Well, here we are at the beginning of another year, and wouldn’t you know it, the technology sector is already showing a bit of pep in its step. The Nasdaq-100, that curious collection of tech giants and hopeful upstarts, is up a respectable 3.4% so far in 2026. The S&P 500, that broader measure of American business, is lagging behind at a mere 0.3%. It’s a bit like watching a greyhound race alongside a particularly determined tortoise. Not a fair comparison, perhaps, but illustrative nonetheless.

The whispers on Wall Street suggest another strong year for tech, and the reason, predictably, is artificial intelligence. It’s become something of a mantra, hasn’t it? Goldman Sachs, those people who seem to know everything (or at least have very expensive models that tell them they do), predict a double-digit jump for the S&P 500, with AI infrastructure investment being a significant driver. One can’t help but wonder if we’re on the cusp of a genuinely transformative shift, or simply caught up in a particularly enthusiastic bubble. Time, as always, will tell.

Given this AI-fueled optimism, it seems prudent to take a closer look at a couple of companies that might benefit disproportionately. Not as a recommendation, mind you – I’m merely an observer, a chronicler of market whims – but as a matter of informed curiosity.

CoreWeave: The Data Center That Roared

Shares of CoreWeave (CRWV 2.40%), a name that sounds suspiciously like a knitting circle, are already up 29% this year. A welcome relief, no doubt, for investors who saw the stock stumble a bit after its initial public offering. IPOs, you see, are a bit like launching a rocket – a lot of initial excitement, followed by a period of anxious adjustment.

The dip last year was largely due to concerns about the sustainability of AI spending and some rather complicated financing arrangements. But CoreWeave appears to be weathering the storm, with robust growth and a hefty revenue pipeline. They provide dedicated AI data centers, essentially warehouses filled with powerful graphics processing units (GPUs). These GPUs are the engines that drive AI workloads, and CoreWeave rents them out to everyone from tech giants to nimble startups. It’s a bit like renting a powerful telescope to amateur astronomers – essential equipment for those peering into the vastness of data.

The business model, it seems, is working. Revenue tripled in the first nine months of 2025, reaching $3.56 billion. And lucrative contracts with Meta Platforms, OpenAI, and others have swelled their backlog to a staggering $55.6 billion. That’s a lot of computing power. This backlog should provide a solid foundation for future growth, allowing them to build additional data center capacity and fulfill customer contracts. So, a continued climb seems likely, though predicting the future, as I’m sure you’ve noticed, is a remarkably unreliable endeavor.

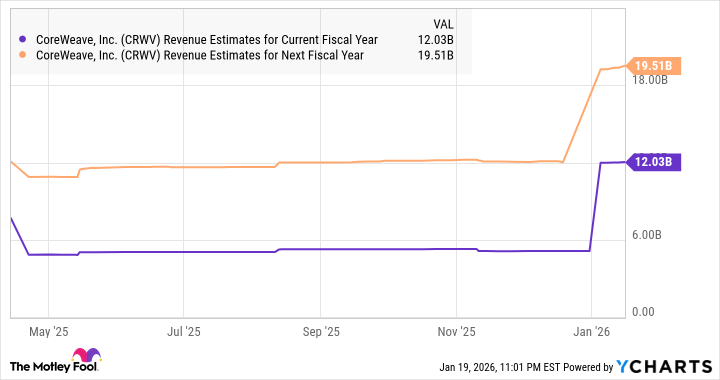

The chart above suggests that CoreWeave’s top line could quadruple in just two years. Currently trading at 12 times sales, a slight premium to the broader tech sector’s average, that seems a reasonable valuation given the company’s growth trajectory. A bit pricey, perhaps, but then again, what isn’t these days?

Palantir: Data Detective and AI Enabler

Palantir Technologies (PLTR +0.34%), a name that evokes images of shadowy intelligence agencies (and, admittedly, a Tolkien character), is emerging as a key provider of generative AI software. They’ve developed an Artificial Intelligence Platform (AIP) that allows customers to connect their data to AI tools, boosting productivity and, presumably, making better decisions. It’s a bit like giving a detective a super-powered magnifying glass – they can still solve the case, but they can do it a lot faster.

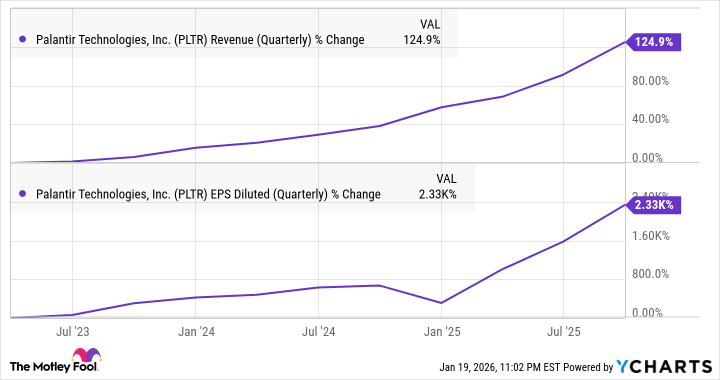

The improved decision-making, greater automation, and reduced redundancy explain why AIP has been a hit, attracting new customers and expanding contracts with existing ones. Earnings more than doubled year over year in the third quarter of 2025. The growth, it seems, is accelerating with each passing quarter. Remarkable, really, though one must always be wary of extrapolating past performance into future projections.

Since introducing AIP in April 2023, the platform has supercharged the company’s growth. Consensus estimates project a 40% increase in earnings in 2026, but Palantir seems poised to exceed those expectations. They’re winning new business faster than they can fulfill existing contracts, leading to a 91% increase in their remaining deal value (RDV) to $8.6 billion. That’s a lot of future revenue.

The customer count increased by 45% year over year. And given that new customers tend to expand AIP deployment across their businesses, there’s a strong likelihood that RDV will continue to grow. The unit economics are strong, potentially leading to triple-digit earnings growth in 2026. Currently trading at 172 times forward earnings, the valuation is undeniably steep. But given the potential for continued growth, it might just be justified. A gamble, perhaps, but then again, investing always is.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Lilly’s Gamble: AI, Dividends, and the Soul of Progress

- Celebs Who Fake Apologies After Getting Caught in Lies

- Nuclear Dividends: Seriously?

- Berkshire After Buffett: A Fortified Position

- Chips & Shadows: A Chronicle of Progress

- A Few Pennies to a Fortune

2026-01-23 01:23