. One might observe a stock rising or falling without apparent reason, a phenomenon that creates opportunities for those with the patience and discernment to recognize them. Yet, beneath the surface of this volatility lies a fundamental principle: a stock’s price, in the long run, will reflect the performance of the company it represents.

Wall Street, in its calculations, assigns expectations to each enterprise, and the extent to which a company meets or exceeds those expectations will largely determine its fate. This is where valuation comes into play. A company’s earnings, for instance, provide a measure of its intrinsic worth, and a stock’s price can grow in proportion, without exceeding a reasonable ratio. In the case of TSMC, the price-to-earnings ratio stands at thirty-one, a figure that, given its rate of growth and the opportunities before it, appears quite attractive. Indeed, the stock has gained fifty-four percent in the past year, while the P/E ratio has remained essentially unchanged.

This suggests that further gains are not merely possible, but likely, as increased sales and earnings translate into a higher valuation. Wall Street anticipates earnings per share of $13.05 for the coming year, a twenty-three percent increase from the previous year. They also foresee a thirty-one percent increase in sales, aligning with the company’s own guidance. But these are merely projections, based on past performance. The true measure of a company’s potential lies in its ability to surprise, to exceed expectations. And in this regard, TSMC has consistently delivered. In the past four quarters, it has surpassed analyst estimates, often by a considerable margin, including a notable $0.16 in the most recent quarter.

The most optimistic price target currently stands at $520, a fifty-nine percent increase from today’s price. And while such a gain may seem ambitious, I believe it is within reach, given the company’s trajectory and the forces at play. The currents of fortune favor those who are prepared to navigate them, and in this instance, the signs point towards a continued ascent.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Dividends: A Most Elegant Pursuit

- Venezuela’s Oil: A Cartography of Risk

- AI Stocks: A Slightly Less Terrifying Investment

- Chipotle & Sweetgreen: A Market’s Quiet Bloom

2026-01-25 09:54