Western Union. The name itself echoes with the weight of remittances, of anxious relatives sending what they can across vast distances. It’s a business built on hope, and frankly, a little bit of desperation. But hope, as any seasoned investor knows, doesn’t always pay the dividends. And in recent years, Western Union (WU 1.40%) has been looking… well, let’s just say its coffers aren’t overflowing with dragon’s gold. The payments landscape, you see, has become less a gently rolling pasture and more a chaotic bazaar, overrun with nimble fintech sprites and blockchain conjurers offering instant transfers at prices that would make a goblin blush.

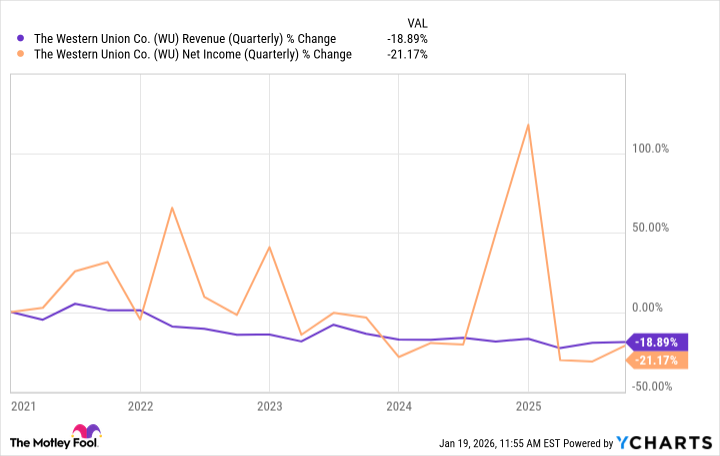

Over the last five years, the stock has performed with the enthusiasm of a troll guarding a particularly boring bridge – a decline of nearly 58%. Quarterly revenue and net income have been heading south with the migratory patterns of particularly pessimistic geese.1

Now, some might see this as a signal to abandon ship. But here at the Guild of Prudent Investors, we’ve learned that opportunity often lurks in the shadows of perceived failure. The stock is, shall we say, ‘economically challenged’, and the dividend currently yields over 10%. A tempting siren song for those seeking income, perhaps. But is Western Union a buy, a sell, or merely a stock to be observed with polite disinterest?

A Story, If You Can Find It

Western Union’s core business remains the transfer of funds by ordinary folk – the bakers, the blacksmiths, the slightly-dodgy merchants – across borders. They have a network spanning 200 countries, a web of agents and digital connections that would make even the most ambitious spider envious. However, these services come with fees. And in a world where digital pixies offer near-instantaneous transfers for a handful of enchanted dust, those fees are starting to look… substantial. Revenue in this core business has fallen 8% year over year, accounting for around 85% of total revenue so far in 2025.2

But not all is gloom and doom. Western Union’s newer consumer services division is showing signs of life, with revenue up nearly 50% year over year. This isn’t just about sending money; it’s about providing a broader range of financial services – digital wallets, prepaid cards, and even the ability to pay bills in certain countries. And, in a move that has the more conservative investors clutching their pearls, Western Union is launching its own U.S. dollar stablecoin on the Solana blockchain.3 A bold move, or a desperate gamble? Time, as always, will tell.

Cash reserves have dwindled, falling from nearly $1.5 billion at the end of 2024 to $948 million by the end of the third quarter of 2025. However, they’ve been diligently paying down debt, making $500 million in principal payments, leaving a remaining balance of around $2.6 billion. Operating cash flow continues to comfortably cover that hefty dividend, and the company is still buying back shares – a signal of confidence, or a desperate attempt to prop up the share price? One wonders.

Ultimately, Western Union could be a deep-value turnaround play, trading at a mere 5 times forward earnings. But it’s still early days. The crucial question, in my estimation, is how much further that core consumer money transfer business will decline, and whether this burgeoning consumer services division can truly fill the gap and drive overall revenue growth. It’s a bit like trying to bail out a leaky boat with a teacup, but not entirely impossible.

For now, I suggest a cautious approach. Hold the stock if you already own it, or consider a small initial investment, and then monitor the company’s progress closely. After all, in the realm of investments, as in life, a little patience can often yield a surprising reward.

1

It’s a curious thing, this human tendency to equate downward trends with failure. Perhaps it’s a lingering echo of our hunter-gatherer ancestors, who frowned upon anything moving

down

the hill.

2

One must remember that percentages, while mathematically precise, can be remarkably misleading. A 50% increase on a very small number is still… a small number.

3

The Solana blockchain, a fascinating and slightly chaotic realm of digital ledgers and cryptographic puzzles. One can only hope they’ve hired a good accountant.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- The Academy Has Reveales the Best Visual Effects Contenders Shortlist for the 2026 Oscars

- Games That Bombed Because of Controversial Developer Tweets

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

2026-01-21 16:23