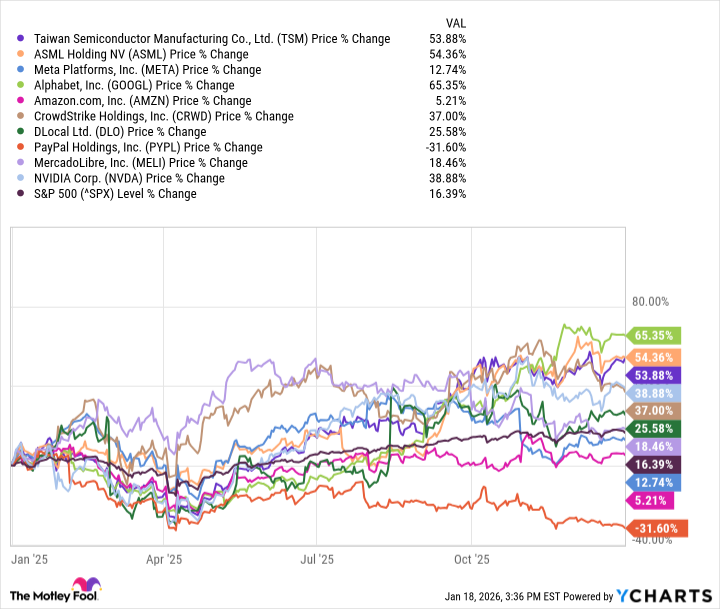

Last December, I ventured a mapping of ten constellations in the firmament of commerce, projecting their arcs across the coming year. Taiwan Semiconductor, ASML, Meta Platforms, Alphabet, Amazon, CrowdStrike, dLoca, PayPal, MercadoLibre, and Nvidia – a gathering of names, each a vessel carrying the hopes and anxieties of a restless age. For the most part, they navigated the currents well. Only three dipped below the waterline, a result not entirely unwelcome, for even in triumph, there is a shadow.

The broader market, a surging tide, lifted many boats. Yet, to measure success solely by its rise is to mistake the surface for the depths. These three – Meta, Amazon, and PayPal – presented a more nuanced story, a whisper of resistance against the prevailing wind. Do they still hold promise as the year turns, as winter yields to a tentative spring?

The Weight of Underperformance

A chart reveals much, but it speaks in the language of numbers, a blunt tongue. PayPal’s descent is the most stark, a solitary figure against the rising curve. It is a reminder that even the most established currents can falter, that the past does not guarantee the future. The S&P 500 ascended, a confident climb of 16.4%, but these three trailed, each for its own reasons, each a miniature tragedy in the grand opera of the market.

Meta, briefly radiant, dimmed as it announced further investment in its data centers. A paradox, one might think – to strengthen the foundations while the structure appears to sway. But such is the nature of progress, a constant balancing act between present stability and future ambition. Amazon, burdened by its own early success, found the ascent steeper. The premium it carried, a testament to past triumphs, became a weight, and it settled into a more modest orbit. Yet, its core strength remains, a slow, steady pulse that suggests a resurgence is possible.

And then there is PayPal, a vessel attempting a difficult turn. It is not a story of explosive growth, but of quiet rebuilding. Its valuation, now surprisingly modest, suggests a forgotten potential. A stock, at some point, becomes too inexpensive to ignore, like a weathered artifact hinting at a lost civilization. It holds a certain gravity, a quiet dignity.

A Second Glance: Prospects for the Turning Year

I believe each of these three holds the possibility of reclaiming lost ground. Meta, fueled by its continued investment, may yet soar. Amazon, stripped of its inflated price, may find a new rhythm, a more sustainable momentum.

PayPal, however, is the most uncertain. It requires a shift in perception, a reawakening of faith. But if it continues to repurchase shares, if it demonstrates a consistent growth in earnings, a turnaround is not merely possible, but inevitable. It is a long game, a slow blossoming, but sometimes, the most enduring beauty is found in the patient unfolding.

These three offer a compelling, if not entirely assured, proposition for the coming year. They are not guarantees, but possibilities, whispers of potential in the vast, echoing chamber of the market. And in a world defined by uncertainty, perhaps that is enough.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

2026-01-22 08:52