The clamor for speculative excess, for the fleeting mirage of ‘the next big thing,’ drowns out the steady rhythm of genuine wealth-building. We are conditioned to chase the ephemeral, the inflated, the ultimately unsustainable. Yet, a quieter path exists – a path not of breathless anticipation, but of methodical accumulation. It is a path paved with dividends, those modest distributions that speak not of overnight riches, but of enduring enterprise.

To place one’s faith in a single entity is to invite vulnerability. The monolithic corporation, for all its apparent strength, is but a fragile construct, susceptible to the whims of fashion, the failings of leadership, the inevitable corrosion of time. Therefore, diversification is not merely a prudent strategy; it is a recognition of inherent instability. Exchange-traded funds, while imperfect instruments, offer a degree of insulation, a spreading of risk across a multitude of endeavors. But even within this realm, discernment is paramount. Not all funds are created equal. Some are merely reflections of the prevailing mania, bloated with overpriced assets. Others, however, offer a genuine prospect of long-term value.

If one were to allocate a modest sum – say, two thousand units of currency – the prudent course would be to divide it between two funds, each embodying a distinct philosophy of value. These are not to be viewed as panaceas, but as tools – imperfect, yet capable of serving a purpose.

The Schwab U.S. Dividend Equity ETF: A Study in Resilience

The Charles Schwab U.S. Dividend Equity ETF – a cumbersome title, indicative of the bureaucratic excess of our age – has, for over a decade, quietly selected companies demonstrating a capacity for consistent cash flow. It is a fund that does not chase yield, but rather seeks out enterprises capable of generating it reliably. It is a filter, a sifting process that winnows out the speculative chaff. The holdings reveal a preference for established industries – energy, consumer staples, healthcare – those sectors that, while lacking the glamour of technological innovation, offer a degree of predictability. Consider the presence of Chevron and Coca-Cola – companies that have weathered decades of upheaval, adapting and enduring. Industrials like Lockheed Martin, and even the unglamorous realm of regional banking, provide further ballast.

- Energy (19.34% of the ETF): Chevron, ConocoPhillips

- Consumer staples (18.50%): Coca-Cola, PepsiCo

- Health care (16.10%): Merck, AbbVie

- Industrials (12.28%): Lockheed Martin, United Parcel Service

- Financials (9.37%): Fifth Third, Regions Financial

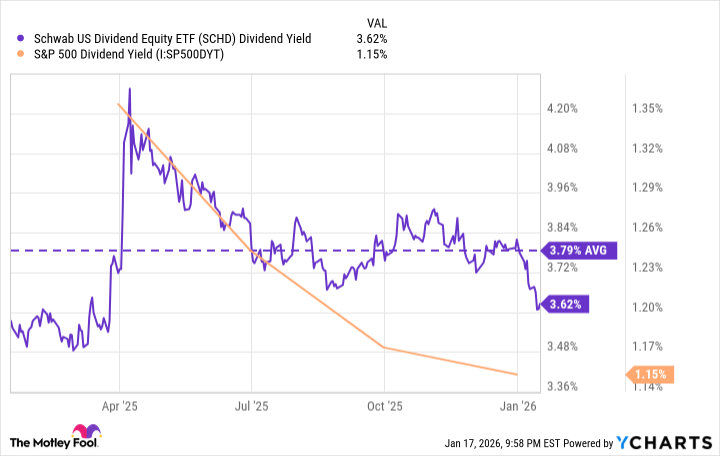

At the time of writing, the dividend yield hovers around 3.6% – a modest return, perhaps, but one that exceeds the anemic payout of the broader market. To receive $36 annually on a $1,000 investment is not a fortune, certainly. But to reinvest those earnings, to allow them to compound over time, is to engage in a quiet rebellion against the prevailing culture of instant gratification. It is to build wealth not through speculation, but through patient accumulation.

The Vanguard Dividend Appreciation ETF: A Glimpse of Sustained Growth

The Vanguard Dividend Appreciation ETF differs in its emphasis. While the Schwab fund seeks current income, this one prioritizes companies demonstrating a history of increasing dividend payouts. A decade of consistent growth is the threshold – a testament to underlying strength and responsible management. This focus allows for a greater allocation to growth-oriented sectors, such as technology. Twenty-seven percent of the holdings are in this realm – a stark contrast to the Schwab fund’s mere eight percent. Companies like Broadcom and Microsoft – enterprises that have disrupted entire industries – are prominent features. This is not to say that these companies are immune to risk. But their capacity for innovation, their ability to adapt and evolve, suggests a greater resilience in the face of change.

- Broadcom: 6.66% of ETF

- Microsoft: 4.41%

- Apple: 4.15%

- JPMorgan Chase: 4.06%

- Eli Lilly: 3.92%

- Visa: 2.54%

- ExxonMobil: 2.36%

- Johnson & Johnson: 2.29%

- Walmart: 2.25%

- Mastercard: 2.17%

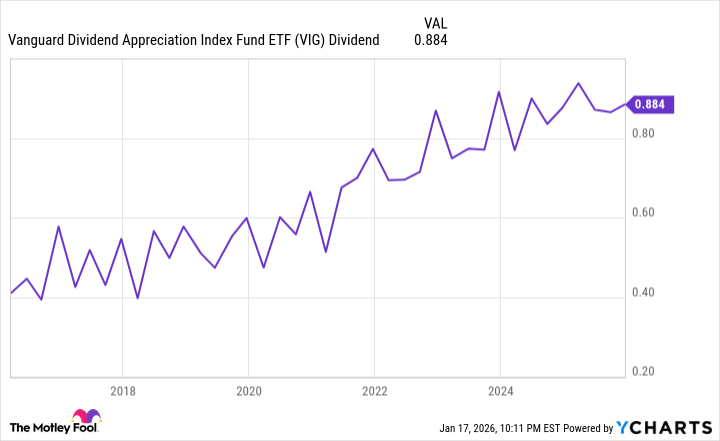

The current dividend yield is a modest 1.6% – lower than the Schwab fund, and lower than its historical average. But the payout has increased by 115% over the past decade – a testament to the power of compounding. It is a slow, incremental process, to be sure. But it is a process that rewards patience and discipline.

A Deliberate Pairing

The strength of this pairing lies in its lack of redundancy. There is minimal overlap between the two funds – only 29 holdings are common. This allows for a broader diversification, a greater exposure to different sectors and industries. The Schwab fund provides a foundation of stability, a source of reliable income. The Vanguard fund offers the potential for growth, a pathway to increased future earnings. It is a combination that appeals not to the speculator, but to the long-term investor – the one who seeks not to get rich quickly, but to build wealth steadily and sustainably.

To hold these funds for the long haul is not merely a prudent strategy; it is an act of quiet defiance – a rejection of the prevailing culture of instant gratification, and a commitment to building wealth through patience, discipline, and a steadfast adherence to the principles of value.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gold Rate Forecast

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

- Celebs Who Fake Apologies After Getting Caught in Lies

2026-01-21 21:53