Docusign, once a purveyor of mere electronic signatures – a convenience, one might say, for the hurried executive – has attempted a transformation. It now aspires to manage the entire contractual lifecycle, a rather grand ambition. The pandemic, of course, provided a temporary and, one suspects, unsustainable boost. Lockdowns encouraged a reliance on digital processes, and Docusign, for a fleeting moment, appeared to be a beneficiary of circumstance. The share price, predictably, reached a peak in 2021, before returning to a more realistic valuation – a decline of approximately 81% from that ephemeral height.

The company now touts “Intelligent Agreement Management” – IAM, as they call it – a system utilizing artificial intelligence. One gathers that this is intended to alleviate the tedium of contract administration, a task not generally considered a source of either profit or excitement. The suggestion that AI can simplify such matters is, perhaps, optimistic, but the initial uptake appears encouraging. Whether it represents a genuine turning point remains to be seen; one must always view such pronouncements with a degree of skepticism.

IAM: A Solution in Search of a Problem?

Deloitte, a firm not entirely averse to identifying problems for which it can then offer solutions, has calculated that businesses squander a staggering 55 billion hours annually on inefficient contract management. This translates, they claim, to a loss of $2 trillion. One suspects that a significant portion of this “loss” is simply the cost of doing business, but Docusign hopes to capture a slice of it with its IAM platform.

The core of this system is a “Navigator,” a digital repository for contracts. The AI extracts key information, making it, in theory, searchable. This eliminates the necessity for clerks to wade through mountains of paper – or their digital equivalents – a task which, while undeniably tedious, did at least provide employment. The “AI-Assisted Review” feature promises to uncover risks and opportunities, a claim that sounds suspiciously like a sophisticated form of due diligence, previously handled by lawyers at considerable expense. The revamped eSignature product, integrated with IAM, now summarises contracts for the signer, a gesture that might be construed as either helpful or patronising.

As of the end of the third quarter of their fiscal year 2026, over 25,000 businesses had adopted IAM, a 150% increase in six months. Such growth, while impressive on paper, does not necessarily equate to profitability. One must remember that the technology sector is littered with companies that achieved rapid expansion only to collapse under the weight of their own ambition.

Profitability, a Novel Concept

Docusign anticipates revenue of $3.2 billion for fiscal 2026, an increase of 8% over the previous year. A modest rate of growth, perhaps, but the company appears to have shifted its priorities. They are, it seems, focusing on profitability, a concept that has often been overlooked in the pursuit of market share.

In the first three quarters of fiscal 2026, Docusign reported a GAAP profit of $218 million, a remarkable turnaround from the $102 million loss recorded in the same period in 2022. Adjusted profits have doubled, despite a relatively modest increase in revenue. This suggests that management is exercising a degree of fiscal restraint, a welcome development in an industry often characterised by extravagant spending.

There is, of course, a trade-off. Reduced spending on marketing has contributed to the slower revenue growth. However, with the company now consistently profitable, management has the flexibility to reinvest in growth initiatives if they deem it appropriate.

Valuation: A Question of Perspective

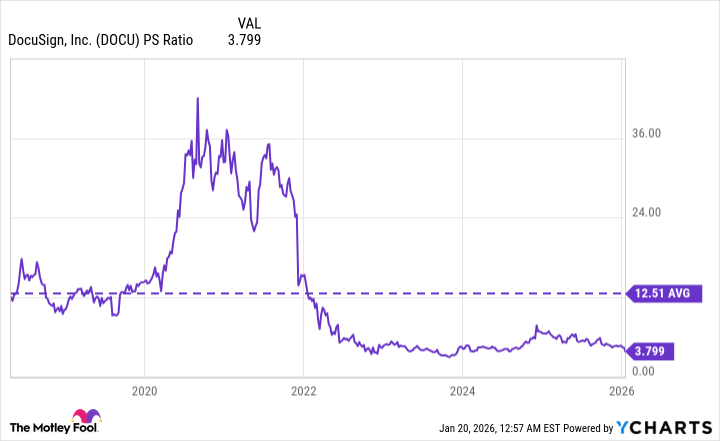

Docusign currently trades at a price-to-sales ratio of 3.8, a 70% discount to its historical average. From this perspective, the stock appears attractively valued. However, the trailing-12-month GAAP earnings of $1.43 per share place the price-to-earnings ratio at 39.6, a premium to both the S&P 500 and the Nasdaq-100. Whether this premium is justified is debatable.

Given the momentum in the IAM platform, and the company’s newfound profitability, a cautious optimism is perhaps warranted. Investors willing to adopt a long-term perspective – three years or more – may find that Docusign offers a reasonable opportunity. However, one should always remember that the technology sector is a notoriously fickle mistress.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nuclear Dividends: Seriously?

- Lilly’s Gamble: AI, Dividends, and the Soul of Progress

- Berkshire After Buffett: A Fortified Position

- Chips & Shadows: A Chronicle of Progress

- A Few Pennies to a Fortune

- Celebs Who Fake Apologies After Getting Caught in Lies

2026-01-22 21:23