The pursuit of appreciation, in the realm of capital, resembles nothing so much as the tracing of a labyrinth. Each investment, a corridor; each fluctuation, a deceptive mirror. To seek a singular ‘growth stock’ is to presume the existence of a final chamber, a delusion perhaps, yet one that compels us nonetheless. I have, through a protracted observation of these fluctuating systems, encountered a peculiar entity – MercadoLibre – that merits a closer scrutiny. Not as a guaranteed egress from this financial maze, but as a cartography of potential, a map constantly redrawing itself.

The chronicles of MercadoLibre, as reconstructed from fragmented reports and analyst pronouncements, reveal a trajectory not merely of ascent, but of multiplication. It began, as so many things do, with the simple exchange of goods – a digital bazaar, if you will. But its ambition, it seems, is not confined to the mere facilitation of commerce. It aspires, according to certain whispers within the financial academies of Buenos Aires, to become a foundational layer of economic life in Latin America – a digital nervous system, if you will.

The Geometry of Growth

The raw numbers, while superficially pedestrian, betray a deeper, more unsettling logic. A revenue increase of 49% – a figure repeated with unnerving consistency – is not merely a percentage; it is a fractal, a pattern endlessly replicating itself. The growth in Gross Merchandise Volume (35%), coupled with a 26% increase in active buyers, suggests a system feeding upon itself, a virtuous cycle that defies easy prediction. The recent reduction in free shipping thresholds in Brazil – a seemingly minor adjustment – has triggered a cascade of effects, a ripple expanding outwards from a single point of intervention. It is as if the company has discovered a hidden lever within the economic machinery of the region.

But MercadoLibre is not solely a purveyor of goods. Its fintech arm, MercadoPago, is a more intriguing development. A digital wallet evolving into a full-fledged banking system – a Library of Babel containing the financial histories of millions – is a project of considerable audacity. The ambition to become the dominant digital bank in Latin America is not merely a business goal; it is a reshaping of the financial landscape, a reordering of economic power. The 54% increase in total payment volume is not simply a number, but a signal – a harbinger of a future where traditional banking institutions may find themselves relegated to the margins.

The operating margin, while experiencing a slight contraction (from 10.5% to 9.8%), is presented by management as a ‘reasonable trade-off.’ A curious phrasing, suggesting a deliberate acceptance of short-term costs in pursuit of long-term dominion. It is a strategy reminiscent of the alchemists of old, sacrificing immediate gains for the promise of transmutation.

The Labyrinth Expands

The true opportunity, it seems, lies not in the current state of affairs, but in the vast, largely untapped potential of the Latin American market. A population exceeding 500 million, lagging behind in e-commerce and fintech – a fertile ground for disruption. Brazil, as the largest market, is receiving the bulk of the attention, with investments designed to capture market share. The 28% increase in shipments, coupled with a 8% reduction in unit costs, suggests a system achieving economies of scale – a relentless optimization of efficiency.

The fintech landscape is equally compelling. The concentration of credit in the hands of five large banks – a rigid, centralized structure – presents a vulnerability. The $200 billion sitting in low-yield accounts – a reservoir of untapped capital – is a temptation for any ambitious disruptor. MercadoLibre’s strategy of becoming the ‘principal’ banking partner for its users – fostering loyalty, encouraging cross-selling, minimizing delinquencies – is a subtle but potent approach. It is a strategy of infiltration, of gradually replacing the existing order with a new, more fluid system.

A Reasonable Valuation?

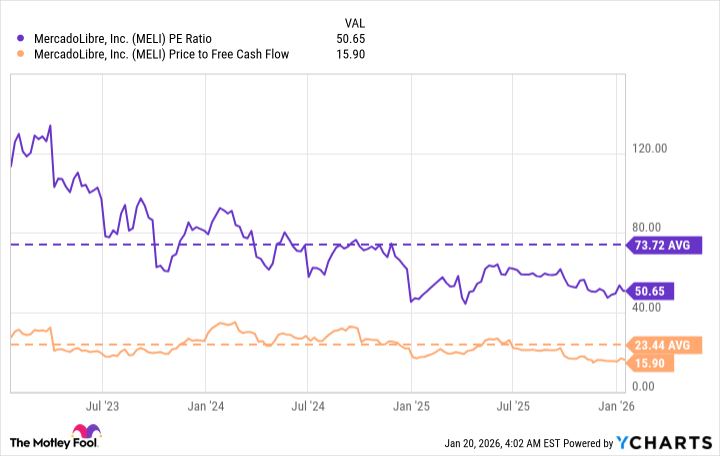

To declare any stock the ‘ultimate’ anything is, of course, a folly. The market, like a dream, is subject to constant revision. But MercadoLibre, at present, appears to be reasonably valued – its P/E and price-to-free cash flow ratios below their three-year averages. The ability to purchase fractional shares – a recent innovation – allows even those with limited resources to participate in this unfolding narrative. It is a small step, perhaps, but a step nonetheless into the labyrinth – a tentative exploration of a potentially boundless domain.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TV Leads Dropped After Leaked Demanding Rider Lists

- Gold Rate Forecast

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- MARTY SUPREME Was Supposed To End As A Vampire Flick

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

2026-01-22 19:42