The current enthusiasm for Artificial Intelligence resembles a fever dream. Capital is being poured into this sector with a recklessness that would shame a gambler. While genuine innovation exists, the market’s valuation of these companies appears divorced from any rational assessment of future earnings. It is not a question of whether AI will change the world, but whether the current beneficiaries will reap the rewards, or if this is simply a speculative bubble waiting to burst. Three companies – Alphabet, Meta Platforms, and Nvidia – are at the forefront of this frenzy, and a closer look reveals a landscape riddled with contradictions.

Alphabet: The Rebranded Giant

Alphabet, formerly Google, stumbled initially in the race for AI dominance. This is often glossed over in the current narratives. Their early attempts were clumsy, overshadowed by competitors. However, they possess a crucial advantage: scale. Their Gemini model, integrated into Google Search, now quietly gathers data from millions of users daily. This is not merely innovation; it is the leveraging of an existing monopoly. The argument that this will organically convert users is… convenient. The real value lies in the data collected, a resource unavailable to most challengers. The promise of a personalized AI, tailored to your Google account history, is less a breakthrough and more a sophisticated method of surveillance, presented as convenience.

The market seems content to wait for “Gemini to turn into a real cash cow.” This is a dangerous complacency. The true return on investment may not be financial, but rather an expansion of Alphabet’s already considerable power. Investing in Alphabet is not simply buying a stock; it is endorsing a system.

Meta Platforms: The Illusion of Growth

Meta Platforms, formerly Facebook, is attempting a similar transformation. Their Llama model is deployed across their social media empire, demonstrably increasing user engagement and, consequently, advertising revenue. This is not a testament to the quality of the AI itself, but rather to the addictive nature of the platforms it serves. The claim that AI is improving ad conversion rates is self-serving. It is merely a more efficient method of manipulating consumer behavior.

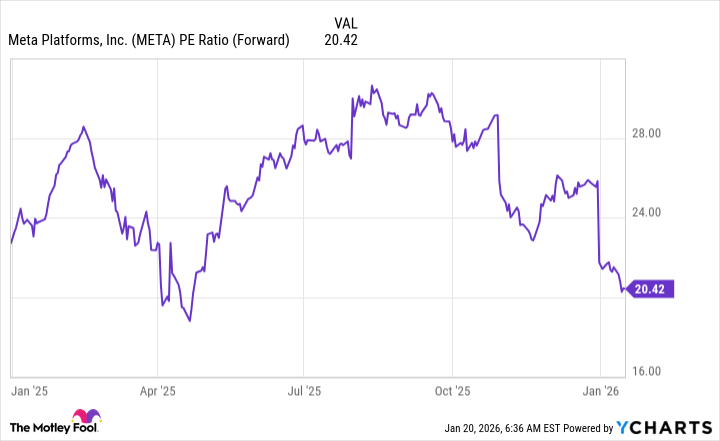

The company’s stock has suffered a minor correction, ostensibly due to projected increases in data center spending. This is presented as a negative, but it is a logical consequence of pursuing AI at scale. The market’s reaction reveals a fundamental misunderstanding of the required infrastructure. The reported 26% year-over-year revenue increase is impressive, but it masks a deeper truth: Meta is selling attention, and AI is simply a more effective tool for capturing it. The current valuation, while seemingly reasonable, ignores the ethical cost of this pursuit.

Investing in Meta is not a prudent financial decision; it is an endorsement of a business model predicated on exploitation.

Nvidia: The Enabler

Nvidia, the manufacturer of graphics processing units (GPUs), is often hailed as the purest play on the AI boom. Their new Rubin architecture promises significant improvements in efficiency and performance. This is undeniably impressive from an engineering perspective. However, it is crucial to recognize that Nvidia does not create AI; it merely provides the tools that others use to do so. The claim that clients will not reduce GPU purchases, but rather increase their training power, is optimistic. It assumes a continued escalation of AI development, regardless of cost or consequence.

Nvidia’s stock has experienced an unprecedented run, fueled by speculation and hype. The notion that it still has “room to go” is a dangerous delusion. Investing in Nvidia is not supporting innovation; it is inflating a bubble. It is profiting from a frenzy that will inevitably end in disappointment for many.

The AI revolution is not a technological inevitability; it is a social and political choice. Before blindly investing in these companies, consider what kind of future you are helping to create.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Celebs Who Fake Apologies After Getting Caught in Lies

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- The 35 Most Underrated Actresses Today, Ranked

- Rivian: A Most Peculiar Prospect

- A Golden Dilemma: Prudence or Parity?

2026-01-24 14:12