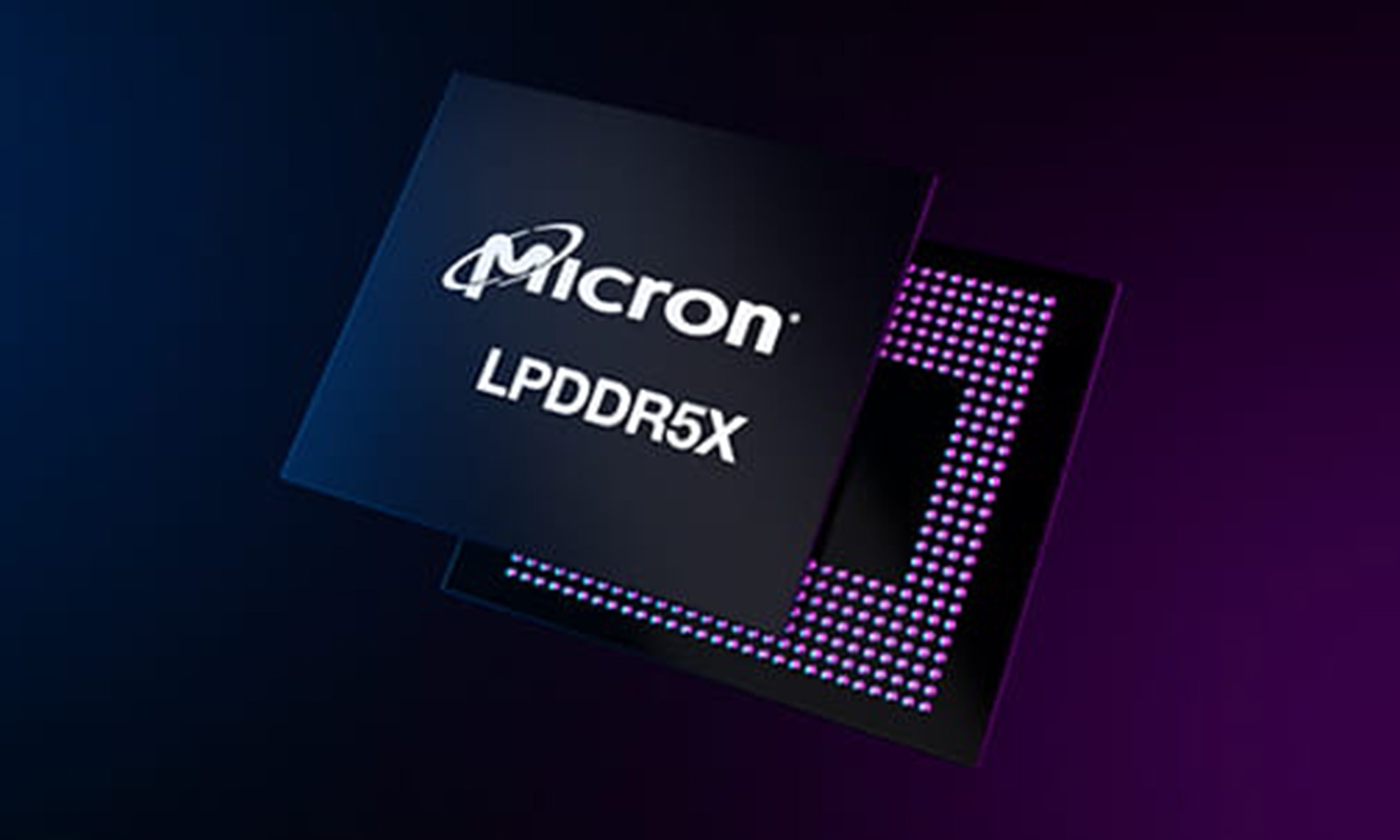

Everyone’s talking about AI, naturally. It’s the new scented candle, the sourdough starter of 2025. Nvidia gets all the press, which is understandable, I suppose. They make the flashy bits, the things that look like intelligence. But honestly, I’ve always been more fascinated by the plumbing. And in this particular digital house, Micron Technology is doing a lot of the plumbing.

My Aunt Carol, who believes 5G causes migraines, tried to explain AI to me over Thanksgiving. It involved a lot of hand-waving and references to “the cloud” as if it were a physical place. She thought Nvidia was building robots. I didn’t correct her. It was easier. But what I should have explained is that all those clever algorithms need somewhere to, well, remember things. And that’s where Micron comes in. They don’t build the robots, they build the brains’ short-term memory.

See, it’s not just about processing power. It’s about access speed. I’m not a tech person, really. I still occasionally call the IT guy at the library to help me print. But even I understand that if you’re trying to solve a complicated problem, you need to be able to find the information quickly. And that means memory chips. Specifically, something called DRAM and this even fancier version, HBM. It’s like the difference between remembering where you parked the car and instantly recalling every detail of that embarrassing incident from high school. One is useful, the other is just painful.

Apparently, there are only three companies on the planet that really know how to make this stuff: Samsung, SK Hynix, and Micron. Which, from an investor’s perspective, is…comforting. It’s not a crowded field. It’s like finding a decent cup of coffee in a small town. You know you’re getting something special, and you can reasonably expect the price to reflect that.

The demand is, predictably, insane. Micron announced in December that their entire 2026 supply of HBM is already sold out. Sold out! Before 2025 is even over. It reminds me of the toilet paper shortage of 2020, except this has actual economic consequences. And, thankfully, doesn’t involve hoarding.

They’re spending a fortune to ramp up production – over $200 billion, which, frankly, feels like a lot of money, even for a company that makes tiny silicon chips. New factories in Virginia, Idaho, New York… it’s a logistical nightmare, I’m sure. But a potentially very profitable one. I read an article about the semiconductor industry the other day, and it was all talk about “wafer fabrication” and “yield optimization.” It made my head spin. I just want to know if the price is right.

The stock has already had a good run, but at 5.5 times forward sales and 11 times forward earnings, it still seems reasonable. It’s not a screaming buy, but it’s not priced for perfection either. Which, in this market, is a refreshing change. I’m not looking for the next overnight sensation. I’m looking for a solid company, doing essential work, with a reasonable valuation. And Micron, quietly, seems to fit the bill. It’s not glamorous, it’s not sexy, but it might just be a good investment. And sometimes, that’s enough.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Celebs Who Fake Apologies After Getting Caught in Lies

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- The 35 Most Underrated Actresses Today, Ranked

- Rivian: A Most Peculiar Prospect

- A Golden Dilemma: Prudence or Parity?

2026-01-24 12:33