Peter Thiel, a name whispered with a peculiar mixture of reverence and suspicion in the higher circles of finance—a man who once conjured PayPal from the ether and now dabbles in the shadowy arts of venture capital—has made a move. Not a rash, impulsive leap, mind you, but a calculated shift, like a chess master rearranging pieces before a particularly grim endgame. He’s been pruning his Tesla holdings, a rather substantial pruning, and reinvesting in… Apples. Yes, Apples. The fruit of knowledge, the symbol of… well, a remarkably efficient supply chain, mostly.

One might ask, what dark portents does this signify? Is it a premonition of Tesla’s inevitable descent from its lofty perch? Or simply a man, weary of chasing phantom valuations, seeking the comforting solidity of a company that, at least, knows how to make something tangible? The answer, as always, is likely a blend of both, seasoned with a dash of pure, unadulterated human folly.

Does Selling Tesla Stock Make Sense Right Now?

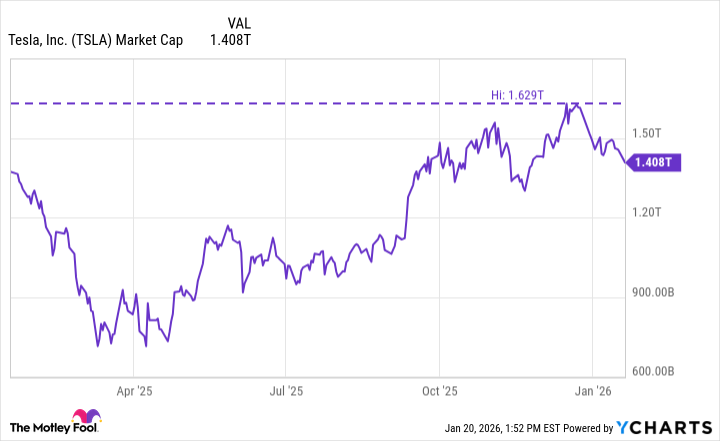

Tesla, at present, carries a market capitalization of $1.4 trillion. A figure so astronomical it threatens to collapse under its own weight. It’s as if the market collectively decided to believe Elon Musk’s pronouncements were not merely ambitious forecasts, but immutable laws of physics. A dangerous delusion, wouldn’t you agree? The price-to-sales ratio hovers around 16, a number that suggests either extraordinary growth or, more likely, a rather spectacular bubble.

The price-to-earnings ratios, both current and forward-looking, are… optimistic, let’s say. A perfectly reasonable valuation for a company that has solved the fundamental problem of human mortality, perhaps. But merely an automobile manufacturer? The competition is stirring, particularly in the realm of autonomous vehicles. And while Mr. Musk speaks of robotaxis, one suspects the only robots currently involved are those tirelessly assembling the cars themselves. The air is thick with promise, but remarkably devoid of actual, demonstrable progress.

Is Apple Stock a Good Buy for 2026?

The stock market, as anyone with a functioning nervous system can attest, is currently exhibiting symptoms of acute hysteria. The S&P 500, buoyed by the intoxicating fumes of artificial intelligence, dances on the precipice of reason. Meanwhile, inflation stubbornly refuses to yield, and unemployment, a grim specter, is beginning to gather strength. Add to this the geopolitical chaos unfolding across the globe, and one is left with a distinctly unsettling premonition.

Thiel’s move, therefore, isn’t entirely surprising. It’s the act of a man who, having stared into the abyss of speculative excess, has decided to retreat to a more… fortified position. Apple may not offer the same potential for exponential growth as a Tesla fueled by pure imagination, but it possesses something far more valuable: resilience. A capacity to weather the storms that inevitably buffet the financial seas.

Thiel is Positioned for Upside No Matter What

The true brilliance of Thiel’s maneuver lies not in the individual trades, but in the overall strategy. Tesla remains his largest holding, a testament to his faith in the company’s long-term potential. Apple, however, represents a calculated hedge, a lifeboat prepared for the inevitable deluge. It’s a portfolio constructed not for maximum profit, but for survival.

If Tesla miraculously manages to launch a fully autonomous robotaxi fleet, the rewards could be… considerable. But if it falters, if the dream of self-driving cars proves to be just another illusion, institutional capital will flee, seeking refuge in the relative safety of Apple. It’s a masterclass in risk management, a lesson in the art of anticipating the inevitable disappointments of the human condition.

Thiel, it seems, has positioned himself to profit from both the triumphs and the failures of the modern age. A cynical strategy, perhaps, but also a remarkably astute one. After all, in a world governed by chaos and uncertainty, the only true victory is to be the last man standing.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Celebs Who Fake Apologies After Getting Caught in Lies

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- The 35 Most Underrated Actresses Today, Ranked

- AIQ: A Calculated Gamble (That Paid Off)

- Chips & Shadows: A Chronicle of Progress

2026-01-24 05:32