The latest report, a survey really, suggests people are still throwing money at artificial intelligence stocks, despite a nagging feeling it’s all a bit… inflated. It reminds me of my Aunt Mildred’s Beanie Baby collection. She insisted they were an investment, a secure future. Now they reside in the attic, a monument to optimism and poor financial judgment. Apparently, 57% of these AI investors aren’t changing course, and another 36% are doubling down. Ninety-three percent! It’s like watching a slow-motion train wreck, only instead of twisted metal, it’s portfolios.

They talk about “holding through volatility.” A nice phrase. It sounds… stoic. I tried stoicism once. Lasted about three hours, mostly because the grocery store was out of my preferred brand of yogurt. The idea, of course, is that even the good stocks stumble. True enough. But there’s a difference between a temporary dip and a full-blown, reality-bending bubble. It’s subtle, like the difference between being politely ignored and actively disliked. I suspect most people can’t tell the difference until it’s far too late.

The report admits 41% of investors think this is a bubble. Forty-one percent! That’s almost half. It’s like admitting the pot roast smells vaguely of burning, but continuing to serve it anyway. They’re acknowledging the potential for disaster while simultaneously accelerating toward it. It’s… endearing, in a deeply unsettling way. They’re clinging to the hope that this time, it’s different. My Uncle Leo said the same thing about his timeshare in Florida.

What, Exactly, Should One Do?

Bubbles pop. It’s a historical certainty. And when they do, there are tears. And recriminations. And a lot of explaining to your spouse. But not investing is also a risk. Missing out on something potentially transformative. It’s a classic bind. I feel this way about learning to play the ukulele. I know I’d be terrible, but I also don’t want to be the only person at the retirement home who can’t strum a jaunty tune.

I suppose the smart thing is to be selective. Alphabet, they suggest, is a solid bet. Which is reassuring. It’s a company I recognize. Unlike some of the AI startups that seem to materialize overnight, promising to revolutionize everything from dog grooming to astrophysics. Investing in those feels… reckless. Like betting on a particularly enthusiastic hamster in a race.

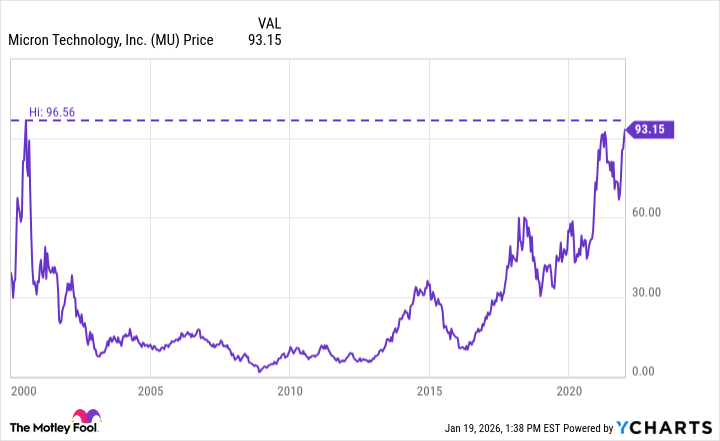

And don’t go all in at once. The report brings up Micron Technology from the dot-com era. Apparently, if you’d bought at the peak, it took over two decades to recover. Two decades! That’s a significant chunk of life. Enough time to learn to play the ukulele, several times over. They advocate for “dollar-cost averaging.” A fancy term for spreading your bets. It’s a sensible strategy. It’s also remarkably similar to how I approach buying socks. I don’t buy them all at once. I buy them gradually, as needed, to avoid a catastrophic sock shortage.

Micron, it turns out, is still important, particularly now that everything requires more memory. Which is ironic. I can barely remember where I put my keys, but computers need exponentially more memory to process increasingly complex algorithms. It’s a humbling thought. The idea of dollar-cost averaging is sound, though. It smooths out the bumps, reduces the risk of ruin, and allows you to participate in the potential upside without betting the farm. It’s a perfectly reasonable strategy. It’s also a bit… boring. But then, so is responsible financial planning.

So, buy a little. Hold on tight. And try not to think about Aunt Mildred’s Beanie Babies. Or my Uncle Leo’s timeshare. Or the inevitable bursting of whatever bubble we’re currently inflating. It’s probably best not to dwell on it. I’m going to go buy some socks.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Lilly’s Gamble: AI, Dividends, and the Soul of Progress

- Celebs Who Fake Apologies After Getting Caught in Lies

- Nuclear Dividends: Seriously?

- Berkshire After Buffett: A Fortified Position

- Chips & Shadows: A Chronicle of Progress

- A Few Pennies to a Fortune

2026-01-22 23:02