The counsel of the Oracle of Omaha, Warren Buffett, to steer clear of individual stock-picking and instead embrace the broad sweep of the S&P 500, is, on its surface, a pragmatic simplification. Yet, even in this apparent wisdom, a subtle distortion resides. It is a truism, of course, that the aggregate reflects the nation’s economic pulse. But to equate the index wholly with the health of the Republic is to succumb to a convenient, and potentially ruinous, delusion. The index, you see, is not a mirror, but a carefully constructed simulacrum.

The Illusion of Representation

The Wall Street cognoscenti speak of the S&P 500 as “the market,” a shorthand that obscures a fundamental truth: it is a curated selection, a committee’s judgment rendered in ticker symbols. It is not an organic growth, but a deliberate architecture. The intent, ostensibly, is to capture the broad contours of American economic activity. But the selection process, and the weighting of its constituents, introduces biases, vulnerabilities, and a concentration of power that demands closer scrutiny.

The committee, acting as a sort of economic priesthood, chooses those enterprises deemed “large and economically important.” A reasonable enough criterion, one might think. But what constitutes “importance”? Is it merely the size of the balance sheet, the velocity of transactions, or some more nebulous measure of societal contribution? The selection, inevitably, favors established behemoths, those already possessing the advantages of scale and entrenched power. The smaller, more innovative entities, those potentially driving genuine progress, are often relegated to the periphery, their contributions diluted, their voices unheard.

And then there is the matter of weighting. The larger the enterprise, the greater its influence on the index’s performance. This, too, seems logical, a reflection of economic reality. But it also creates a self-reinforcing cycle, where the already dominant enterprises exert an even greater pull on the index, further marginalizing their smaller competitors. The system, in essence, rewards size and entrenchment, stifling competition and innovation.

The Vanguard Anomaly

To simply purchase an index tracker, such as the Vanguard S&P 500 ETF (VOO +0.52%), is to implicitly endorse this system, to participate in its inherent biases. The expense ratio of 0.03% is, admittedly, a pittance, a negligible cost for access to this curated representation of the American economy. But the true cost is not measured in basis points, but in the erosion of diversification and the concentration of risk.

The Weight of Technology

Observe, for instance, the disproportionate influence of the technology sector. Currently, these enterprises constitute a full 34% of the index. And within that sector, a mere three entities – Nvidia, Apple, and Microsoft – account for nearly 21% of the index’s total weight. This is not a reflection of a balanced economy, but a precarious concentration of power. Should these enterprises falter, or succumb to the inevitable cycles of disruption and obsolescence, the consequences for the index, and for those who blindly follow it, would be severe.

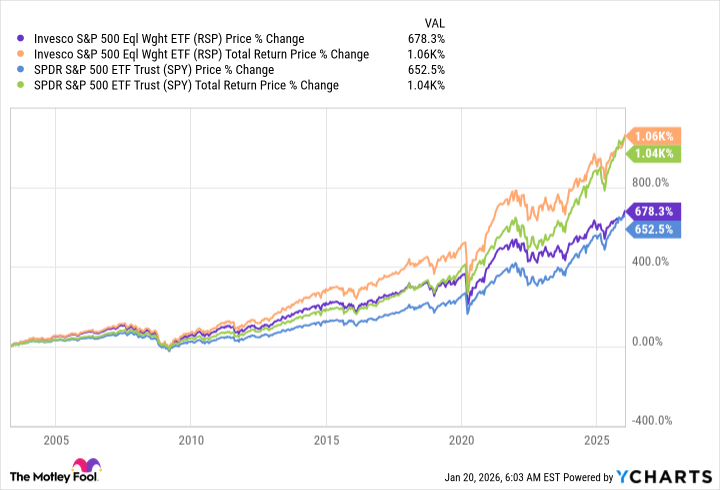

There exists an alternative, a variant that attempts to mitigate this concentration of risk: the Invesco S&P 500 Equal Weight ETF (RSP +0.13%). By assigning equal weight to each constituent, this ETF seeks to level the playing field, to reduce the influence of the dominant enterprises and to provide a more balanced representation of the American economy.

The result is a portfolio with a more diversified sector allocation. Industrials, financials, and healthcare all receive a more substantial weighting, providing a buffer against the volatility of the technology sector. The expense ratio of 0.20% is, admittedly, higher than that of the Vanguard ETF. But the cost of diversification, of mitigating risk, is rarely negligible.

The Long View, and its Discontents

Historical performance, of course, is no guarantee of future results. In recent years, the technology sector has propelled the market to new heights, and the Vanguard ETF has outperformed its equal-weighted counterpart. But this is a temporary phenomenon, a consequence of a specific market cycle. Over the long term, a more diversified portfolio is likely to provide more stable and sustainable returns.

A $100 investment, even a fractional share, is a small gesture, a symbolic act of participation in this complex and often opaque system. But it is a choice, nonetheless. A choice to blindly follow the herd, or to seek a more balanced and diversified path. The Oracle of Omaha may offer a simplified solution, but the truth, as always, is far more nuanced. And the weight of the index, ultimately, rests on the shoulders of those who choose to follow it.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Lilly’s Gamble: AI, Dividends, and the Soul of Progress

- Celebs Who Fake Apologies After Getting Caught in Lies

- Nuclear Dividends: Seriously?

- Berkshire After Buffett: A Fortified Position

- Chips & Shadows: A Chronicle of Progress

- A Few Pennies to a Fortune

2026-01-23 01:03