The market was humming, a nervous energy clinging to the ticker tape. Even at these heights, a man could still find a decent return, if he knew where to look. The scent of cloud computing and artificial intelligence hung thick in the air – the new gold rushes. And in that particular landscape, Alphabet – the outfit formerly known as Google – stood out. Not flashy, not a sure thing, but solid. A place to park five hundred dollars, maybe, and watch it breathe.

They call it a growth stock. A pretty name for a company that simply refuses to stay still. But growth needs a foundation, and Alphabet has one built of something tougher than hope. It has a moat. A wide, slippery one.

A Moat Worth Considering

Day traders chase shadows. Long-term men, the ones who understand the game, look for advantages. Alphabet’s advantage isn’t some secret formula; it’s recognition. The name ‘Google’ isn’t just a word anymore. It’s a verb, a habit. Try to unseat a habit. It’s like trying to hold smoke.

The AI chatbots came and went, a brief flurry of excitement. Alphabet absorbed the challenge, adapted, and moved on. It’s a company that doesn’t flinch easily. They refine their search, not with magic, but with data. Every click, every search, a tiny adjustment. The more they learn, the more people come. A simple equation, really. A profitable one. That’s network effect, for those keeping score.

Then there’s Google Cloud, growing faster than the rest of the business. Switching costs are a quiet killer. Once a company’s data is woven into that cloud, they’re not likely to unravel it for a cheaper option. That’s a comfortable position to be in.

More Than One Track

A wide moat is useless if the tide is going out. Luckily for Alphabet, the tide is still coming in. They aren’t just sitting on their laurels, counting ad revenue.

Digital advertising, cloud computing, artificial intelligence, video streaming, even a gamble on self-driving cars. They’ve got fingers in a lot of pies. A backlog of $155 billion in cloud contracts, up 46% from last quarter. That’s not a backlog; that’s a promise. And promises, in this business, are worth something. Their revenue for the period? A mere $102 billion. Small change, really.

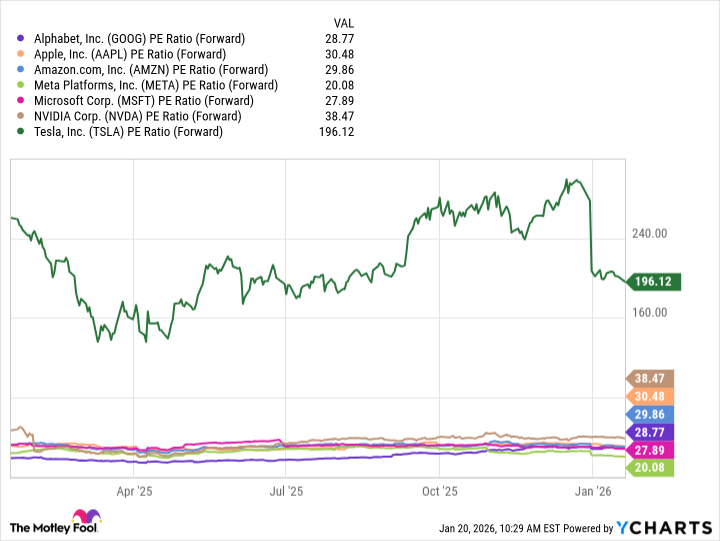

Trading at 28.77 times forward earnings, they’re not cheap. But they’re not the most expensive player in this game, either. And they are, notably, the most profitable. A man could do worse. A lot worse.

At around $325 a share, five hundred dollars buys you one. Not a fortune, but a piece of something solid. A place to start. In this town, that’s saying something.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gold Rate Forecast

- Lilly’s Gamble: AI, Dividends, and the Soul of Progress

- Celebs Who Fake Apologies After Getting Caught in Lies

- USD PHP PREDICTION

- Elon Musk Calls Out Microsoft Over Blizzard Dev Comments About Charlie Kirk

- Nuclear Dividends: Seriously?

2026-01-23 10:43