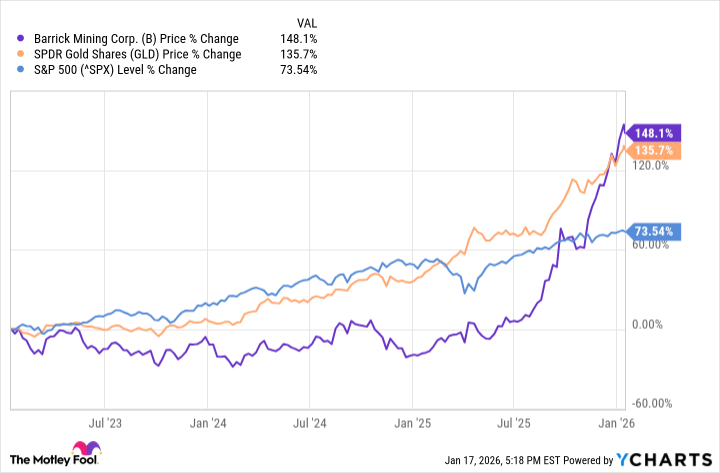

Now, I reckon folks have been chasin’ shiny bits of metal for a good long while, and these past few years, that chase has been particularly rewarding, what with gold and silver puttin’ on a show. Why, the SPDR Gold Shares ETF, that’s the biggest pile of bullion held by a fund, mind you, has climbed a good 135.7% over the last three years. Beats the S&P 500 hands down, and leaves it coughin’ in the dust, I tell ya. It’s enough to make a man believe in alchemy, almost.

This here gold fever is spreadin’ to them that dig for the stuff, and Barrick Mining, the second largest gold-digger in the world, is feelin’ the warmth. They’re pullin’ out around 4.5 million ounces a year, and plan to keep at it ’til 2029. That’s a considerable heap of yellow metal, and ties their fortunes pretty tight to the price of gold. A fella could almost set his watch by it.

Barrick also dabbles in copper, which they say is a sign of the times, economically speakin’. But let’s not fool ourselves, it’s the gold that’s the bedrock of this whole shebang. It’s the lure, the promise of riches that keeps ’em diggin’, and investors handin’ over their coin.

Barrick’s Bets May Pay Off Again in ’26

Now, investin’ in gold stocks like Barrick is a bit like gamblin’ on a riverboat. They can soar higher than a hawk when gold’s climbin’, or sink faster than a lead weight when it dips. Luckily for Barrick, the current is runnin’ in their favor. They’ve been outpacin’ that gold ETF, and that’s sayin’ somethin’.

The smart money’s whisperin’ that with governments buryin’ themselves in debt and the Federal Reserve lookin’ to cut interest rates, gold’s got a good run ahead. Some folks on Wall Street are predictin’ prices as high as $4,900 or even $5,000 an ounce. That’s a sight higher than the $4,601 it fetched on January 13th. Makes a man wonder if they’re lookin’ at the same metal we are.

And there’s another wrinkle to this tale. Barrick’s considerin’ spinnin’ off their North American gold assets. They’re mum about it, but say they might have somethin’ to announce when they report their fourth-quarter results. If they go through with it, it could unlock some value for investors. They’d keep a sizable stake in the new company, which would focus on prime gold spots in Nevada and the Dominican Republic. It’s a way to squeeze a few more drops of juice from the lemon, as they say.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- The Academy Has Reveales the Best Visual Effects Contenders Shortlist for the 2026 Oscars

- Games That Bombed Because of Controversial Developer Tweets

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

2026-01-21 18:52