Recent market exuberance surrounding quantum computing ventures has drawn investor attention, mirroring a pattern observed with emerging technologies over the past three decades. While artificial intelligence currently dominates the narrative, quantum computing experienced a period of significant speculative investment in late 2025. Shares of IonQ and Rigetti Computing registered substantial gains – 670% and over 6,200% respectively – over the trailing twelve months. These figures, while noteworthy, warrant a more circumspect assessment of underlying fundamentals.

The Addressable Opportunity and Early Adoption

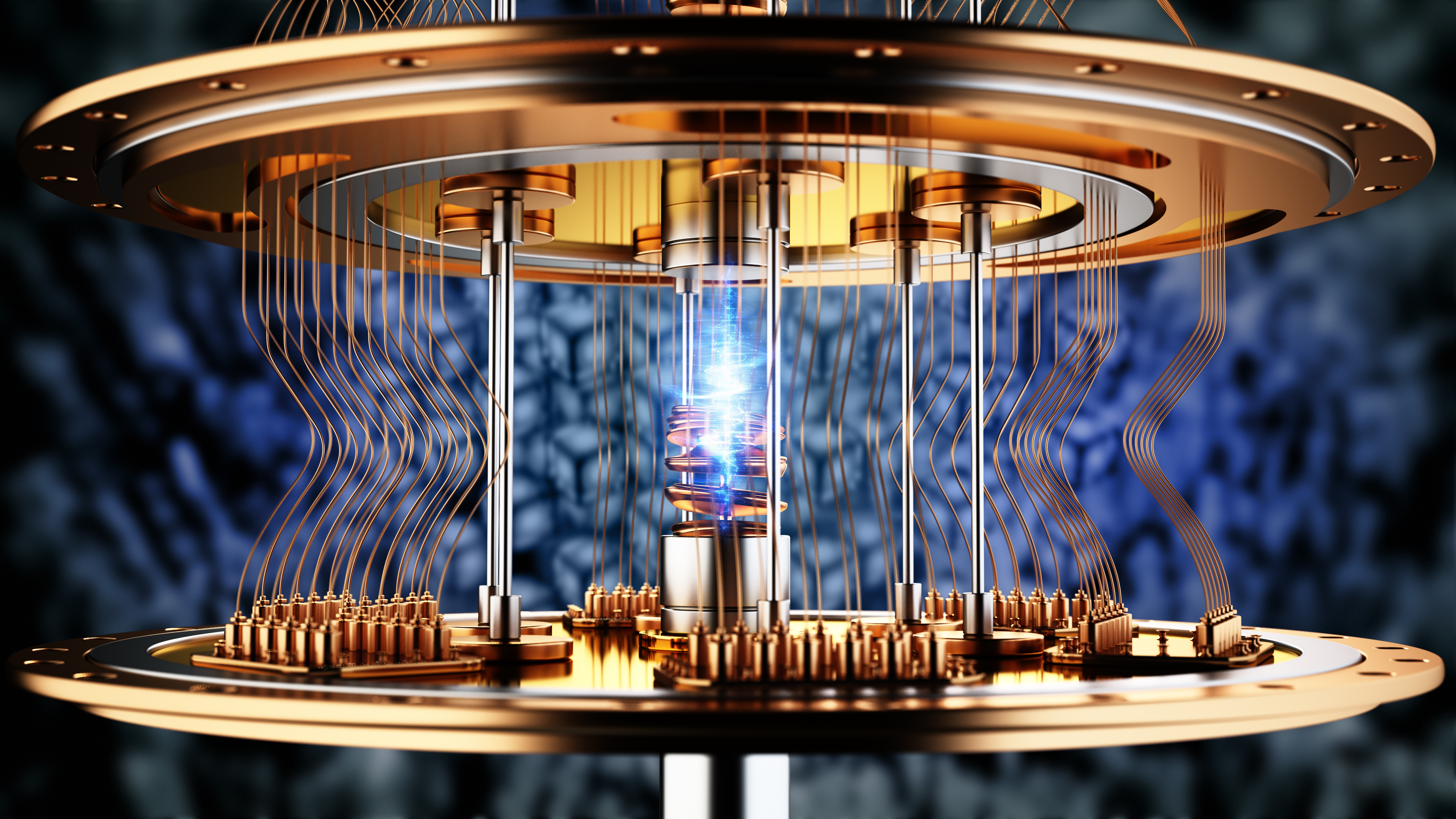

Analysts project a substantial addressable market for quantum computing, ranging from $450 billion to $1 trillion by 2035-2040. This potential, coupled with nascent real-world applications – including molecular simulations for pharmaceutical development, enhanced cybersecurity protocols, accelerated AI learning, and improved weather modeling – has fueled investor optimism. The announcement of JPMorgan Chase’s $1.5 trillion Security and Resiliency Initiative, with a dedicated focus on quantum computing, further catalyzed this momentum. Early access to IonQ and Rigetti’s hardware through cloud services offered by Amazon and Microsoft represents a further validation of the technology’s potential.

Quantum Computing 1 Year Returns 🤯$RGTI +6,217% $QBTS +3,912%$QUBT +2,798%$IONQ +670%

Sustainability Concerns and Competitive Landscape

However, the trajectory of emerging technologies is rarely linear. The current market valuation of quantum computing ventures appears predicated on a rapid commercialization timeline that may prove optimistic. While IonQ and Rigetti have secured initial clients and collaborations, widespread adoption remains contingent upon demonstrable cost-effectiveness compared to existing classical computing solutions. A critical factor often overlooked is the relatively low barrier to entry for established technology giants.

The competitive landscape is rapidly evolving. Alphabet’s unveiling of the Willow quantum processing unit in December 2024, and subsequent reports of a 13,000x performance advantage over conventional supercomputers, underscore the potential for disruption from well-capitalized incumbents. As of September 30, Alphabet held approximately $98.5 billion in cash and generated over $112 billion in net cash from operating activities through the first nine months of 2025. This financial strength provides a significant advantage in pursuing long-term, capital-intensive research and development initiatives.

Microsoft’s development of the Majorana 1 QPU, with the potential for scaling to 1 million qubits, further intensifies the competitive pressure. These companies possess the resources and expertise to rapidly deploy quantum computing solutions, potentially marginalizing smaller, specialized ventures.

Capital Allocation and Long-Term Viability

IonQ and Rigetti, while demonstrating early technological prowess, have yet to establish a sustainable operating model or a clear path to recurring profitability. Their reliance on external capital raises concerns regarding long-term viability. The ability to secure continued funding will be crucial, but is not guaranteed in a potentially crowded and competitive market. Without a defensible competitive advantage – a “moat” – these ventures are vulnerable to disruption from larger, more financially secure players.

In conclusion, while the potential of quantum computing remains substantial, the current market valuation of certain ventures appears disconnected from underlying fundamentals. Investors should exercise caution and conduct thorough due diligence, focusing on long-term sustainability, competitive positioning, and capital allocation strategies. The current exuberance may prove unsustainable in the face of intensifying competition and the inherent challenges of commercializing a nascent technology.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TV Leads Dropped After Leaked Demanding Rider Lists

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

2026-01-22 12:13