The S&P 500, that curiously-named collection of 500 companies (imagine trying to keep track of 500 things – it’s enough to make anyone question the universe), has recently embarked on a performance trajectory that can only be described as… enthusiastic. Over the past three years, it’s managed a total return of 86%. Which, if you consider the inherent unpredictability of markets (and the fact that we’re all, essentially, just guessing), is rather remarkable. Investors, naturally, are currently experiencing a mild to moderate sense of smugness, which is perfectly understandable. Though perhaps a bit premature. (The universe has a peculiar sense of humor, you see.)

However, a closer inspection reveals a rather… uneven distribution of success. It appears that a disturbingly small number of stocks have been doing most of the heavy lifting. In fact, unless you’ve diligently adhered to the strategy of simply buying the entire index (a perfectly sensible approach, if you can find an index to physically purchase), your returns have likely been… less exuberant. Last year, just seven stocks accounted for nearly half of the S&P 500’s total return. A situation akin to a team of penguins attempting to push a grand piano up a hill – impressive, but ultimately reliant on a few particularly determined penguins. Approximately 30% or fewer of the index’s components have outperformed the average return in each of the last three years. Which, statistically speaking, is… unusual. (And potentially foreshadowing something.)

This has resulted in a historical anomaly. The market-cap-weighted S&P 500 has outperformed its equal-weight counterpart by the widest margin in over half a century. It’s as if the index has developed a gravitational pull, attracting all the gains towards a select few. And history, being the occasionally-reliable narrator it is, offers a clue as to what might happen next. (Though, admittedly, history often gets the details wrong.)

Can the Big Keep Getting Bigger?

Between 2023 and 2025, the S&P 500 delivered that aforementioned 86% return. Its equal-weight cousin, however, managed a mere 43%. Put another way, someone who invested in the standard S&P 500 index fund at the beginning of 2023 now has a portfolio approximately 30% larger than someone who opted for the equal-weight version. (A difference that could, theoretically, fund a small expedition to locate the Lost City of Atlantis. Or a really nice television.)

The last time we saw such a disparity was in the late 1990s, during the height of the dot-com bubble. The S&P 500 outperformed the equal-weight index by 28% over a three-year period. A time when valuations were based on little more than optimism and the sheer audacity of inventing new acronyms. The current situation bears a striking resemblance. The excitement surrounding artificial intelligence (AI) echoes the fervor surrounding internet stocks three decades ago. Valuations have climbed to levels not seen since then, and concentration within the benchmark index is increasing. (It’s all starting to feel… familiar.)

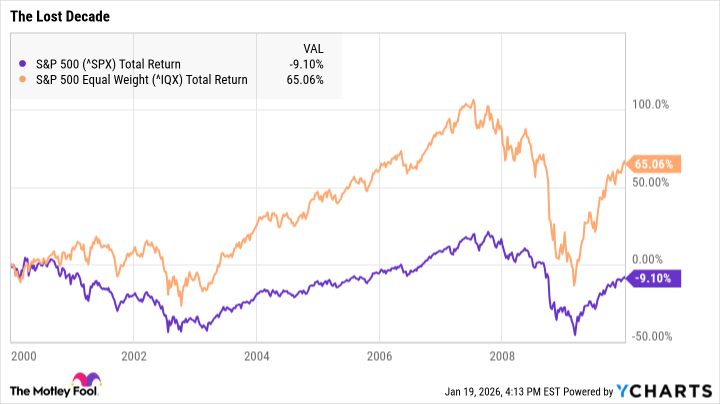

Of course, the dot-com bubble eventually burst. And when it did, the equal-weight index went on to outperform the S&P 500 for seven consecutive years. In the following decade, known as the “lost decade” (a rather dramatic title, really), the equal-weight index delivered a total return of 65% while the S&P 500 declined by 9%. (A sobering reminder that even the most carefully constructed financial plans can be derailed by unforeseen circumstances. Like, say, a rogue asteroid.)

History Repeats Itself (Sometimes)

The “lost decade” was, admittedly, a bit of an outlier. It encompassed both the dot-com bubble and the Great Financial Crisis. Two entirely separate, unrelated catastrophes. (Though, one could argue that they were both caused by excessive optimism and a fundamental misunderstanding of risk. But that’s just a theory.) Therefore, drawing definitive conclusions from that period requires a degree of caution.

However, this isn’t the only instance where high market concentration has been followed by years of outperformance from the equal-weight index. In the late 1960s and 1970s, the “Nifty Fifty” – a group of 50 prominent stocks – drove the market higher, only to be followed by the bear market of 1973 and 1974. The equal-weight index then outperformed in nine of the following ten years, delivering a total return of 410% versus 173% for the S&P 500. (A rather impressive feat, considering the prevailing economic conditions. And the questionable fashion choices of the era.)

The market, it seems, tends to oscillate between periods of increasing concentration and broader performance. As concentration increases, the odds of a shift towards broader performance also increase. (It’s a bit like a pendulum swinging back and forth. Though, admittedly, a pendulum is a much simpler mechanism.)

Furthermore, the equal-weight index has historically outperformed over the long run. It’s simply easier for a smaller company to achieve a relatively large increase in value. Since 1971, the equal-weight index has outperformed the S&P 500 by an average of 1.2% per year. (Which, over several decades, can add up to a considerable sum. Enough to purchase a small island. Or a very large collection of rubber ducks.)

Therefore, investors may wish to consider adding an equal-weight index fund to their portfolio, such as the Invesco S&P 500 Equal Weight ETF (RSP). It can be a simple way to reduce concentration risk and capitalize on the expectation that the market will broaden out over time. (Though, of course, past performance is no guarantee of future results. The universe, as always, reserves the right to surprise us.)

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Lilly’s Gamble: AI, Dividends, and the Soul of Progress

- Celebs Who Fake Apologies After Getting Caught in Lies

- Gold Rate Forecast

- Nuclear Dividends: Seriously?

- Berkshire After Buffett: A Fortified Position

- Chips & Shadows: A Chronicle of Progress

2026-01-23 03:23