The curious case of Quantum Computing Inc. (QUBT 2.58%), a name that, even uttered, feels faintly provisional, offers a miniature drama of market caprice. Uplisted from the shadowy realms of the over-the-counter market in July of 2021, it commenced its Nasdaq sojourn at $6.60, a price that, in retrospect, possessed a certain naive optimism. It descended, naturally, to a nadir of $0.42 on July 1st of this year – a sum that, one might observe, is alarmingly close to the cost of a decent cup of coffee. A thousand dollars invested at that low ebb, the article breathlessly informs us, would now yield nearly $27,400. A pleasing arithmetic exercise, certainly, but one that neglects the psychological toll of such a volatile ascent – a sort of financial vertigo.

QCi, it appears, traffics in photonic quantum chips – minuscule constellations of light, beamed through silicon and glass. The conceit, rather elegant, is that these chips might circumvent the cryogenic demands of more conventional quantum architectures. Room temperature, you see, is a desirable condition, suggesting a certain domesticity, a lessening of the chillingly abstract. Yet the reality, as is so often the case, proves more recalcitrant. These chips, while theoretically cheaper and more scalable, currently exhibit a disconcerting tendency toward error, requiring cumbersome optical appendages and proving, ironically, costly to manufacture in modest quantities. A paradox, wouldn’t you agree?

A foundry, recently opened, now churns out these luminous wafers. But the bulk of QCi’s revenue, it transpires, derives not from the sale of chips themselves, but from the more pedestrian realm of professional services and a cloud-based platform called Dirac-3. A curious situation, reminiscent of a confectioner who makes more money selling the boxes than the chocolates. The analysts, with their predictable myopia, foresee a paltry $2.8 million in revenue for 2026. This, applied to a market capitalization of $2.69 billion, yields a price-to-sales ratio that borders on the hallucinatory – 960 times, to be precise. A meme stock valuation, ripe for a reckoning. Short sellers, one suspects, are already sharpening their pencils.

Nearly a fifth of the outstanding shares are currently ‘shorted’ – a fascinating display of bearish sentiment. This proportion will, undoubtedly, increase as investors awaken to the protracted timeline for scaling QCi’s chip-making ambitions. Therefore, rather than chasing this particularly flamboyant butterfly, a more discerning investor might turn their attention to a somewhat less excitable, yet demonstrably more stable, pioneer: IBM (IBM 1.09%).

Why IBM’s Quantum Pulse Beats Stronger

IBM, once the monolithic titan of the tech world, was, until recently, perceived as a relic of a bygone era, a dinosaur lumbering towards obsolescence. From 2011 to 2020, its annual revenue plummeted from $106.9 billion to a mere $55.2 billion – a decline precipitated by strategic divestitures and a struggle to invigorate its core businesses. Instead of embracing disruptive innovation, it opted for the familiar comfort of cost-cutting and share buybacks – a financial sleight of hand that, while temporarily inflating earnings per share, did little to address the underlying malaise.

All this altered with the arrival of Arvind Krishna, a cloud architect who assumed the helm in 2020. Krishna, with a surgeon’s precision, spun off the struggling managed infrastructure services segment as Kyndryl (KD 2.09) and aggressively expanded Red Hat’s hybrid cloud and artificial intelligence offerings. This strategic recalibration yielded a modest, yet encouraging, growth in revenue and earnings per share – CAGRs of 3% and 1%, respectively, from 2020 to 2024. Analysts anticipate further acceleration, projecting CAGRs of 5% and 19% from 2024 to 2027. A turnaround, it seems, is underway.

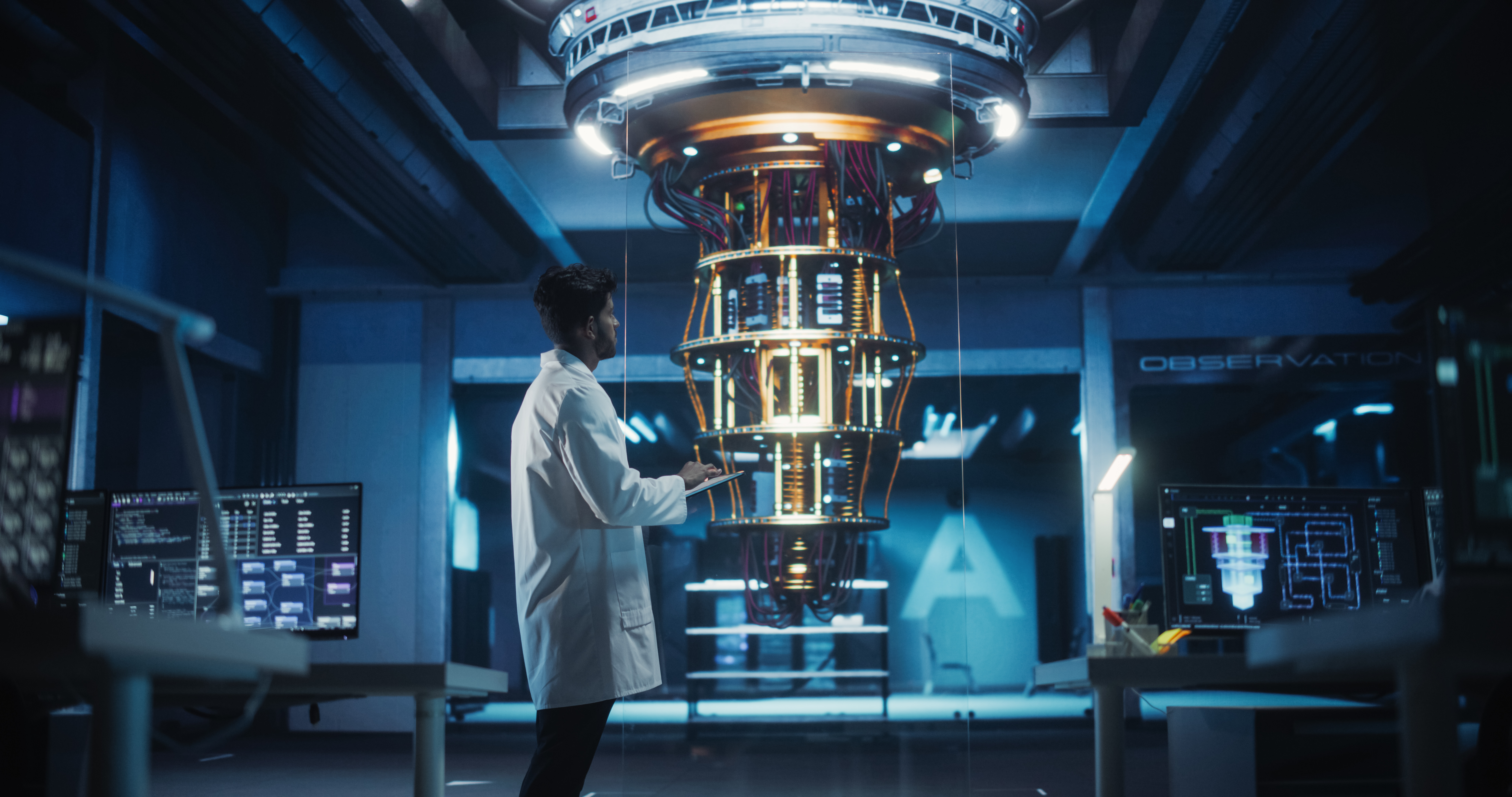

As its core business stabilizes, IBM is cautiously expanding its quantum computing division, focusing on electron-driven chips optimized for power and accuracy – a deliberate departure from the ‘scale at all costs’ ethos. It has already deployed over 85 quantum systems, which have collectively executed at least 3 trillion programs. Experimental chips – Eagle, Heron, Nighthawk, and Loon – are being developed with the ambitious goal of creating a fully fault-tolerant quantum system by 2029. A grand, if somewhat distant, vision.

IBM’s quantum deployments range from research-scale systems (less than 100 qubits) to utility-scale systems (over 100 qubits). Its clientele, at this nascent stage, consists primarily of universities and government research institutions – a predictably academic audience. Meaningful revenue generation remains some years away, but the foundation, one might argue, is being laid with admirable diligence.

IBM’s stock, admittedly, appears somewhat richly valued at 30 times this year’s earnings. However, its accelerating growth and exposure to the burgeoning hybrid cloud, AI, and quantum computing markets justify, at least to this observer, that premium valuation. Moreover, it has consistently raised its dividend for three decades, currently yielding a forward rate of 2.3%. A comforting regularity in a world of capricious volatility.

While IBM may lack the flamboyant allure of QCi or other ‘hot’ quantum stocks, it represents a more compelling long-term investment. It is, at present, primarily a cloud and AI play, but it is strategically positioned to become a dominant force in the emerging quantum computing landscape. A subtle elegance, perhaps, but one that, in the long run, may prove far more rewarding than a fleeting, iridescent shimmer.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Celebs Who Fake Apologies After Getting Caught in Lies

- The 35 Most Underrated Actresses Today, Ranked

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- AIQ: A Calculated Gamble (That Paid Off)

- Chips & Shadows: A Chronicle of Progress

2026-01-23 21:03