They say ASML makes lithography machines. That’s a polite way of saying they build the things that build everything else. Tiny, intricate machines etching silicon. Costing, oh, a few hundred million apiece. So it goes. Most folks think of Nvidia when they hear “artificial intelligence.” Or Alphabet. Shiny things. But without ASML, those shiny things are just… well, nothing. Just potential. A lot of potential, granted. But still.

It’s a peculiar position, really. Holding the keys to the kingdom. A kingdom built on sand, of course, because everything is temporary. But a kingdom nonetheless. They don’t shout about it, these Dutch engineers. They just keep building the machines. The machines that make the machines. It’s a sort of recursive nightmare, if you think about it too hard. Which, naturally, I do.

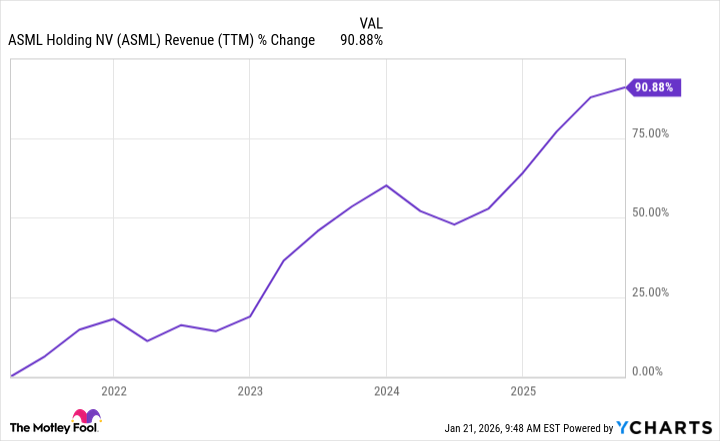

The numbers are… robust. An operating margin flirting with 35%. Return on equity over 50%. Return on invested capital a respectable 43%. It’s enough to make a sensible person suspicious. But then again, sensible people rarely get rich. They just avoid unpleasantness. And this, let’s be honest, is a bit unpleasant. The sheer scale of it all. The dependence. The potential for everything to go sideways. So it goes.

They’ve got cash. 5.1 billion euros, last I checked. Debt? A mere 2.7 billion. They could buy a small country, probably. Not that they would. Engineers aren’t interested in geopolitics. They’re interested in tolerances. And wavelengths. And making things smaller. It’s a comforting sort of obsession, really. A distraction from the void.

Now, about the stock. It’s a “high-quality business,” they say. And it is. Defensible position, growing industry, strong balance sheet. All the boxes are ticked. But it’s expensive. 50 times earnings. That’s a lot of future baked into the price. A lot of hoping. A lot of assuming that the machines will keep selling. And that someone will keep buying them. Which, for now, they are. So it goes.

They’re aiming to double revenue by 2030. And increase gross margins to 60%. Ambitious. But they’ve shown they can deliver. They reinvest their profits wisely. And they’re starting to return capital to shareholders through buybacks and, bless their hearts, dividends. A little trickle of money to ease the existential dread. It’s a nice gesture, really. A small act of defiance against the inevitable.

So, is it a buy? I don’t know. None of us do. The future is a murky thing. But it’s a long-term compounder, that much is certain. If you can stomach the price, and you’re willing to hold on for the ride, it’s likely to make you money. But remember, money is just a symbol. A temporary reprieve from the fundamental absurdity of it all. So it goes. And the machines keep building.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Celebs Who Fake Apologies After Getting Caught in Lies

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- The 35 Most Underrated Actresses Today, Ranked

- AIQ: A Calculated Gamble (That Paid Off)

- Chips & Shadows: A Chronicle of Progress

2026-01-24 03:22