The currents shift in the markets, as they always do. For a time, the bright promise of artificial intelligence fell upon a handful of names, a small cluster of companies – Nvidia among them – drawing the light and the capital. They built monuments to the new age, shining and impressive, but monuments are often built on shifting sands. The truth is, the real wealth isn’t always in the flash, but in the slow, deliberate work of planting a seed, even in barren ground.

Alphabet, the company born of a search for order in the chaos of information, has been quietly doing just that. It hasn’t roared, hasn’t boasted, but has instead been laying down roots, deep and strong. Last year saw a rise, yes, a lifting of the share price by some sixty-five percent, but that number feels less like a sudden windfall and more like a recognition, a slow turning of the tide. The money flowing in now isn’t simply chasing a trend, it’s recognizing something more fundamental, a capacity for enduring growth.

Let us look beyond the numbers, beyond the quarterly reports, and see what separates Alphabet from its peers. It’s not simply a matter of profit, though profit there is, abundant and steady. It’s a matter of building a foundation, a complete ecosystem, and doing so with a long view, a patience that is rare in these hurried times.

A Machine That Doesn’t Just Count, But Grows

Alphabet doesn’t simply gather revenue; it cultivates it. The advertising empire, built on the foundations of Google and YouTube, is the visible fruit, but beneath the surface lies a deeper nourishment. Subscriptions, consumer electronics, the foray into cloud computing – these are not disparate ventures, but branches of the same tree, drawing sustenance from a common root.

The company’s services, advertising, subscriptions, devices, generate a healthy margin – forty percent through the first nine months of last year. The cloud platform, still finding its footing, shows promise with a twenty-one percent margin. But the true measure of success isn’t in these numbers alone, but in the deliberate allocation of resources, the steady investment in the future. Alphabet isn’t simply counting its gains; it’s reinvesting them, nurturing the seeds of further growth.

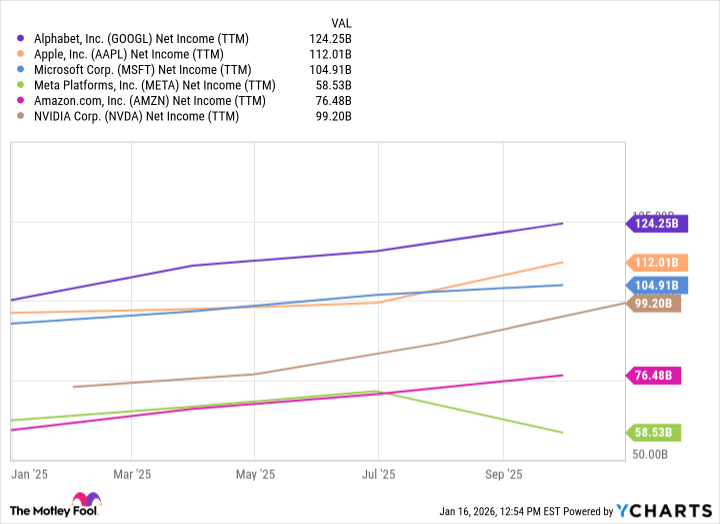

In a landscape dominated by hype and speculation, Alphabet stands apart as the most consistently profitable player in the AI game. It hasn’t rushed to embrace every new trend, but has instead methodically allocated its resources across the entire value chain. It’s a quiet strength, a deliberate strategy, and one that speaks to a deeper understanding of the forces at play.

A Whole Field, Not Just a Row of Corn

What sets Alphabet apart is its vertical integration, its control over the entire process, from the initial spark of an idea to the final delivery of a service. It’s a rare quality in a world of outsourcing and specialization. A company that controls its own destiny, that isn’t beholden to the whims of external forces, is a company built to endure.

DeepMind, the research laboratory, refines the AI model, Gemini. Custom silicon solutions, tensor processing units (TPUs), are deployed. Collaboration with Broadcom provides expertise, but the real innovation lies in the ability to compete with established cloud infrastructure providers, to move beyond a reliance on Nvidia GPUs. It’s a matter of self-reliance, of building a foundation that can withstand the storms.

Investments in data centers, in efficient energy infrastructure, further solidify this foundation. The acquisition of Intersect, for $4.7 billion, provides flexibility, reduces reliance on external power suppliers. It’s a long-term strategy, a deliberate attempt to control the essential elements of the supply chain. Alphabet isn’t simply building a business; it’s building an ecosystem, a whole field, not just a row of corn.

By controlling the entire process, Alphabet is paving the way for cheaper training and inference costs, for wider adoption of AI at the enterprise level. It’s a virtuous cycle, a self-reinforcing pattern of growth. And it positions the company to usher in a wave of continued revenue acceleration, bolstered by expanding profit margins.

A Seed That Might Outlive Us All

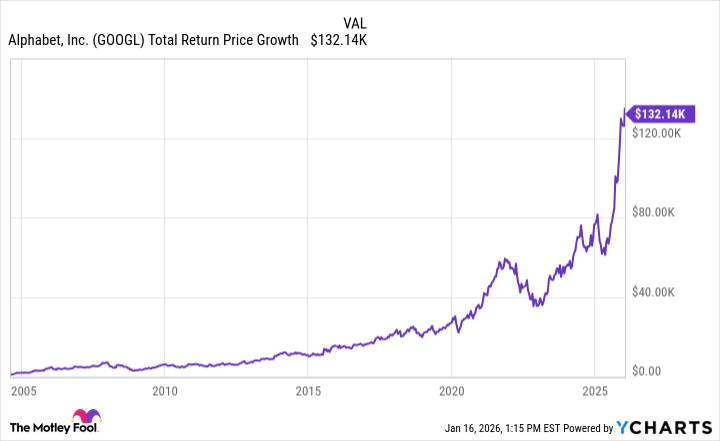

Alphabet isn’t a company defined by a single product lifecycle. It began as a search engine, a tool for navigating the vastness of information. But it has evolved, masterfully, into a multifaceted platform, serving consumers and businesses alike. A modest investment at the IPO would now be worth a considerable fortune – a testament to the power of long-term vision.

Today, Alphabet should be viewed through the lens of an AI ecosystem, a trend that could prove transformational over the coming decades. It’s not about chasing the next shiny object, but about building a foundation that can withstand the test of time.

With AI still in its early stages, Alphabet’s trajectory feels like the start of a decades-long arc of compounding, market-beating returns. It’s a rare example of a stock to buy and hold forever. A seed planted in barren ground, nurtured with patience and care, might just outlive us all.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- The Academy Has Reveales the Best Visual Effects Contenders Shortlist for the 2026 Oscars

- Games That Bombed Because of Controversial Developer Tweets

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

2026-01-21 14:02