It was observed, upon the close of the year 2025, that Mr. Warren Buffett, a gentleman long esteemed for his sagacity in matters of commerce, had relinquished the active management of Berkshire Hathaway. A retirement, though anticipated, did not diminish the regard held for his remarkably successful tenure – a period during which the fortunes of the company increased by a sum so considerable as to defy easy calculation.

Mr. Buffett’s skill lay not merely in amassing wealth, but in discerning true value amidst the prevailing fashions of the market. While not entirely immune to error – for even the most discerning eye may occasionally be misled – his successes were, as a general rule, of a most substantial nature. It was, therefore, a matter of some interest to observe his investment choices in the years preceding his withdrawal from public life.

For a considerable period, it appeared that Mr. Buffett found the opportunities for prudent investment somewhat limited. The records of Berkshire Hathaway revealed a disposition to reduce holdings in equities, a circumstance which prompted quiet speculation amongst those familiar with his methods. It was understood, of course, that a gentleman of Mr. Buffett’s standing would not engage in any transaction without careful consideration, but the extended period of divestment did give rise to a degree of polite inquiry.

Nevertheless, one particular concern – the company known as Sirius XM Holdings – continued to attract his attention. It was a business possessed of a most unusual advantage – a virtual monopoly, sanctioned by law, in the provision of satellite radio services. A circumstance not to be lightly dismissed in a world increasingly reliant upon communication and entertainment.

A Concern Overlooked by Many

It was a matter of some surprise to observe that Sirius XM had, for a time, fallen out of favour with a considerable portion of the investing public. While the general market experienced a period of considerable prosperity, the shares of this company had suffered a most regrettable decline. A disparity which suggested that either the merits of the business were misunderstood, or that some temporary difficulty had obscured its true value.

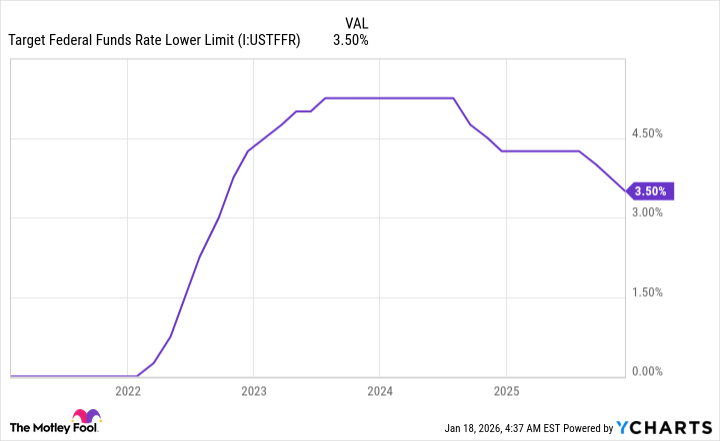

Three particular circumstances appeared to contribute to this unfavourable assessment. Firstly, the prevailing rate of interest, raised to an uncommon height by the nation’s central bank, presented a challenge to all businesses reliant upon borrowing. Secondly, a degree of economic uncertainty cast a shadow upon the prospects of advertising revenue, a significant component of the company’s income. And thirdly, a modest decline in the number of subscribers, attributable to the increased competition in the field of entertainment, gave cause for a degree of apprehension.

However, it was Mr. Buffett’s continued investment in Sirius XM, despite these difficulties, which proved most noteworthy. Before relinquishing his duties, Berkshire Hathaway had accumulated a substantial holding in the company, representing a considerable proportion of its outstanding shares. A demonstration of confidence which could not fail to attract attention.

The initial appeal of Sirius XM undoubtedly lay in its unique position within the market. While facing competition from various providers of audio entertainment, it remained the sole operator possessing the necessary licenses to transmit signals via satellite. A circumstance which afforded it a degree of pricing power, and a measure of protection against undue competition.

However, the true strength of the business lay, perhaps, in the composition of its revenue stream. Unlike many traditional radio operators, reliant upon the fluctuating fortunes of advertising, Sirius XM derived the majority of its income from subscriptions. A more stable source of revenue, less susceptible to the vagaries of economic cycles.

A Prudent Match, Indeed

It was a circumstance worthy of note that Sirius XM also possessed a remarkably predictable cost structure. While certain expenses – such as royalty payments and talent acquisition – were subject to fluctuation, the costs associated with transmission and equipment remained relatively constant. A degree of stability which would undoubtedly appeal to a gentleman of Mr. Buffett’s cautious disposition.

Furthermore, the company had demonstrated a commitment to returning capital to its shareholders, through a combination of share repurchases and dividend payments. A practice which, while not always consistent, suggested a responsible approach to financial management.

In conclusion, it appeared that Sirius XM possessed many of the qualities which Mr. Buffett sought in a potential investment: a defensible market position, a stable revenue stream, a predictable cost structure, and a commitment to shareholder value. At a time when many stocks were trading at inflated prices, the shares of this company appeared to offer a particularly attractive opportunity. A prudent match, indeed, and one which had clearly captured the attention of a most discerning investor.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- The Academy Has Reveales the Best Visual Effects Contenders Shortlist for the 2026 Oscars

- Games That Bombed Because of Controversial Developer Tweets

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

2026-01-21 11:53