Recent surveys indicate a heightened degree of investor apprehension regarding potential macroeconomic deceleration. While predictive accuracy remains elusive, certain indicators warrant careful consideration. Approximately 80% of respondents to a December 2025 MDRT survey expressed at least moderate concern regarding a forthcoming recessionary environment.

Evaluating Extended Valuations

The ratio of total U.S. equity market capitalization to U.S. Gross Domestic Product – commonly referred to as the Buffett Indicator – currently registers at 223%. While not an immutable predictor of market correction, a sustained valuation exceeding 200% has historically coincided with periods of increased downside risk. This metric, in isolation, does not constitute a definitive signal; however, its magnitude necessitates a rigorous assessment of underlying fundamentals.

It is crucial to acknowledge that market valuations are influenced by a complex interplay of factors, including interest rate policy, earnings growth expectations, and investor sentiment. A high valuation, therefore, does not automatically imply imminent decline. However, it does suggest a diminished margin of safety and increased vulnerability to adverse shocks.

The Importance of Fundamental Strength

Periods of market stress invariably expose the inherent vulnerabilities of individual enterprises. While speculative fervor can temporarily elevate the valuations of even poorly positioned entities, a sustained downturn typically compels a reversion to intrinsic value. Companies with robust balance sheets, consistent profitability, and defensible competitive advantages are demonstrably more likely to navigate turbulent conditions successfully.

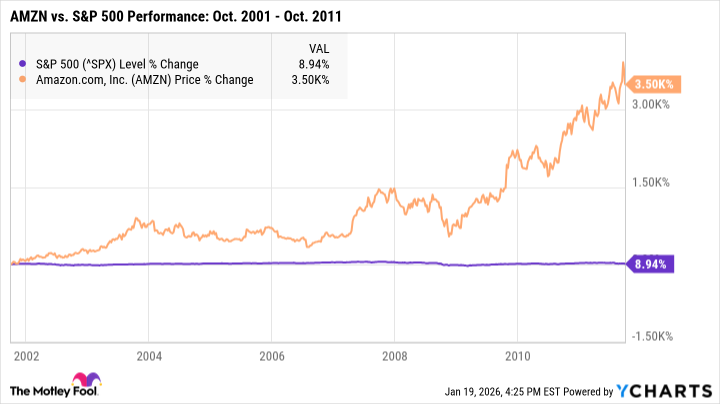

The dot-com bubble of the early 2000s serves as a salient example. Numerous internet-based companies experienced exponential growth in market capitalization, despite lacking sustainable business models or demonstrable profitability. The subsequent market correction resulted in catastrophic losses for investors who had prioritized speculation over fundamental analysis. Even established entities, such as Amazon, experienced substantial declines – losing approximately 95% of its value between 1999 and 2001 – before embarking on a period of sustained growth.

While historical patterns offer valuable insights, it is imperative to recognize that each market cycle is unique. The specific catalysts and characteristics of future downturns may differ significantly from those observed in the past. However, the underlying principle remains constant: companies with strong fundamentals are better positioned to withstand adversity and capitalize on opportunities.

Defining Fundamental Strength: Key Metrics

A comprehensive assessment of fundamental strength necessitates a rigorous analysis of financial statements and qualitative factors. Key metrics to consider include:

- Price-to-Earnings (P/E) Ratio: Provides an indication of relative valuation.

- Debt-to-EBITDA Ratio: Measures a company’s ability to service its debt obligations.

- Return on Equity (ROE): Indicates the efficiency with which a company generates profits from shareholder equity.

- Gross Margin: Reflects a company’s pricing power and cost control.

Beyond quantitative metrics, qualitative factors are equally important. A capable and experienced management team, a defensible competitive advantage, and a favorable industry outlook are all indicative of a company’s long-term prospects.

In conclusion, while market corrections are inevitable, a disciplined investment approach focused on fundamental strength can mitigate downside risk and enhance long-term returns. The current valuation environment warrants increased vigilance, but does not necessarily preclude continued market appreciation. A prudent strategy involves prioritizing companies with robust balance sheets, consistent profitability, and sustainable competitive advantages.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- The Academy Has Reveales the Best Visual Effects Contenders Shortlist for the 2026 Oscars

- Games That Bombed Because of Controversial Developer Tweets

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

2026-01-21 20:02