Now, Apple. A perfectly polished, rather smug fruit, wouldn’t you say? Worth a king’s ransom, they claim. Three trillion dollars! Enough to pave a road to the moon with solid gold teeth. But even the shiniest toffee apple starts to go soft around the edges, and I suspect this one is about to get a rather nasty bite taken out of it. There are other companies, you see, bubbling and fizzing with proper innovation, and they’re starting to sniff around Apple’s picnic basket.

I’ve had a peek into the crystal ball (it’s a rather dusty thing, frankly) and I reckon four companies have a decent shot at overtaking the Apple cart within the next five years. Microsoft, Amazon, Taiwan Semiconductor, and Broadcom. A rather motley crew, if you ask me, but they have something Apple seems to have misplaced: a spark of actual cleverness.

What’s the Matter with the Apple?

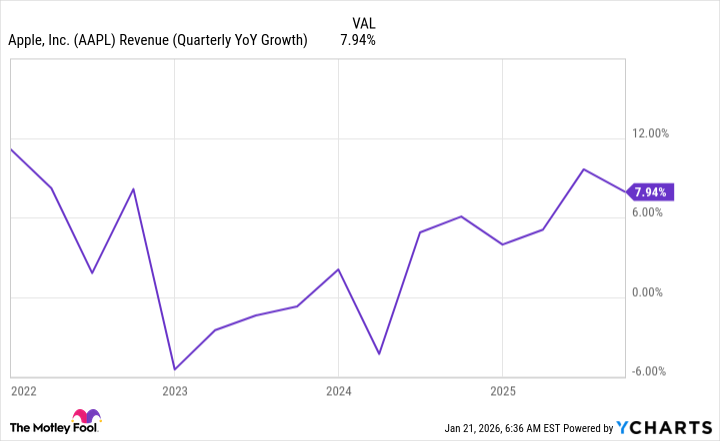

Let’s be blunt. Apple hasn’t truly invented anything new in ages. They’re remarkably good at making things look new, of course. A slightly different shade of beige, perhaps. A camera bump that’s a millimeter higher. But real innovation? It’s been a long, long time. They’re living on the fumes of past glories, like a particularly stubborn ghost. And ghosts, as everyone knows, eventually fade away.

They’re awfully fond of buying back their own shares, you see. It’s like a greedy child stuffing their pockets with sweets, hoping no one notices they haven’t actually made any new ones. It boosts the share price, of course, but it’s a rather hollow victory. It’s a bit like polishing a particularly dusty turnip and pretending it’s a prize-winning pumpkin.

Microsoft and Amazon: The Hungry Beasts

MSFT“>

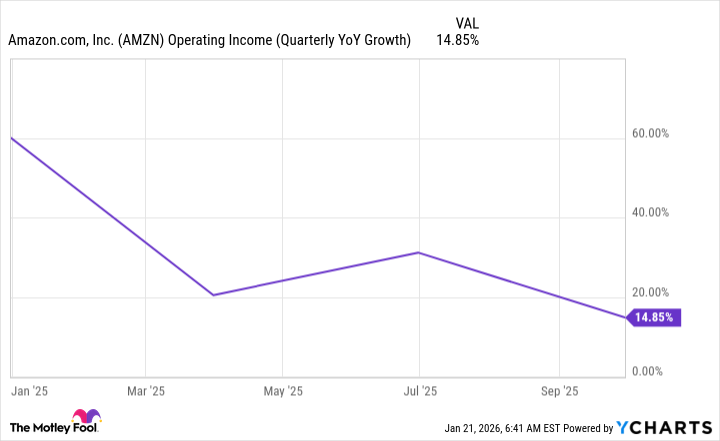

Amazon, meanwhile, is a bit of a different beast. They’re masters of logistics, those fellows. They can get practically anything delivered to your doorstep before you’ve even finished ordering it. And they’re starting to make a proper profit, too. It’s not just about selling books and knick-knacks anymore; it’s about building a proper, profit-generating machine. They’re not growing revenue as fast, but their operating income is rising. It’s a bit like a particularly clever spider spinning a web of profits.

The Chip Champions: Broadcom and Taiwan Semiconductor

Now, Broadcom and Taiwan Semiconductor are a bit like the unsung heroes of the digital world. They make the tiny, incredibly complicated chips that power everything from your smartphone to your toaster. And they’re about to get very, very rich. Artificial intelligence, you see, requires a lot of chips. It’s like feeding a particularly greedy monster. These two companies are poised to become the monster’s primary suppliers.

Taiwan Semiconductor reckons it can grow at a rate of 25% a year. That’s a rather ambitious claim, of course, but if they can pull it off, they’ll be bigger than Apple in no time. It’s a bit like a particularly fast-growing beanstalk, reaching for the clouds.

Broadcom, meanwhile, is even more exciting. They’re making custom chips for artificial intelligence, and they’re selling like hotcakes. They expect their sales to double in the next year. That’s a rather remarkable feat, and it suggests they’re onto something truly special. It’s a bit like discovering a pot of gold at the end of the rainbow.

Data center spending is expected to explode, reaching trillions of dollars. That’s a rather astonishing sum, and it suggests there’s a lot of money to be made in the digital world. These two companies are perfectly positioned to take advantage of this boom. It’s a bit like a pair of particularly clever foxes, sneaking into the henhouse.

So, there you have it. Apple may be a shiny, polished fruit, but it’s starting to show its age. The other companies are hungrier, cleverer, and poised to take its place. It’s a bit like a changing of the guard. And I, for one, am rather looking forward to the spectacle.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gold Rate Forecast

- Lilly’s Gamble: AI, Dividends, and the Soul of Progress

- Celebs Who Fake Apologies After Getting Caught in Lies

- USD PHP PREDICTION

- Elon Musk Calls Out Microsoft Over Blizzard Dev Comments About Charlie Kirk

- Nuclear Dividends: Seriously?

2026-01-23 09:13