One observes, with a certain detached amusement, that ASML Holding (ASML 0.43%) has been having a positively good run of late. A 75% climb over the past year, while the PHLX Semiconductor Sector merely toddled along at 47%? Quite the performance, really. One trusts, of course, that it won’t go to its head.

The rather crucial point, and one that even the most cynical observer must concede, is that ASML’s role in the global chip industry is, shall we say, significant. These extreme ultraviolet (EUV) lithography machines of theirs – frightfully complicated things, I’m told – are what allow one’s customers to manufacture advanced chips. Chips that, rather conveniently, deliver strong computing performance with high power efficiency. A useful combination, wouldn’t you agree?

And these chips, naturally, are in rather high demand. Primarily, it seems, due to this current obsession with artificial intelligence (AI). Morgan Stanley, a perfectly respectable firm, suggests this demand isn’t merely a passing fad. A rather encouraging thought, and one that might, just might, pave the way for further gains in ASML’s stock. Though one always approaches such pronouncements with a raised eyebrow.

Let’s examine, shall we, why Morgan Stanley believes this rally is likely to continue. One suspects they have their reasons. And, of course, a vested interest.

A Boost from the Chip Makers

Morgan Stanley points out, with a degree of optimism that borders on the naive, that the increase in semiconductor manufacturing capacity – driven by this insatiable hunger for AI chips – could send ASML’s stock up by a rather substantial 70%. Apparently, continued investment in foundry and memory manufacturing capacity, where demand currently exceeds supply, is the key. One wonders if they’ve considered the possibility of a downturn. But let’s not dwell on the gloomy possibilities.

Analysts at Morgan Stanley predict ASML’s earnings per share could nearly double by 2027. Quite a forecast. Taiwan Semiconductor Manufacturing (TSM +2.29%), a behemoth in the industry, has just announced a 32% ramp-up in capital spending for 2026, totaling a rather eye-watering $54 billion. They’re allocating 70% to 80% of that expenditure towards advanced process nodes. And, conveniently for ASML, they’re the only company that manufactures the EUV machines capable of producing such chips. A rather clever position to be in, wouldn’t you say?

There’s also a severe shortage of memory chips, driven by demand for high-bandwidth memory (HBM) used in AI data center accelerators. This is compelling Micron Technology to build more facilities, with a planned capex of $20 billion this fiscal year – a 45% increase. Naturally, this all plays into ASML’s hands. The industry association SEMI is projecting a robust 69% increase in advanced chipmaking capacity through 2028. Producing these advanced chips will, inevitably, boost demand for ASML’s EUV machines. One suspects Morgan Stanley isn’t entirely wrong.

Why 70% Isn’t Entirely Fantastical

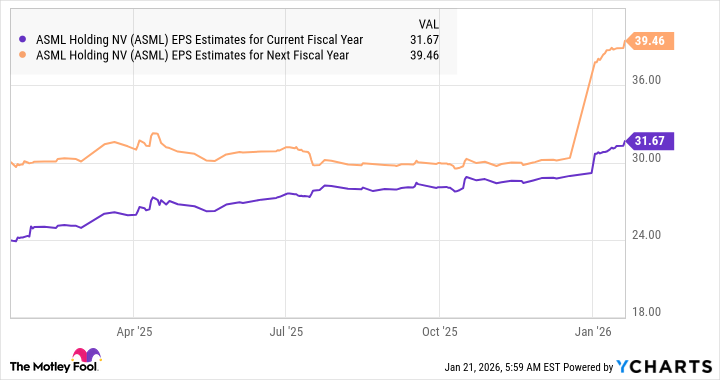

Consensus estimates suggest ASML finished 2025 with earnings of 24.78 euros per share, translating to $29.01 at the current exchange rate. Analysts anticipate a smaller jump this year, following last year’s 29% increase. However, growth is expected to accelerate in 2027, as the chart demonstrates.

The chart, naturally, presents figures in U.S. dollars. However, Morgan Stanley’s estimate of 46 euros per share in 2027 suggests ASML’s bottom line could be considerably higher than consensus expectations. Their forecast suggests earnings of $53.85 per share. If the stock trades in line with the U.S. technology sector’s average earnings multiple of 44.7, its price could reach $2,407. A potential jump of 81% from current levels. One begins to suspect this isn’t a bad investment, even after the impressive gains it has already clocked.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Celebs Who Fake Apologies After Getting Caught in Lies

- Dividends: A Most Elegant Pursuit

- Venezuela’s Oil: A Cartography of Risk

- AI Stocks: A Slightly Less Terrifying Investment

2026-01-24 19:33