Okay, so. Banking. It used to involve tweed jackets and disapproving looks. Now it’s…apps. Which is, frankly, a relief. Especially when you consider the queues. I spent a good hour once trying to deposit a cheque, and the woman behind me kept sighing dramatically. Anyway, the point is, Latin America is going digital, and one company seems to be leading the charge: Nu Holdings (NU +1.59%). Honestly, 100 million customers. It makes our high street banks look…well, a bit dusty.

It’s been doing rather well, the stock has. Up, up, up. But still under $18 as of today, January 20, 2026. Which, naturally, raises the question: is it a buy? A sensible question, I think. A financially responsible question. Although, let’s be honest, my track record with “sensible” investments is…patchy.

Rising Revenue, Declining Costs (and My Rising Anxiety)

The legacy banks in Mexico and Brazil, apparently, are a bit…aggressive. High fees, long queues, technology that feels like it was designed in the Stone Age. Nu Bank, on the other hand, is all about being user-friendly. Which, you’d think, would be the

minimum

requirement for a bank, but there you go.

Unsurprisingly, people are flocking to it. 110 million in Brazil, 13 million in Mexico (and growing at an alarming rate – almost makes me feel guilty for not having bought in earlier). Colombia is also showing interest, although, let’s face it, it’s not going to be a game-changer.

And here’s the clever bit. They’re not just acquiring customers, they’re making

more

money from each one, while simultaneously reducing the cost of serving them. Average revenue per customer in Mexico is now $12.50, up from $5.20 in 2021. Cost per customer has plummeted from $3 to $1. It’s almost…efficient.

Units of Cryptocurrency Lost: 12. Hours Spent Watching Charts: 9. Number of Panicked Texts to Friends: 24.

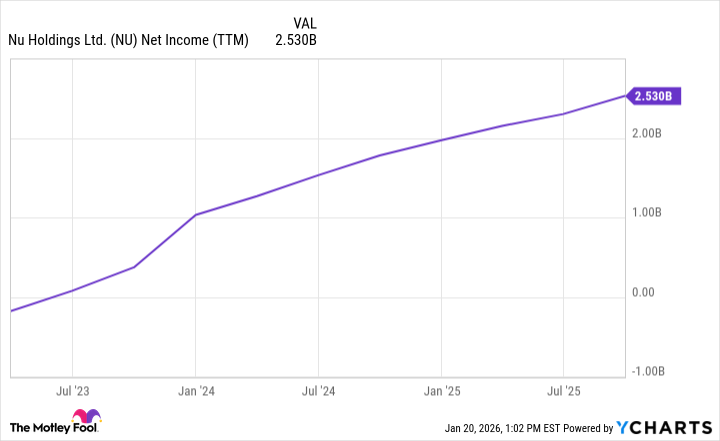

This, apparently, is why their net income has gone from basically nothing to $2.5 billion in three years. Which, when you think about it, is quite a lot of money.

Multiple New Markets (and My Multiple New Worries)

So, they’ve got a good foothold in Brazil, Mexico, and Colombia. But that’s just the beginning. The region has a population of over 600 million, and they’re hinting at expansion into Chile, Argentina, Peru…even the United States.

Apparently, they’ve applied for a banking license in the US, which could allow them to serve immigrants sending money home. Which is…nice. Although, it does make me wonder if they’re spreading themselves too thin.

Will become disciplined long-term investor. (Current status: doubtful).

They’ve got room to grow revenue and customer numbers in their existing markets,

and

a long runway for expansion. Which, in investment terms, is apparently a good thing.

Is Nu Holdings Stock a Buy Today? (Or Am I Just Deluding Myself?)

Okay, so here’s the numbers. Market cap of $81 billion. P/E ratio of 32.4, based on net income of $2.5 billion.

Expensive for a bank? Possibly. But maybe not, if you’re willing to hold for the long term. They’ve got the potential to significantly grow revenue through new customers and additional services (credit cards, etc.). And decreasing costs should help their profit margin.

I’m imagining, five years from now, they’re generating $10 billion in annual net income. That would give the stock a P/E of 8, which, even on a five-year forward basis, looks…reasonable.

Don’t think Nu Holdings is a stock to avoid after rising close to 50% in the past year. Shares still look cheap for long-term investors at $18 or below right now.

Honestly, it’s tempting. Very tempting. Although, I should probably do more research. And maybe consult a financial advisor. And definitely avoid looking at the charts for at least 24 hours. It’s all a bit…stressful, really. But, yes, potentially worth a look. At $18 or below. Definitely. (Disclaimer: I am not a financial advisor. And I am prone to impulsive decisions.)

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

2026-01-22 04:12