Right. Let’s talk money. Everyone’s obsessed with the S&P 500 – 500 companies, basically the cool kids club of US business. It’s the benchmark, the yardstick, the thing everyone pretends to understand. And honestly, it’s a pretty good measure of… well, if everyone else is having a good time. But here’s the thing: benchmarks are for following, not beating. And I’m in the business of beating things.

So, if I absolutely had to put money on one ETF outperforming that whole shebang by 2026? It’d be the Vanguard Growth ETF (VUG). Don’t look so surprised. It rose a respectable 18.9% in 2025, leaving the S&P 500 trailing at 16.4%. It’s not rocket science, is it? Though, knowing my luck, it probably involves some obscure quantum physics principle I’ll never grasp.

Chasing the Shiny Things

This Vanguard fund basically mirrors the CRSP US Large Cap Growth Index, which sounds terribly important, but really just means it picks companies that are growing faster than everyone else. 151 companies, to be precise. It’s a bit like a school playground – you want to hang with the kids who are actually going somewhere. And because it’s weighted by market cap, the big boys get a bigger say. Which, let’s face it, is how the world works.

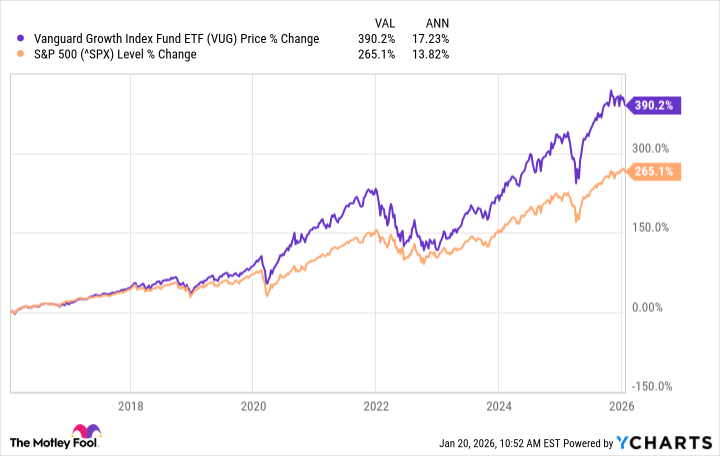

Unsurprisingly, this makes it a bit tech-heavy – 65.8%, in fact. And honestly, thank goodness for that. Tech has been the engine of growth for the last decade, and I’m not about to bet against it. The fund’s gained 390% in that time, compared to the S&P 500’s 265%. Numbers don’t lie, darling. Though they can be selectively presented, of course.

The Magnificent Seven & My Existential Dread

Now, here’s where it gets interesting – and slightly terrifying. The “Magnificent Seven” stocks account for a whopping 58% of this fund. So, yeah, a lot rides on them. It’s a bit like putting all your eggs in a very expensive, very volatile basket. Here’s the breakdown, because transparency is… well, it’s good marketing, isn’t it?

- Nvidia: 12.7%

- Apple: 11.9%

- Microsoft: 10.6%

- Alphabet (Class A): 5.4%

- Amazon: 4.6%

- Alphabet (Class C): 4.3%

- Meta Platforms (Class A): 4.3%

- Tesla: 3.8%

There’s a lot of chatter about these stocks being overvalued. And honestly? It’s probably true. But here’s the thing about bubbles: they tend to inflate a little bit more before they pop. And there are some genuine tailwinds here – AI, cloud computing, the relentless march of technology. In 2025, Nvidia and Alphabet actually outperformed the S&P 500. Small victories, right?

If investors start seeing real revenue growth and tangible returns from all this AI spending, these stocks could fly. But if they get impatient – and they always do – we could see a correction. It’s a delicate balance, really. A bit like my life.

History & a Dash of Hope

The Vanguard Growth fund has outperformed the S&P 500 in 15 out of its 22 years. Not a bad record, if I do say so myself. But past performance is never a guarantee of future results, blah, blah, blah. The seven times it did underperform? Investors were all hot and bothered about value stocks. Boring.

But with the expected growth of AI infrastructure, cloud computing, digital advertising, and the potential for interest rate cuts? This fund is positioned to keep outperforming. It’s not a sure thing, of course. Nothing ever is. But it’s a calculated risk. And I’m rather good at those.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Celebs Who Fake Apologies After Getting Caught in Lies

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- The 35 Most Underrated Actresses Today, Ranked

- Rivian: A Most Peculiar Prospect

- A Golden Dilemma: Prudence or Parity?

2026-01-24 15:04