Now, investing in technology is always a bit like peering into a particularly murky crystal ball. You’re essentially betting on people’s ability to invent things that haven’t quite been invented yet, and hoping they’ll be useful when they finally arrive. Nvidia, for instance. A decade ago, it was a maker of graphics cards, perfectly respectable, but hardly world-altering. Then came gaming, then cars that drive themselves (mostly), and then, of course, artificial intelligence, which is currently trying to convince us it’s not about to take over the world. A thousand dollars in Nvidia back then? You’d be looking at something north of a quarter of a million now. A rather compelling illustration of the potential, wouldn’t you say?

Which brings us to IonQ. It’s a company operating in a field called quantum computing, which, if you’re anything like me, sounds like something out of a science fiction novel. And, truthfully, it kind of is. Traditional computers, the ones we use every day, store information as bits – ones and zeros. Quantum computers, however, use something called qubits. Now, a qubit isn’t just a one or a zero; it’s a one and a zero, simultaneously. It’s a bit like being both awake and asleep at the same time. A dizzying thought, and one that allows these machines to perform calculations that would take even the most powerful supercomputer centuries, if not millennia.

The promise, naturally, is enormous. Drug discovery, materials science, financial modeling, even just making your online shopping experience a little bit faster – all potentially revolutionized. IonQ isn’t building these machines in its garage, either. They’ve created a cloud platform, meaning you don’t need to buy a quantum computer the size of a small apartment. You simply rent time on theirs. It’s like renting a particularly powerful telescope, but instead of looking at stars, you’re solving problems that are, frankly, beyond the scope of most human minds.

The Error Problem (and Why It Matters)

Now, there’s a catch. And there’s always a catch, isn’t there? Quantum computers are notoriously…fickle. They’re incredibly sensitive to their environment – a stray vibration, a change in temperature, even a particularly grumpy electromagnetic field can throw them off. This leads to errors. Lots of errors. Think of trying to build a house of cards during an earthquake. For years, this has been the biggest hurdle to quantum computing’s progress.

IonQ, however, seems to be making headway. They’ve been focusing on something called “trapped-ion technology.” Essentially, they trap individual ions (charged atoms) in a vacuum, shielding them from the outside world. It’s a bit like giving each ion its own little protective bubble. In October, they announced they’d achieved two-qubit gate fidelities of 99.99%. Which, translated from quantum-speak, means they’ve gotten remarkably good at preventing errors. Almost error-free performance. That’s a big deal. It’s like finally managing to build that house of cards, and it actually staying up.

The market for quantum computing is projected to be…well, substantial. McKinsey estimates $72 billion by 2035, up from a mere $4 billion today. And that’s just the computing part. Throw in quantum communication and quantum sensing, and you’re looking at a potential $198 billion market by 2040. IonQ, with its cloud platform and error-reduction technology, is positioning itself to be a key player. It’s a bit like being the first to build a railroad across a vast, uncharted territory.

A Pricey Proposition

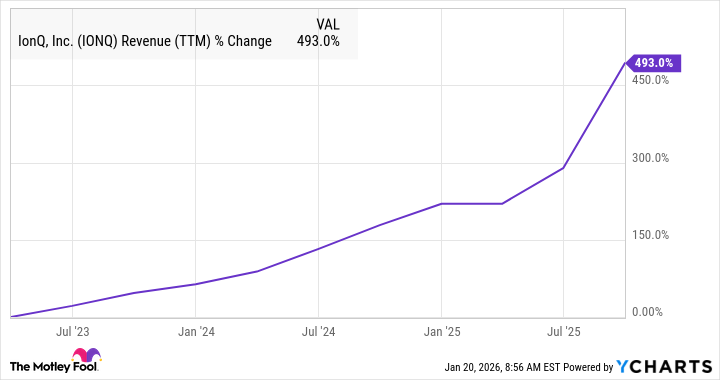

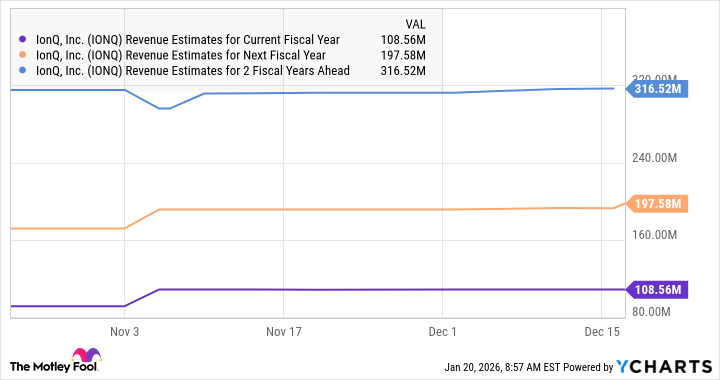

Now, let’s be honest. IonQ isn’t cheap. Its price-to-sales ratio is currently hovering around 158, significantly higher than the average for the tech sector. But then again, most tech companies aren’t trying to rewrite the laws of physics. The company is growing rapidly, and if it can continue to reduce error rates and expand its cloud platform, that valuation might actually be justified. It’s a risk, certainly, but a potentially rewarding one.

IonQ also boasts over 1,100 patents, a strong balance sheet with minimal debt, and a cost structure that’s reportedly 30 times lower than its competitors. All of which suggests it’s well-positioned to capitalize on the long-term quantum computing opportunity. It’s not a sure thing, of course. But in the world of technology, very few things are.

Investing in IonQ is a leap of faith. A bet on a future that’s still largely unwritten. But sometimes, the most rewarding investments are the ones that require a little bit of courage, and a willingness to embrace the unknown. After all, who knows what wonders these quantum machines might unlock? It’s a bit like exploring a new planet – you never quite know what you’ll find, but the journey is always worth it.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Gold Rate Forecast

- Lilly’s Gamble: AI, Dividends, and the Soul of Progress

- Celebs Who Fake Apologies After Getting Caught in Lies

- USD PHP PREDICTION

- Elon Musk Calls Out Microsoft Over Blizzard Dev Comments About Charlie Kirk

- Nuclear Dividends: Seriously?

2026-01-23 14:53