Ah, Amazon. A mercantile behemoth, they call it. In 2025, the shareholders experienced a slight…discomfort. A temporary setback, you might say. I, with the foresight of a seasoned pigeon, suggested a strong year, banking on their cloud division, Amazon Web Services. The cloud, naturally. Where else does one store excess ambition these days? AWS performed adequately, yes. But the stock… the stock was priced as if woven from unicorn hair and hope. Forty-four times forward earnings! A valuation that would make even a seasoned speculator blush.

It spent the year, predictably, growing into that price. Like a man attempting to fill a very large coat. A mere 5% gain for the year, but the underlying business, let’s be clear, wasn’t crumbling. It was simply…resting. Now, in 2026, with the valuation brought down to a more reasonable level – a price one might actually discuss over a cup of tea – the stage is set. The cloud, free from the burden of excessive expectations, can finally lift the stock to heights previously reserved for hot air balloons.

The Cloud’s Subtle Ascent

Most investors, bless their simple hearts, fixate on the delivery vans. The boxes. The endless stream of consumer goods. It’s understandable, of course. We all interact with that side of the operation. But to focus solely on the parcels is to mistake the forest for a particularly well-organized pile of firewood. AWS, while only 18% of total sales, is the engine room. The hidden dynamo. The source of actual, verifiable profit.

Amazon, you see, is a remarkably diverse enterprise. And its retail side… well, let’s just say profit margins are a quaint historical notion. Look at any retailer, and you’ll find margins thinner than a politician’s promise. Cloud computing, however, is a different beast entirely. A robust 35% operating margin in the third quarter. A figure that would make a Swiss banker weep with envy. So, despite representing a modest slice of overall revenue, AWS accounted for a whopping 66% of operating profits. A delightful imbalance, wouldn’t you agree?

Therefore, I consider AWS the most crucial component. The very heart of the operation. And, crucially, its growth is accelerating. A 20% revenue increase year-over-year in the third quarter – the best performance in several years. A promising sign, wouldn’t you say? If Amazon can maintain this momentum throughout 2026, I have no doubt the stock will ignite. A veritable bonfire of investor enthusiasm. Especially now that the valuation absurdity of 2025 has been… rectified.

A Price Tag That Doesn’t Require a Loan

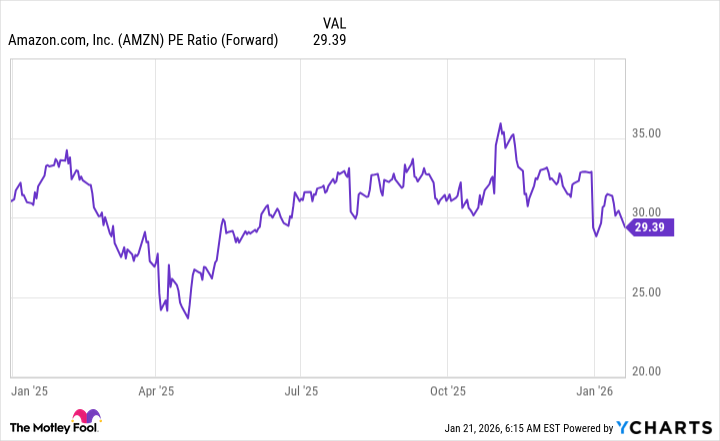

In today’s market, most big tech stocks trade at a multiple of 30 times forward earnings. A historically expensive price, admittedly. But that’s the reality, isn’t it? Amazon, however, currently trades at 29 times forward earnings – some of the lowest levels seen since the tariff-related turbulence of early 2025. A bargain, one might say. A rare opportunity to acquire a piece of the future at a reasonable price.

I believe this presents an excellent buying opportunity. A chance to acquire a dominant cloud computing business at a price that doesn’t require mortgaging one’s ancestral home. And, in 2026, I anticipate Amazon’s stock will flourish. Not because of fleeting trends or speculative bubbles, but on the solid foundation of its cloud-based empire. A perfectly reasonable expectation, wouldn’t you agree?

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Dividends: A Most Elegant Pursuit

- Venezuela’s Oil: A Cartography of Risk

- AI Stocks: A Slightly Less Terrifying Investment

- The Apple Card Shuffle

2026-01-25 03:02