The matter of Apple (AAPL +0.31%) presents itself not as a chronicle of success, but as a protracted exercise in the deferral of consequences. For a decade, the company has issued devices – these polished rectangles, these conduits to elsewhere – and the market has, with a peculiar lack of scrutiny, accepted them. A 900% ascent in share price is not evidence of ingenuity, but rather, a testament to the market’s capacity for willful blindness. One begins to suspect a complex accounting procedure, a subtle redirection of funds, though the precise mechanism remains, as always, obscured within layers of corporate pronouncements.

Recently, however, the deferral has begun to fray. The absence of immediate, demonstrable engagement with the so-called ‘artificial intelligence’ – a phrase which itself feels like a bureaucratic evasion – has not gone unnoticed. It is as though Apple, rather than participating in the frenzy, has chosen to observe it from a distance, meticulously documenting the chaos as a detached anthropologist might. This restraint, while logically sound, has not been rewarded. The market, it seems, prefers enthusiasm, even if misplaced, to considered judgment. And the matter of production, tethered so inextricably to the geopolitical currents of a distant land, casts a long, unsettling shadow. The tariffs, though temporarily abated by assurances of investment in domestic production, remain a latent threat, a suspended judgment waiting to fall.

The current trajectory, if one can apply such a linear term to this increasingly erratic course, suggests a tentative engagement with these previously ignored realities. AI features are being introduced, not as a revolution, but as incremental adjustments, as if testing the waters before committing to a full immersion. The easing of tariff concerns is, of course, a welcome development, though one suspects the underlying issues remain unresolved, merely postponed. The question, then, is not whether Apple will adapt, but whether it can adapt quickly enough to avoid the inevitable reckoning.

Apple Versus Samsung: A Ritualistic Dance

The competition with Samsung is not a battle for market share, but a ritualistic dance, a carefully choreographed performance designed to distract from the underlying stagnation. While Apple briefly surpassed Samsung in smartphone market share (20% to Samsung’s 5% in 2025, according to Counterpoint Research), this is a temporary advantage, a fleeting moment of respite in an otherwise relentless decline. The 10% growth in shipments is not a sign of strength, but a desperate attempt to maintain the illusion of momentum. The ‘moat’ – that cherished concept of competitive advantage – is not a protective barrier, but a self-imposed isolation, a gilded cage that prevents Apple from responding to the changing tides.

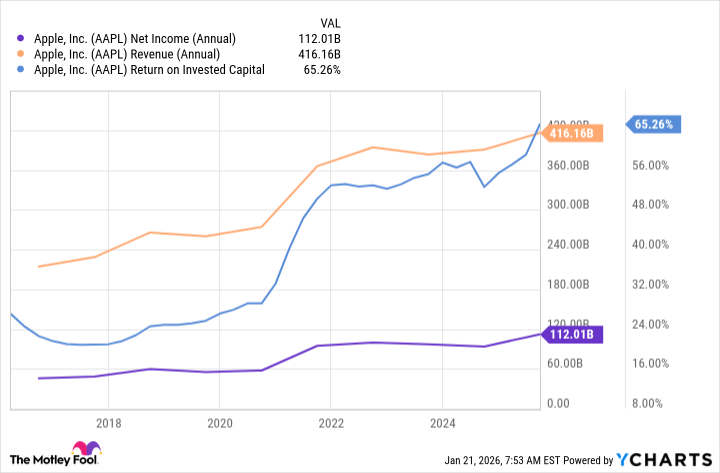

The steady climb in earnings and return on invested capital (ROIC) is, of course, encouraging. However, one must ask: at what cost? The relentless pursuit of efficiency has created a system that is increasingly brittle, increasingly vulnerable to disruption. The cash reserves, amassed over years of careful accumulation, are not a source of strength, but a burden, a constant reminder of the company’s inability to innovate. The investment decisions, while ostensibly sound, are merely palliative measures, designed to delay the inevitable.

The increase in ROIC is not a testament to Apple’s brilliance, but a reflection of the market’s irrational exuberance. The company is rewarded not for what it does, but for what it is perceived to be. The cycle continues, self-perpetuating, until the inevitable correction.

Underperforming the S&P 500: A Necessary Discomfort

The underperformance relative to the S&P 500 (an 8% increase last year) is not a failure, but a necessary discomfort. The market’s obsession with AI growth has created a distorted reality, a bubble that is destined to burst. Apple’s reluctance to participate in this frenzy is not a weakness, but a strength. The company is, in effect, hedging its bets, preparing for a future that is less reliant on hype and more grounded in reality.

The rollout of AI features, while incremental, is a step in the right direction. The promise of a revamped Siri, powered by Alphabet’s Gemini large language model, is intriguing. However, one must remain skeptical. The integration of external technologies is not a sign of innovation, but a tacit admission of weakness. The reliance on Alphabet, a competitor, is particularly troubling. It is as though Apple has surrendered a portion of its sovereignty, accepting a subordinate role in the AI ecosystem.

Apple’s Foldable Smartphone: A Diversionary Tactic

The potential release of a foldable iPhone, priced at $2,000, is a diversionary tactic, a carefully orchestrated attempt to distract from the underlying stagnation. The projected shipment of 20 million units next year is, frankly, irrelevant. The market does not need another expensive, niche device. It needs innovation, disruption, a fundamental rethinking of the mobile experience. The pursuit of incremental improvements is not enough.

The record September quarter revenue and the booming services business are, of course, positive developments. However, these are merely temporary reprieves, fleeting moments of respite in an otherwise relentless decline. The underlying problems remain unresolved, festering beneath the surface. The cycle continues, self-perpetuating, until the inevitable reckoning.

Wall Street’s expectation of a 16% increase in Apple stock over the next 12 months is, frankly, delusional. The company’s valuation, at 29x forward earnings, is unsustainable. The stock has reached a point of diminishing returns. The potential for further growth is limited. The risks are substantial. The market is, as always, operating on a foundation of illusion and wishful thinking. And so, the dance continues.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Gold Rate Forecast

- Lilly’s Gamble: AI, Dividends, and the Soul of Progress

- Celebs Who Fake Apologies After Getting Caught in Lies

- USD PHP PREDICTION

- Elon Musk Calls Out Microsoft Over Blizzard Dev Comments About Charlie Kirk

- VSS: A Thousand Bucks & a Quiet Hope

2026-01-23 19:14