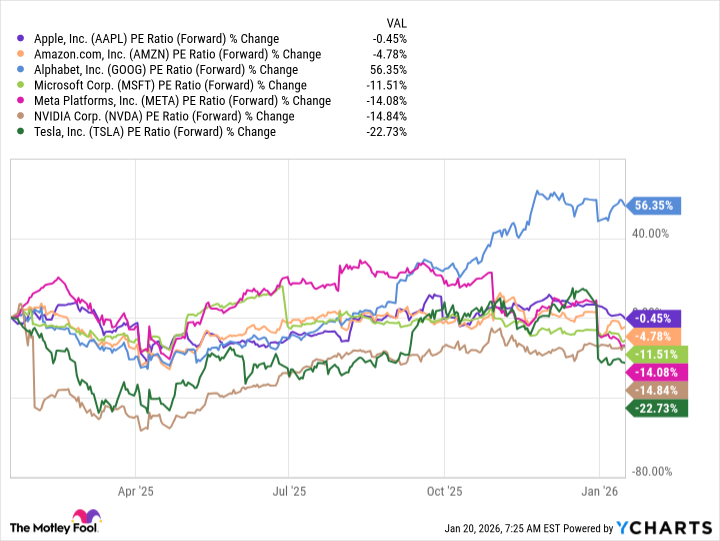

They call them the Magnificent Seven. A grandiose title, isn’t it? As if a handful of publicly traded entities require such… embellishment. One suspects marketing departments, swollen with self-importance, are to blame. These companies – Amazon, Alphabet, Apple, Meta, Microsoft, Nvidia, and Tesla – have indeed enjoyed a recent ascent, fueled by the intoxicating fumes of artificial intelligence. A boom, they proclaim. I call it a particularly well-managed delusion. They’ve lifted the S&P 500, yes, but at what cost to reason? One imagines Behemoth himself consulting their quarterly reports, a sardonic smile playing on his lips.

1. The Inevitable Climb (and the Hollow Echoes)

My first prediction? They will continue to rise. Not because of inherent value, mind you, but because inertia is a powerful force, and the herd, as always, will follow the loudest bleating. Investors, bless their naive hearts, are still captivated by the AI narrative. Valuations have, admittedly, retreated somewhat from their stratospheric peaks. A minor correction, really. Like a slight adjustment to a noose. Alphabet, at 29x forward earnings, remains reasonably priced, they say. Reasonable, in this context, is a relative term. It’s akin to declaring a cholera outbreak ‘moderately unpleasant.’

The surprise, if one can call it that, is not that valuations have fallen, but that anyone still believes in them. It’s a comforting fiction, this belief in upward momentum. Like a patient clinging to a dubious remedy, they’ll keep investing until the inevitable reckoning arrives.

2. Volatility: The Price of Hubris

Optimism, I find, is a dangerous affliction. I foresee gains, certainly, but not a smooth ascent. Expect turbulence. Investors, ever fickle, will begin to question the pace of AI development. A slight delay, a missed deadline, and the panic will set in. They’ll start locking in profits, abandoning ship like rats fleeing a sinking vessel. External factors – tariffs, governmental whims – will only exacerbate the situation. They’ll suddenly discover the virtues of healthcare stocks, of dividend payments. The predictable flight to safety. But fear not, the tech earnings, for now, are strong enough to withstand a minor storm. For a time.

3. Meta: The Least Unpleasant of the Lot

Meta, trading at a mere 20x forward earnings, is, relatively speaking, the least objectionable of the seven. A bargain, they say. I suspect it’s merely the least damaged. As they continue to report growth and invest in AI – and automate their advertising platform, naturally – the valuation gap will narrow. They’ll become pricier, of course. Everything does, eventually. It’s the natural order of things. Like dust accumulating on forgotten relics.

4. Nvidia: The Master Puppeteer

Nvidia, last year, demonstrated a shrewd understanding of the game. It’s not enough to innovate internally; one must forge alliances, collaborate with others. Their partnership with Nokia, to revolutionize telecom with AI, is a prime example. They are building an ecosystem, a web of dependencies. Partnerships are crucial, of course. They allow one to expand revenue opportunities without actually… earning them. It’s a subtle distinction, but important. I predict Nvidia will continue down this path, forging more alliances, expanding its influence. A master puppeteer, pulling the strings from behind the curtain.

5. Beyond the Magnificent Seven: The Shadows Stir

While I remain cautiously optimistic about the Magnificent Seven, I wouldn’t be surprised if other players outperform them. Nebius Group, a cloud specialist, Broadcom, a custom chip designer – these companies, and others, may see significant gains as the AI boom continues. Investors, in their infinite wisdom, may look beyond the established giants, seeking out new opportunities. The Magnificent Seven will likely continue to power the S&P 500, but they may not be the ones scoring the biggest gains. The shadows are stirring, and in the shadows, fortunes are often made. A chilling thought, isn’t it?

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TV Leads Dropped After Leaked Demanding Rider Lists

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

2026-01-22 12:12