It is a truth universally acknowledged that a company immersed in the pursuit of innovation must, at some juncture, endure a period of obscured vision. The past year has witnessed a feverish preoccupation with artificial intelligence, a force now inescapable in discourse, transforming expectations and, inevitably, the valuations of enterprises. Many have prospered in this new climate, yet Amazon, a titan amongst them, has moved with a deliberation that some have mistaken for sluggishness. To observe its comparatively modest gains amidst the general euphoria is to misunderstand the nature of its ambition, and the patient calculus of its leadership. It is a company not driven by the fleeting winds of speculation, but by the enduring currents of long-term value.

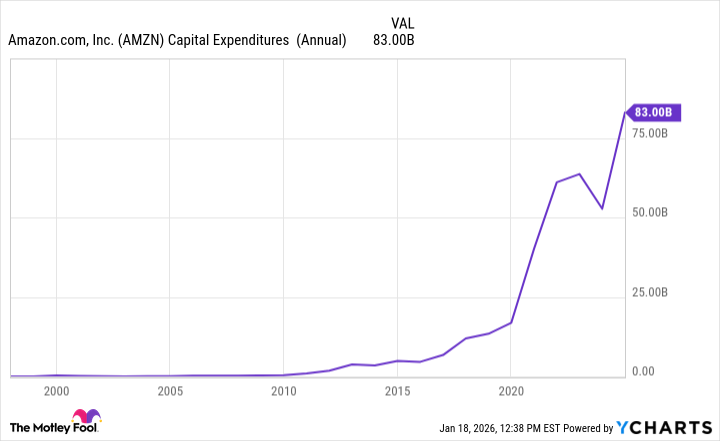

The impatience of the market is a familiar affliction. Investors, ever seeking immediate gratification, have questioned the magnitude of Amazon’s capital expenditures, a sum exceeding one hundred and twenty-five billion dollars for the past year. Such a commitment, unprecedented in its scale, has been viewed by some as reckless, a dissipation of resources. Yet, it is precisely this willingness to invest beyond the immediate horizon that defines Amazon’s character. While others reap the superficial rewards of readily available technologies, Amazon is constructing the very foundations upon which the future will be built. The difference is subtle, but profound, like the distinction between harvesting fruit from an existing tree and cultivating an orchard for generations to come.

Nvidia and Microsoft, pioneers in the current wave, are already enjoying the fruits of their labors. Amazon’s rewards, however, lie further afield. The company is not merely adopting artificial intelligence; it is forging the tools with which to master it. The development of custom silicon, a costly and arduous undertaking, will liberate it from dependence on external providers. The acquisition of energy sources, a seemingly peripheral concern, is in fact a strategic necessity, securing the immense power required to fuel these digital engines. These are not expenditures to be reflected in the next quarterly report, but investments in an enduring competitive advantage, a fortress against the vicissitudes of the market.

The Awakening of a Colossus

The heart of this endeavor lies within Amazon Web Services (AWS). The expansion of cloud computing capacity is not merely a matter of adding servers and storage; it is the creation of a digital ecosystem, a vast and intricate network capable of supporting an ever-growing number of users and applications. AWS experienced a temporary lull, a period of adjustment, but the recent twenty percent revenue growth in the third quarter suggests a resurgence, a return to its former vigor. The substantial backlog of two hundred billion dollars, now poised for realization, is a testament to the enduring demand for its services.

The agreement with OpenAI, a partnership forged in the fires of innovation, further strengthens AWS’s position. The provision of processing power and access to AI accelerator clusters is not merely a commercial transaction; it is a symbiotic relationship, a mutual investment in the future of artificial intelligence. OpenAI’s technology, coupled with AWS’s infrastructure, will unlock new possibilities, accelerate discovery, and reshape the landscape of computation.

To anticipate a more robust performance from AWS in the coming year is not to engage in speculative optimism, but to recognize the inevitable consequences of deliberate investment and strategic planning. Amazon is not merely a company; it is a force of nature, a colossus awakening from its slumber. And like all great forces, its ascent will be measured, deliberate, and ultimately, transformative.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gold Rate Forecast

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

- Celebs Who Fake Apologies After Getting Caught in Lies

2026-01-21 22:52