Many years later, as the market’s fever dreams subsided and the echoes of panicked trading faded into the humid stillness of a late summer afternoon, old Mateo would recall the counsel of his grandfather, a man who understood that true wealth wasn’t measured in fleeting gains, but in the slow accumulation of resilience, like the rings of a ceiba tree marking the passage of centuries. He spoke of companies that didn’t chase the sun, but anchored themselves to the earth, drawing sustenance from the predictable rhythms of need. It was a lesson lost on most, consumed as they were by the ephemeral brilliance of the new, but it remained, a quiet weight in Mateo’s portfolio, a promise whispered across generations.

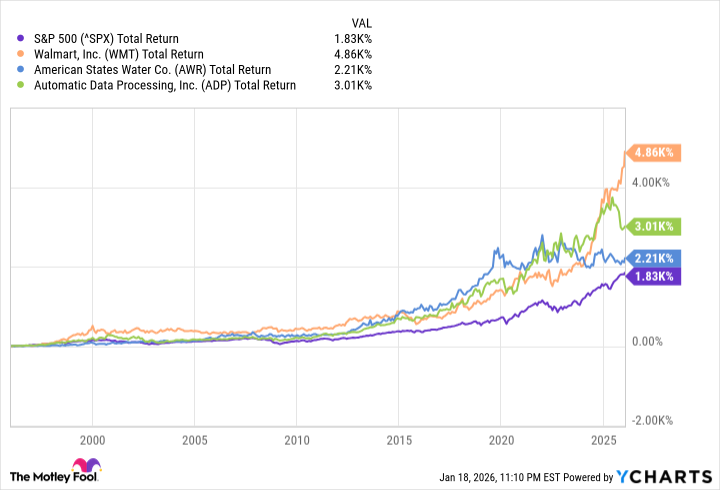

The prevailing wisdom, endlessly repeated by the oracles of the financial districts, is to mirror the S&P 500, to surrender to the tide and hope for a respectable drift. A sensible strategy, perhaps, for those content with merely keeping pace, but a passive acceptance of fate for those who believe in the possibility of exceeding it. The pursuit of exceptional returns often leads investors down treacherous paths, tangled in the complexities of fleeting trends and speculative bubbles. Yet, there exists a more subtle route, a path paved not with explosive growth, but with the unwavering consistency of dividends—a quiet rain nourishing a patient garden.

But not all dividends are created equal. The market is awash in promises, in yields that shimmer like mirages, only to dissolve under scrutiny. True wealth, the kind that endures beyond market cycles and political storms, resides in the hands of a select few—the Dividend Kings. These are not merely companies that distribute profits, but institutions that have mastered the art of generating them, year after year, decade after decade, a testament to their enduring strength and the deep roots they have sunk into the economic landscape.

The Weight of Years, the Alchemy of Income

There are those who raise their dividends annually, a commendable feat, earning them the title of Dividend Aristocrats. A respectable lineage, to be sure, but a mere prelude to the true nobility of the Dividend Kings. These are companies that have not simply endured, but thrived, raising their per-share payouts for at least fifty consecutive years. As of this moment, a scant fifty-six entities claim this title, a fellowship of the steadfast, a reminder that consistency, in a world obsessed with novelty, is a rare and precious commodity.

One might expect these kings to be titans of innovation, pioneers of disruptive technologies. But the truth is far more prosaic. They are, for the most part, companies engaged in the unglamorous, yet essential, business of providing basic necessities: processing payroll, stocking shelves, delivering water. They are the quiet engines of everyday life, their operations as reliable as the rising and setting of the sun. And it is this very predictability, this unwavering commitment to fulfilling fundamental needs, that allows them to consistently generate profits and reward their shareholders.

Hartford, a company that has studied this phenomenon for years, has observed that these dividend-growing corporations possess strong fundamentals, solid business plans, and a deep commitment to their shareholders. It is a simple equation, really: consistent earnings, disciplined capital allocation, and a long-term perspective. Yet, in a world driven by short-term gains and instant gratification, it is a formula that few seem willing to embrace.

For the patient investor, however, these Dividend Kings offer a unique opportunity: the chance to build a portfolio that not only generates a steady stream of income but also has the potential to outperform the broader market over the long term. It is a strategy that requires discipline, patience, and a willingness to ignore the siren song of speculative excess. But for those who are willing to embrace it, the rewards can be substantial.

Three Kingdoms to Consider

1. Automatic Data Processing

Automatic Data Processing, or ADP, is a name that conjures images of endless columns of numbers, of payroll checks and tax forms. It is a business that lacks the glamour of Silicon Valley, but it is essential nonetheless. One in six American workers receives their pay through ADP, a statistic that speaks to its pervasive reach and its critical role in the economy. The company is expected to generate $21.8 billion in revenue this fiscal year, a testament to its enduring strength and its ability to adapt to changing times.

While not a high-growth company, ADP is remarkably profitable, consistently converting 20% to 25% of its revenue into net income. This allows it to comfortably afford its ever-rising dividend, which has now been raised for 51 consecutive years. At a current yield of 2.6%, it may not be the most lucrative dividend on the market, but it is a reliable one, a quiet promise of future income.

2. Walmart

Walmart, a name synonymous with affordability and convenience, has been a fixture of the American landscape for over sixty years. It began as a single store in Arkansas and has grown into a global behemoth, dominating the retail industry with its vast network of stores and its relentless focus on cost efficiency. Remarkably, Walmart has increased its per-share dividend for 52 consecutive years, a testament to its enduring strength and its ability to navigate the ever-changing retail landscape. Currently, the dividend yield is modest, at 0.8%, but the true value lies in the company’s potential for price appreciation.

Walmart’s dominance is so complete that it is practically impossible for a rival to gain a foothold. Ninety percent of the American population lives within ten miles of a Walmart store, a statistic that speaks to its pervasive reach. The company has also become the country’s largest grocer, further solidifying its position as a retail powerhouse. Moreover, Walmart has been aggressively buying back its shares, reducing its share count by roughly 40% since the mid-1990s, adding value in ways that extend beyond dividends.

3. American States Water

American States Water, a name that evokes images of pristine reservoirs and underground aquifers, is a utility company that provides water and electricity to over one million people in nine states. It is a business that is often overlooked, but it is essential nonetheless. Water, after all, is life, and the demand for clean, reliable water is only going to increase in the years to come.

American States Water has increased its dividend for an astonishing 70 consecutive years, a record that is unmatched by any other company in the S&P 500. Over the past decade, the company has raised its per-share payout at an annualized average of over 8%, easily outpacing inflation. The company’s success is due in part to the growing scarcity of potable water and the rise of electricity-hungry data centers. These trends are expected to continue, providing American States Water with ample opportunities for growth. At a current yield of 2.8%, the dividend is respectable, a quiet promise of future income.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

2026-01-22 03:43