For the last three years, the whispers of Artificial Intelligence have largely echoed in the digital ether. Large Language Models – the chatbots and digital oracles – have become the new scribes, rewriting the landscape of software with an efficiency that would make even the most diligent quill-driver weep. But AI, you see, isn’t content to remain a phantom in the machine. It desires… substance. It wants to drive.

And that, naturally, brings us to automobiles. Specifically, those ambitious contraptions attempting to navigate the world without the guiding hand of a human. Tesla (TSLA +4.08%) has, for some time, been proclaiming itself the vanguard of this automated revolution. A bold claim, naturally, and one usually accompanied by a significant expenditure of investor capital. However, the road to autonomous driving, it turns out, is less a straight highway and more a labyrinthine track designed by a committee of particularly mischievous gnomes.

One might assume Tesla’s greatest challenge comes from the established automotive houses – the Fords and Volkswagens of this world, slowly awakening to the digital dawn. But the true threat, the subtle shift in the gears, comes from an unexpected quarter: Nvidia (NVDA +0.74%). Yes, the company best known for making the little rectangles that render fantastical worlds on your screens. It appears they’ve decided to build those worlds… for real. Let us delve into Nvidia’s rather understated foray into self-driving technology, and consider whether they’ve just laid a rather elegant trap for the unwary.

What is Nvidia DRIVE?

Nvidia DRIVE, you see, isn’t merely a collection of circuits and silicon. It’s a complete ecosystem, a self-contained universe for autonomous vehicles. It’s the difference between building a cart and commissioning an entire railway system. The platform encompasses the necessary AI and deep learning capabilities to allow a vehicle to perceive, interpret, and react to the chaotic ballet of the external world. Think of it as giving a machine eyes, ears, and a surprisingly cynical worldview.

DRIVE Hyperion is the turnkey solution, the pre-fabricated castle for the self-driving knight. Cameras, radar, lidar (a rather expensive form of echolocation, really), microphones – all integrated with safety software and designed to slot into practically any vehicle chassis. It’s the automotive equivalent of a Lego set, only far more complex and with a significantly higher potential for catastrophic failure.1

Recently, at CES 2026, Nvidia’s CEO, Jensen Huang, unveiled the latest additions to the DRIVE ecosystem. The Alpamayo system, he claims, will revolutionize autonomous driving. A bold claim, naturally, but Huang has a habit of making those, and a rather disconcerting habit of being right. Alpamayo doesn’t just see the world; it attempts to understand it. It uses something called reasoning-based vision language action (VLA) technology, which, as far as I can gather, allows the vehicle to ‘think’ and react, rather than simply execute pre-programmed responses. This could prove… interesting, especially when faced with the unpredictable behaviour of human drivers.2

NVDA”>

Is Nvidia DRIVE better than Tesla Full Self-Driving (FSD)?

Tesla and Nvidia have approached this challenge from fundamentally different directions. Tesla, with its vertically integrated approach, is attempting to build everything in-house. A noble ambition, perhaps, but one that requires a significant investment of time, resources, and sheer stubbornness. It’s like attempting to build a clock from raw materials, rather than simply purchasing one.

Tesla’s Full Self-Driving (FSD) relies heavily on cameras, and on the proprietary chip architectures they’ve designed in-house. This gives them a degree of control, certainly, but it also limits their flexibility. It’s a bit like being a wizard who only knows one spell.

Nvidia, on the other hand, has embraced an open-source model. This lowers the barriers to entry, allowing automobile manufacturers to partner with them and integrate their technology quickly and efficiently. It’s the automotive equivalent of outsourcing your alchemy. It means they aren’t entirely dependent on Tesla’s whims, or on the vagaries of Elon Musk’s latest pronouncements.

While Nvidia’s DRIVE platform may not yet have the scale of FSD, it has the potential to grow exponentially as other automakers seek alternatives. They are, after all, rather keen to avoid being entirely at the mercy of a single supplier. It’s a matter of diversification, you see. A prudent strategy, even in the world of self-driving cars.

Is Tesla stock a buy right now?

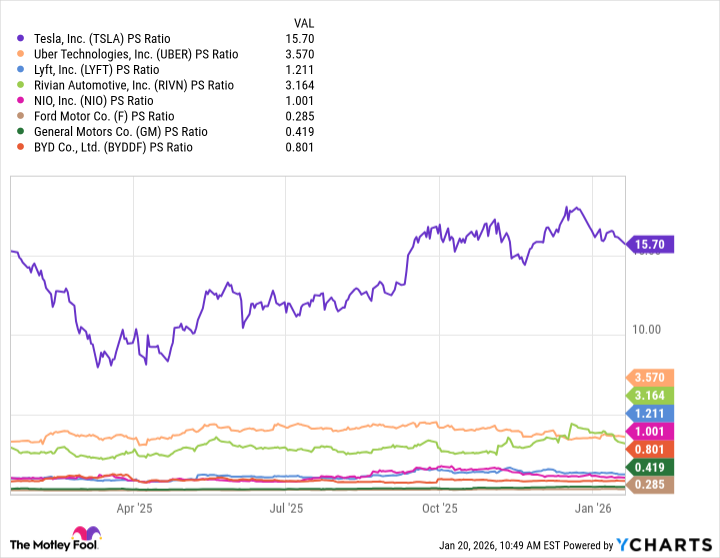

The chart below illustrates the price-to-sales (P/S) ratios for a number of traditional automakers and tech-enabled driving services platforms.

As you can see, Tesla is something of an outlier. Its P/S multiple of 15.7 reflects an extraordinary degree of optimism over its next-generation AI products. The market, it seems, is pricing Tesla less like a car business and more like a hypergrowth technology platform. A rather optimistic assessment, perhaps, but one that is currently being reflected in the stock price.

While the company’s ambitions in robotaxis are inspiring, they remain firmly in the testing phases. Tesla still needs to navigate a complex regulatory landscape before it can launch its autonomous ride-hailing platform at scale. And that, as any seasoned trader knows, is rarely a smooth process.

Nvidia, to be fair, is not immune to regulatory scrutiny. However, DRIVE represents just one of many different businesses. They have a diversified portfolio, a prudent strategy that allows them to weather the inevitable storms.

Nvidia hasn’t quite put Tesla in checkmate, not yet. But they’ve positioned themselves smartly to benefit no matter which automakers emerge as industry leaders. Tesla, by contrast, is a bit more… exposed.

I believe Tesla stock is priced to perfection and carries a significant risk of correction should FSD’s potential underwhelm. Against this backdrop, I don’t see it as a particularly smart buy right now. A prudent trader, after all, prefers a margin of safety. And in the world of self-driving cars, safety is paramount.3

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gold Rate Forecast

- Lilly’s Gamble: AI, Dividends, and the Soul of Progress

- Celebs Who Fake Apologies After Getting Caught in Lies

- USD PHP PREDICTION

- Elon Musk Calls Out Microsoft Over Blizzard Dev Comments About Charlie Kirk

- Nuclear Dividends: Seriously?

2026-01-23 10:03