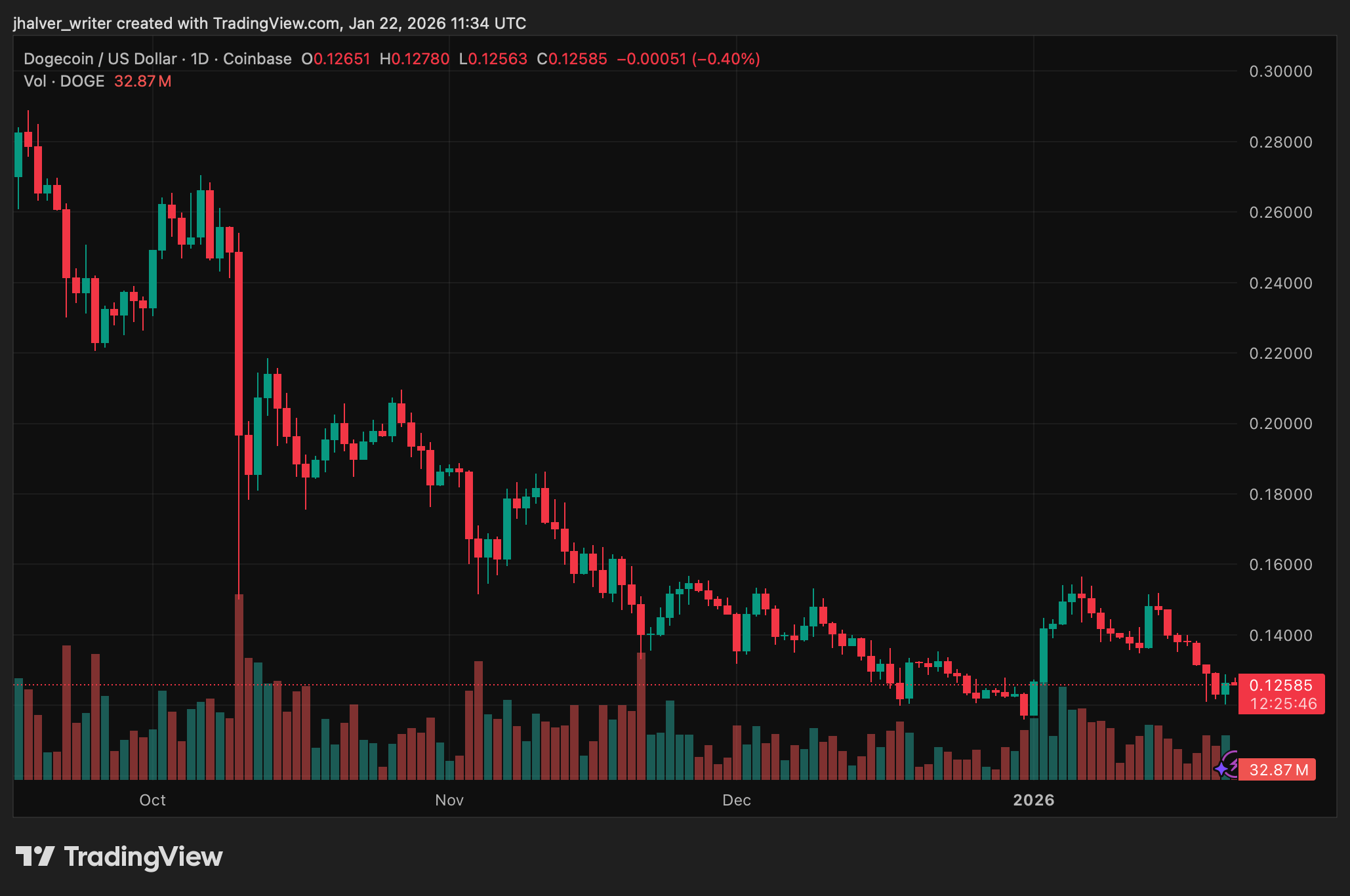

Ah, dear reader, Dogecoin (DOGE) finds itself once more in the delightful position of testing the patience of its investors-a fine pastime, indeed! Here it hovers precariously around the $0.12 mark, a level that has become the talk of the parlor after weeks of delightful volatility akin to a well-scripted comedy.

This charming little meme coin has lost over 20% from its recent heights of $0.15, but fret not! The latest price escapades suggest that perhaps, just perhaps, the selling pressure is beginning to ease like an old man’s sigh on a Sunday morning. Meanwhile, on-chain data and fresh developments regarding token usage provide some intriguing context for DOGE’s fleeting short-term prospects.

As of this fine January day, Dogecoin flits between $0.12 and $0.13, with trading volumes still elevated-like a cat on a hot tin roof-compared to earlier this month. Market participants, in their infinite wisdom, are keenly observing whether this period of consolidation heralds a recovery or is merely a pause before yet another tumble downwards.

Accumulation Signals Emerge: A Comedy of Errors?

On-chain liquidity data reveals a gradual accumulation of DOGE near the $0.12-$0.127 range. Analysts-those daring souls-note that DOGE has bravely defended this support zone, suggesting buyers are tiptoeing in incrementally rather than charging in like a bull in a china shop.

This pattern, dear reader, often graces us during those early accumulation days where the larger players prefer subtlety over ostentation. How civilized!

The technical indicators present a mixed bag, much like a dinner party with both delightful and dubious dishes. Dogecoin dances slightly above its 50-day moving average, while the Relative Strength Index lounges near neutral levels, leaving ample room for movement-perhaps even a waltz-in either direction.

Trading volume has seen a resurgence over the past week, indicating a renewed interest, yet resistance remains as firm as Aunt Mabel’s fruitcake around $0.13 to $0.14. A confirmed break above this range could pave the way for a journey toward $0.14, whilst a slip below $0.12 may reveal unfortunate depths near $0.115 or lower.

Market Sentiment: A Hodgepodge of Emotion

Market sentiment, that fickle mistress, continues to cast shadows over Dogecoin’s path. The Crypto Fear & Greed Index languishes in “fear” territory, reflecting a cautious positioning across digital assets like a cat avoiding a bath. And let us not forget Bitcoin’s dominance-another variable to keep an eye on, like a hawk circling above.

Historically, when Bitcoin’s dominance wanes, capital tends to flow into altcoins like DOGE, much like people flocking to a circus when the main act falters.

Macroeconomic signals and regulatory whims also play their part. A shift towards a more favorable regulatory stance in the U.S. or Europe could invigorate risk appetite, while renewed uncertainty might put pressure on our beloved speculative tokens. Oh, the drama!

Expanding Token Utility: A New Hope?

Beyond the whimsical price action, Dogecoin’s fundamentals are undergoing a delightful transformation. The House of Doge has revealed plans to launch a payment app, “Such,” in the first half of 2026. This app promises to support wallets, facilitate DOGE purchases, and enable direct payments-all while catering to small businesses and peer-to-peer commerce with the grace of a well-trained poodle.

While the announcement hasn’t yet translated into euphoric price movements, it does underscore ongoing efforts to extend Dogecoin’s real-world utility. Over time, one might hope that increased practicality could help DOGE wander beyond the confines of short-term trading narratives. For now, it remains primarily driven by sentiment, technical levels, and broader market trends, much like a ship navigating through foggy waters.

Cover image courtesy of ChatGPT, DOGEUSD chart from Tradingview.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Lilly’s Gamble: AI, Dividends, and the Soul of Progress

- Celebs Who Fake Apologies After Getting Caught in Lies

- Nuclear Dividends: Seriously?

- Berkshire After Buffett: A Fortified Position

- Chips & Shadows: A Chronicle of Progress

- A Few Pennies to a Fortune

2026-01-23 00:40