Oy vey! So, Palantir and Intel had a good year in ’25, huh? A real good year. Palantir, up 145%? Intel, a respectable 84%? Don’t get too comfortable, folks. Wall Street analysts are starting to look at these stocks like a plate of overripe herring. They’re predicting a drop, a big one. A 70% schmear for Palantir, a 60% klutz for Intel. Now, I’ve seen more reliable predictions from a pigeon reading tea leaves, but let’s humor them, shall we? After all, they have the fancy computers…and the even fancier expense accounts.

1. Palantir: The Spy Who Billions of Dollars

Palantir. Sounds like a Russian novel, doesn’t it? Except instead of angst and revolution, it’s data analysis. They started by helping governments spy on…well, everything. Now they’re trying to sell that same software to businesses. It’s like taking a tank to a tea party. Their commercial side is growing, though, faster than my Aunt Mildred’s bunions. But here’s the kicker: an analyst at RBC Capital thinks Palantir’s share price should be $50. Fifty dollars! That’s a 70% haircut for a stock currently trading at $171. It’s enough to make a grown man cry…or short the stock.

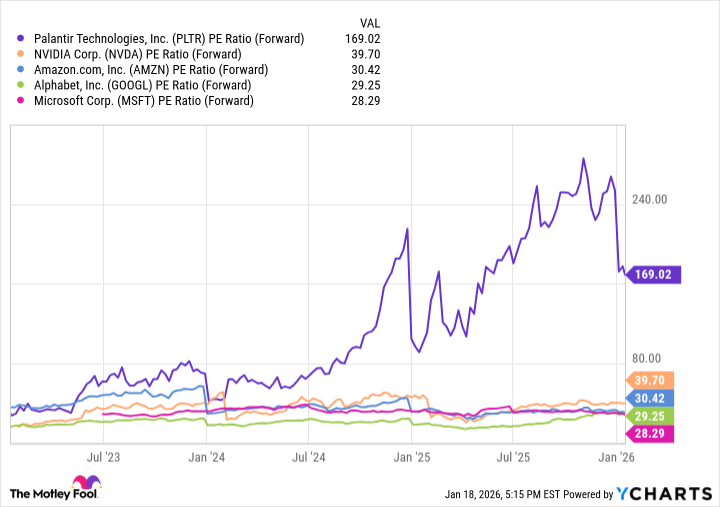

The problem? Valuation. It’s trading at 169 times projected earnings. 169! That’s like paying a million dollars for a bagel. It’s expensive. Even the fastest-growing tech companies don’t trade at that multiple. Palantir needs triple-digit growth for years to justify this price. And let’s be honest, folks, that’s about as likely as me winning the lottery and opening a chain of delicatessens on Mars.

2. Intel: From Chips to…Uh Oh!

Intel had a decent year in ’25. A turnaround, they call it. Investors liked the increased demand for their central processing units. Seems everyone needs a powerful brain for their AI gizmos. But don’t pop the champagne just yet. An analyst at Morgan Stanley has set Intel’s “bear case” price at $19. Nineteen dollars! That’s a 60% plunge from its current price of around $47. It’s enough to give a shareholder indigestion.

The problem? Chip manufacturing. Intel’s been trying to catch up to Taiwan Semiconductor Manufacturing, and it’s like trying to outrun a cheetah on roller skates. Delays, increased costs, lower yields…it’s a mess! Major companies are going to TSMC because they actually deliver working chips. It’s simple, really. You want a reliable chip, you go to the guy who makes reliable chips. It’s like ordering a pastrami sandwich. You don’t go to the butcher who keeps forgetting the mustard, do you?

Intel needs to become number two in the industry. They won’t catch TSMC, that’s a given. But they need to compete with Samsung. So far, though, they haven’t shown much sign of making that happen. They’re still fiddling while Rome burns…or in this case, while TSMC builds the future. And that, my friends, is no laughing matter…unless you’re shorting the stock.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

- Celebs Who Fake Apologies After Getting Caught in Lies

2026-01-21 05:32