The approaching close of business on February 2nd marks not a revelation, precisely, but a procedural checkpoint. Palantir Technologies (PLTR +0.28%), a constructor of data architectures, will submit its quarterly report, and in doing so, will initiate a further round of assessments. The ‘narrative’ concerning artificial intelligence, a term now so pervasive it threatens to lose all meaning, will be subjected to a new accounting. One anticipates, with a certain weary inevitability, the demand for quantification.

The question, then, is not whether Palantir will present numbers—it will, as it always does—but whether those numbers will satisfy the intricate and largely unspoken requirements of the system. To consider a purchase now, before the report, is to engage in a form of anticipatory compliance, a pre-emptive attempt to align oneself with the inevitable judgment of the market. It is, perhaps, a futile gesture, but one that many, driven by an inexplicable urge to participate, will undertake nonetheless.

The Anticipated Figures

In November, management offered a preliminary forecast. Revenue for the fourth quarter is projected to reach $1.3 billion. Adjusted operating income is estimated to fall within the range of $695 to $699 million. These figures, while presented as projections, function more as pre-approved parameters, boundaries within which the company is permitted to operate. To exceed them is to invite scrutiny; to fall short, to invite… well, the consequences are rarely stated directly.

For the full year, revenue is expected to be approximately $4.4 billion. Adjusted operating income and free cash flow are forecast at $2.2 billion and $2 billion, respectively. Should these targets be met—and one assumes they will be, given the meticulous planning that precedes such pronouncements—it would represent a growth of 51% in revenue. Operating income and free cash flow would increase by 100% and 60%, respectively. These percentages, however, feel less like achievements and more like the fulfillment of preordained obligations.

A History of Provisional Acceptance

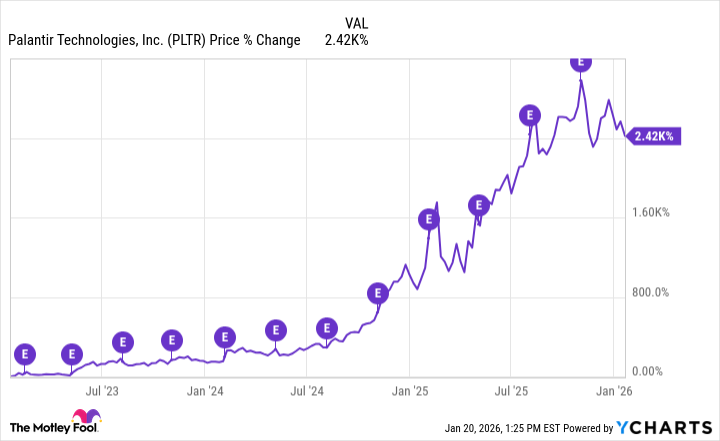

Throughout the recent period of heightened interest in artificial intelligence, the value ascribed to Palantir stock has increased by more than 2,400%. As the accompanying chart illustrates, significant upward movements in the stock price have consistently coincided with the release of earnings reports (indicated by the purple circles). This is not, however, a matter of simple cause and effect. Rather, it is a demonstration of Palantir’s ability to consistently meet—and occasionally slightly exceed—expectations, thereby maintaining its provisional acceptance within the market.

A Question of Valuation, and the Illusion of Control

The primary obstacle to an investment in Palantir is its current valuation. Despite a recent decline of 5%, the company continues to trade at a price-to-sales multiple of 111. This is a high number, and one that suggests a degree of irrational exuberance. However, Palantir has demonstrated a peculiar talent for achieving ambitious growth targets. Given the anticipated acceleration of investment across the entire artificial intelligence ecosystem, it seems plausible that Palantir will continue to generate substantial revenue and profit growth.

Attempting to precisely time one’s purchases is, of course, a futile exercise, a delusion of control in a fundamentally chaotic system. Nevertheless, given the company’s track record, now may be an opportune moment to consider acquiring a small position in Palantir stock prior to the release of its earnings report. It is a gamble, certainly, but one that, given the circumstances, may be worth taking. Or, perhaps, it is simply the inevitable outcome of a predetermined process, and our agency is merely an illusion.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Gold Rate Forecast

- Lilly’s Gamble: AI, Dividends, and the Soul of Progress

- Celebs Who Fake Apologies After Getting Caught in Lies

- USD PHP PREDICTION

- Elon Musk Calls Out Microsoft Over Blizzard Dev Comments About Charlie Kirk

- VSS: A Thousand Bucks & a Quiet Hope

2026-01-23 13:52