One does tire of these tech valuations, doesn’t one? So much breathless anticipation, so little actual profit. However, even a cynical observer can’t entirely dismiss the potential of Artificial Intelligence, particularly when it manifests as something… useful. SoundHound AI, it seems, is attempting to be just that. A company that doesn’t merely promise disruption, but actually delivers a service – voice interaction – that might just stick.

The share price, currently experiencing a bit of a wobble – down over 41% in the last quarter, my dear – is, of course, alarming. But frankly, these short-term fluctuations are rarely indicative of genuine worth. One must look beneath the surface, assess the fundamentals, and decide if a little risk might yield a rather handsome return. And SoundHound, despite its recent misfortunes, possesses a certain… allure.

A Voice in the Wilderness (of Tech)

The concept is elegantly simple: enabling voice control across a variety of platforms – automobiles, call centres, restaurants. Imagine, if you will, ordering a perfectly chilled martini simply by speaking to the bar. Or, more prosaically, scheduling appointments without the ghastly inconvenience of actually telephoning. SoundHound is facilitating this, and doing it rather well, apparently. The automotive tie-ins are particularly promising; a driver’s ability to command their vehicle with a mere utterance is undeniably… convenient.

Healthcare and finance are also showing interest, utilising the technology for everything from appointment scheduling to loan applications. Round-the-clock customer service, they call it. I call it common sense. The market, predictably, is predicting growth – a rather optimistic 28% annually through 2029. A $12.5 billion expansion is anticipated. SoundHound, naturally, intends to take a rather substantial slice of that pie. And with over 400 patents, they’re reasonably well-positioned to do so.

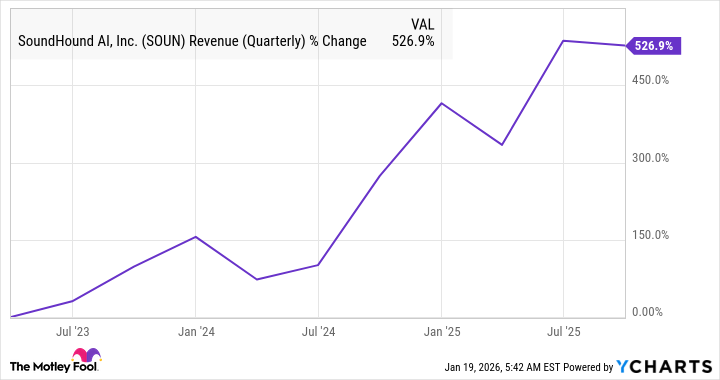

Their partnership with Nvidia – a truly dreadful name, but a remarkably efficient company – is particularly astute. Improving response times and accuracy is paramount, and these two seem to be achieving it. The result? Outstanding revenue growth. One can’t quibble with that.

Wall Street’s Peculiar Short-Sightedness

Analysts, bless their predictable hearts, anticipate a revenue increase to $170 million in 2025. A modest doubling from the previous year, but hardly catastrophic. They’re then predicting a further increase of 37% to $230 million in 2026. Rather pedestrian, wouldn’t you say? I suspect they’re underestimating SoundHound’s potential. A $1.2 billion revenue backlog, coupled with a solid customer base and a rapidly expanding market, suggests a far more robust trajectory.

The median 12-month price target is $15.50, implying a potential gain of 40%. A perfectly respectable return, of course. But I suspect SoundHound could deliver considerably more. The voice AI market is still in its infancy, and SoundHound, with its innovative technology and strategic partnerships, is exceptionally well-placed to capitalize on this burgeoning opportunity. One might even venture to suggest it’s a rather… intelligent investment. And frankly, in this chaotic world, a little intelligence is always welcome.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- The Academy Has Reveales the Best Visual Effects Contenders Shortlist for the 2026 Oscars

- Games That Bombed Because of Controversial Developer Tweets

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

2026-01-21 15:04