In the grand cathedral of crypto, where fortunes rise and fall like the whims of a capricious deity, Bitwise has declared that Ethereum’s price now dances like a peacock in a bear market’s shadow. Their analysis, a symphony of graphs and spreadsheets, insists the broader market stumbled into its lowest point in Q4 2025, a nadir so profound it could make a monk weep into his lentils. Yet lo! While sentiment floundered like a drunkard on a tricycle, Ethereum’s fundamentals strutted into the spotlight, strutting with such vigor that one might think it had swallowed a dozen espresso shots.

Whale Momentum and the Supply-Side Crunch

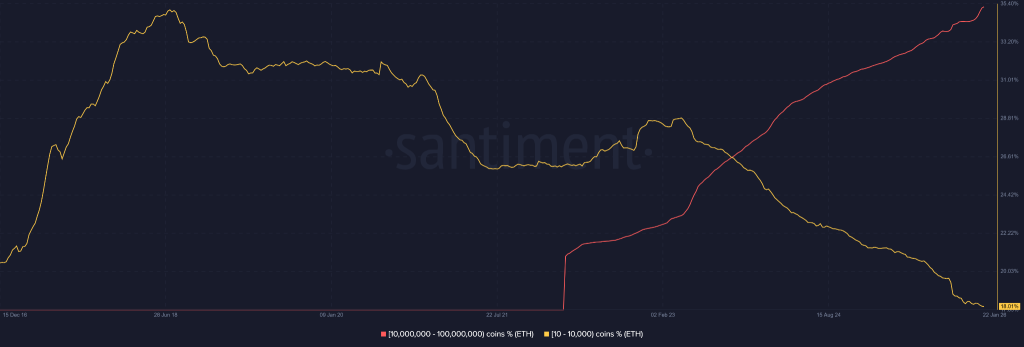

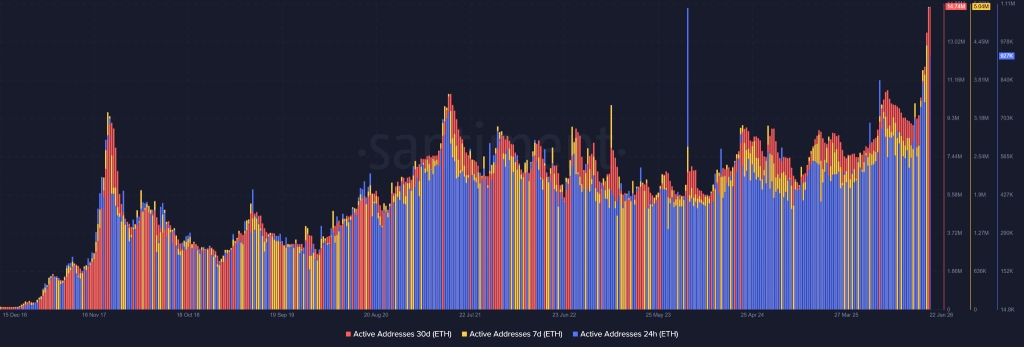

The Ethereum seas, once tempestuous, now shimmer with the glint of whale-scale gold. On-chain data reveals a curious ballet: small-time swimmers, clutching 10 to 10,000 ETH like a beggar’s last coin, flee the waters. Meanwhile, leviathans hoarding 10 million ETH (or more) waltz in, devouring supply with the appetite of a goblin at a feast. These titans, with their $100k+ transactions, march like soldiers to war, each trade a drumbeat heralding a new era-or perhaps just a new tax bracket.

History, that sly old trickster, whispers of past peaks in September 2025, when Ethereum’s price soared to $4955. Now, as these whale-traders resurrect their 30-day moving average, one must wonder: is this the dawn of a new ATH, or merely a parrot reciting old stock tips?

ETH Price Chart Analysis and Resistance Levels

Behold the ETH price chart, a canvas of chaos and hope! A trendline, drawn with the precision of a madman’s doodle, now guards the $3,000 fortress. This line, a psychological moat or perhaps a divine decree, has held firm as if etched by the hand of fate itself. Yet the price, like a drunkard testing the stability of a bridge, has repeatedly stumbled against the 200-day EMA, only to bounce back with the grace of a penguin in quicksand.

This dance of resistance and resolve has birthed a “coiling” effect, a spring wound so tight it threatens to snap like a rubber band aimed at a toddler. If the bulls can flip the 200-day EMA into a shield, the price might vault toward $3,827 and $4,218-though whether this is a bullish breakout or a bear’s last stand remains to be seen.

The Road Ahead for Ethereum in 2026

As Q1 unfolds, Ethereum’s fate teeters on the edge of a knife. The CLARITY Act, a legislative quill dipped in bureaucratic ink, and crypto ETFs, those financial gremlins, may yet tip the scales. Bitwise, ever the prophet of spreadsheets, draws parallels to 2023-a time when the market, declared dead by every soothsayer, rose from the ashes like a phoenix… or perhaps a poorly timed firework.

Exchange reserves, dwindling like a miser’s savings, and decentralized exchanges, outpacing their centralized cousins, paint a picture of structural fortitude-or a house of cards built on vapor. Once the bearish winds subside, institutional gold and Ethereum’s “network utility” (a term as vague as a politician’s promise) may propel the price toward glory. Or perhaps they’ll send it plummeting into the abyss. Only time, that fickle jester, will tell.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TV Leads Dropped After Leaked Demanding Rider Lists

- Gold Rate Forecast

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- MARTY SUPREME Was Supposed To End As A Vampire Flick

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

2026-01-22 16:57