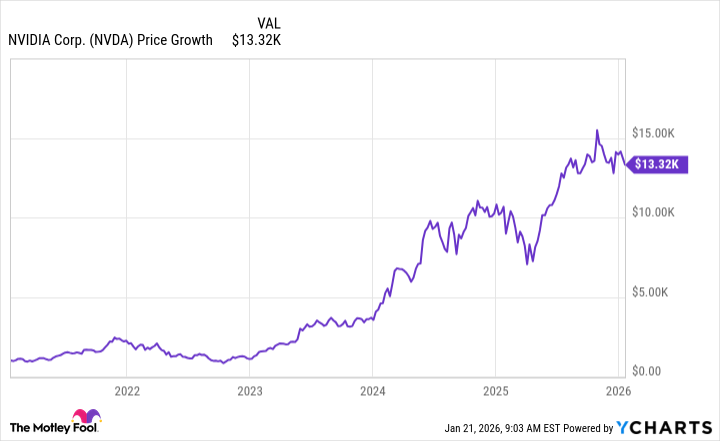

Five years ago, the wind didn’t carry whispers of this. Nobody, not the seasoned hand nor the hopeful newcomer, could have foreseen the bounty Nvidia would reap. It stands now, a titan amongst companies, a market capitalization exceeding four trillion dollars as the opening bell rang on January 21st. A thousand dollars placed then… well, it would fetch around thirteen thousand three hundred today. A generous harvest, wouldn’t you say?

The Seed and the Soil

Many companies have felt the warmth of this new AI spring, but none have flourished quite like Nvidia. They built their foundation on the images flickering across screens – the games we play, the worlds we lose ourselves in. Their graphics processing units, once dedicated to illusion, found a new purpose, a deeper calling. It turns out, those same chips are remarkably suited to the heavy lifting required to nurture these new artificial minds.

Nvidia became the wellspring, the source for the hardware that powers the data centers, the digital farms where these AI models grow. A near-monopoly, some might call it. Demand, relentless and ever-increasing. And it has paid off, handsomely. Five years past, their data center revenue stood at $4.8 billion. Last quarter? A staggering $51.2 billion. A transformation, born not of chance, but of adaptation and a shrewd understanding of the shifting landscape.

The price-to-earnings ratio hovers around 44.1, a steep climb for any stock. Expensive, certainly. But investors, it seems, are willing to pay a premium for a company that has secured its place as one of the most important players in this new world. A world built on silicon and algorithms, where the future is being written, one calculation at a time. It’s a gamble, of course, all investments are. But in this digital dustbowl, Nvidia appears to have found water.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Celebs Who Fake Apologies After Getting Caught in Lies

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Dividends: A Most Elegant Pursuit

- Venezuela’s Oil: A Cartography of Risk

- AI Stocks: A Slightly Less Terrifying Investment

2026-01-24 19:02